Antigua and Barbuda citizenship by investment for Iranian applicants

Antigua and Barbuda offers a

Citizenship is granted by naturalisation after an investment of at least $230,000. The process takes 6 or more months and includes mandatory Due Diligence checks and an

Nationals of restricted countries, including Iran, may apply only by exception. Eligibility depends on strict criteria and enhanced Due Diligence. These are explained in the section below.

Can Iranian‑born applicants qualify for Antigua and Barbuda citizenship?

Antigua and Barbuda considers applications from

- Departure from Iran before reaching 18 years of age. Applicants must provide documentary proof that they left Iran as minors. Suitable evidence may include historical passports, exit stamps, early residence permits, or school records abroad.

- At least 10 years of continuous residence outside Iran. The authorities require clear evidence of

long‑term lawful residence abroad, for example, visas, residence cards, employment records, utility bills, or tax certificates that confirm stable presence outside Iran [189] Source: Restricted country list, CIU . - No economic, financial, or commercial ties with Iran. Applicants must show that they no longer own property, companies, bank accounts, or other assets in Iran, and that they do not receive income from Iranian sources.

Payment routes for the investment must not involve Iranian banks or financial systems.

What enhanced checks should Iranian applicants expect?

The Antigua and Barbuda Citizenship by Investment Unit applies expanded Due Diligence to all

- detailed verification of the applicant’s financial history and corporate affiliations;

- confirmation of

long‑term residence outside Iran; - review of tax documentation and the lawful origin of funds;

- an examination of banking records and the full payment chain for potential compliance risks;

open‑source intelligence checks andcross‑reference screening.

Applicants aged 16 and older must complete a mandatory online interview in English.

The Citizenship by Investment Unit retains full and final discretion in determining whether an applicant meets the exemption criteria. The authorities may request additional documents, extend the review, or refuse the application without providing detailed reasons.

6 benefits of Antigua and Barbuda citizenship

Citizenship of Antigua and Barbuda offers eligible Iranian applicants a structured alternative jurisdiction, improved mobility, and access to compliant international financial services [190] Source: Antigua and Barbuda citizenship by investment, CIU . All benefits remain subject to enhanced Due Diligence, strict banking requirements, and the immigration rules of each destination country.

1. A secure alternative jurisdiction for families

Citizenship provides a practical “Plan B” for Iranian families who have lived outside Iran for many years. It allows free entry into Antigua and Barbuda and serves as a

However, the passport does not grant the right to live or work in the European Union, and entry into other countries always depends on the sovereign decisions of their border authorities [191] Source: Schengen Borders Code on the rules governing the movement of persons across borders .

2. One passport for the whole family

The program allows the inclusion of a spouse, children, parents, grandparents, and unmarried siblings [192] Source: Family inclusion rules, CIU . This is especially relevant for Iranian families seeking a unified mobility solution.

Every adult applicant, including dependents, must independently satisfy the three mandatory exemption criteria for

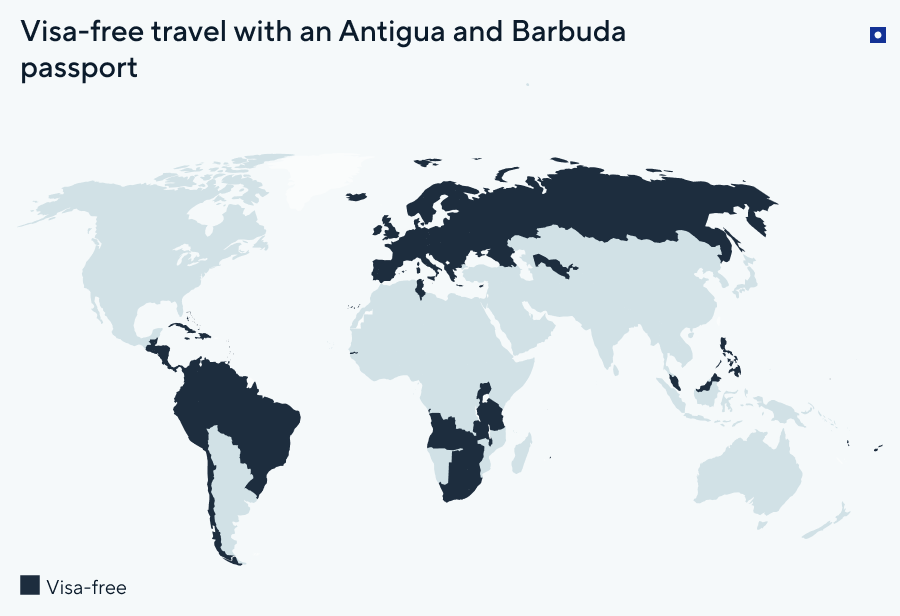

3. Visa-free travel

The passport provides

Iranian applicants must ensure that the passport is not used to circumvent sanctions, export controls, or financial restrictions in any jurisdiction. Even with

Visa-free countries for Antigua and Barbuda citizens

| № | Country | Entry requirement | Duration of stay |

|---|---|---|---|

| 1 | Albania | 90 days | |

| 2 | Andorra | 90 days | |

| 3 | Angola | 30 days | |

| 4 | Armenia | Not specified | Not specified |

| 5 | Austria | 90 days | |

| 6 | Bahamas | 240 days | |

| 7 | Bangladesh | Visa on arrival | 30 days |

| 8 | Barbados | Not specified | |

| 9 | Belarus | 30 days | |

| 10 | Belgium | 90 days | |

| 11 | Belize | Not specified | |

| 12 | Bolivia | Not specified | Not specified |

| 13 | Bosnia and Herzegovina | 90 days | |

| 14 | Botswana | 90 days | |

| 15 | Brazil | 90 days | |

| 16 | Bulgaria | 90 days | |

| 17 | Burundi | Not specified | Not specified |

| 18 | Cambodia | Not specified | Not specified |

| 19 | Cape Verde | Not specified | Not specified |

| 20 | Chile | 90 days | |

| 21 | China | 30 days | |

| 22 | Colombia | 90 days | |

| 23 | Comoros | Visa on arrival | 45 days |

| 24 | Congo (Dem. Rep.) | Not specified | Not specified |

| 25 | Costa Rica | 30 days | |

| 26 | Cote d'Ivoire (Ivory Coast) | Not specified | Not specified |

| 27 | Croatia | 90 days | |

| 28 | Cuba | 30 days | |

| 29 | Cyprus | 90 days | |

| 30 | Czech Republic | 90 days | |

| 31 | Denmark | 90 days | |

| 32 | Djibouti | Not specified | Not specified |

| 33 | Dominica | Not specified | |

| 34 | Dominican Republic | Not specified | Not specified |

| 35 | Ecuador | 90 days | |

| 36 | Egypt | Visa on arrival | 30 days |

| 37 | El Salvador | 180 days | |

| 38 | Equatorial Guinea | Not specified | Not specified |

| 39 | Estonia | 90 days | |

| 40 | Eswatini | 30 days | |

| 41 | Ethiopia | Not specified | Not specified |

| 42 | Fiji | 120 days | |

| 43 | Finland | 90 days | |

| 44 | France | 90 days | |

| 45 | Gabon | Not specified | Not specified |

| 46 | Gambia | 90 days | |

| 47 | Georgia | 360 days | |

| 48 | Germany | 90 days | |

| 49 | Greece | 90 days | |

| 50 | Grenada | Not specified | |

| 51 | Guatemala | 90 days | |

| 52 | Guinea | Not specified | Not specified |

| 53 | Visa on arrival | 90 days | |

| 54 | Guyana | 180 days | |

| 55 | Haiti | 90 days | |

| 56 | Honduras | 90 days | |

| 57 | Hong Kong | 90 days | |

| 58 | Hungary | 90 days | |

| 59 | Iceland | 90 days | |

| 60 | India | Not specified | Not specified |

| 61 | Iran | Not specified | Not specified |

| 62 | Ireland | 90 days | |

| 63 | Italy | 90 days | |

| 64 | Jamaica | Not specified | |

| 65 | Jordan | Not specified | Not specified |

| 66 | Kenya | Not specified | Not specified |

| 67 | Kiribati | 90 days | |

| 68 | Kosovo | 90 days | |

| 69 | Laos | Not specified | Not specified |

| 70 | Latvia | 90 days | |

| 71 | Lebanon | Visa on arrival | 30 days |

| 72 | Lesotho | 90 days | |

| 73 | Liechtenstein | 90 days | |

| 74 | Lithuania | 90 days | |

| 75 | Luxembourg | 90 days | |

| 76 | Macao | Visa on arrival | 30 days |

| 77 | Madagascar | Not specified | Not specified |

| 78 | Malawi | 90 days | |

| 79 | Malaysia | 30 days | |

| 80 | Maldives | Visa on arrival | 30 days |

| 81 | Malta | 90 days | |

| 82 | Mauritania | Not specified | Not specified |

| 83 | Mauritius | 90 days | |

| 84 | Micronesia | 30 days | |

| 85 | Moldova | 90 days | |

| 86 | Monaco | 90 days | |

| 87 | Montenegro | 90 days | |

| 88 | Mozambique | Not specified | Not specified |

| 89 | Namibia | Not specified | Not specified |

| 90 | Nepal | Not specified | Not specified |

| 91 | Netherlands | 90 days | |

| 92 | Nicaragua | 90 days | |

| 93 | Nigeria | Not specified | Not specified |

| 94 | North Macedonia | 90 days | |

| 95 | Norway | 90 days | |

| 96 | Palau | Visa on arrival | 30 days |

| 97 | Palestinian Territories | Not specified | |

| 98 | Panama | 90 days | |

| 99 | Papua New Guinea | Not specified | Not specified |

| 100 | Peru | 180 days | |

| 101 | Philippines | 30 days | |

| 102 | Poland | 90 days | |

| 103 | Portugal | 90 days | |

| 104 | Qatar | Not specified | Not specified |

| 105 | Romania | 90 days | |

| 106 | Russian Federation | 90 days | |

| 107 | Rwanda | 30 days | |

| 108 | Saint Kitts and Nevis | Not specified | |

| 109 | Saint Lucia | Not specified | |

| 110 | Samoa | Visa on arrival | 90 days |

| 111 | San Marino | 90 days | |

| 112 | Serbia | 90 days | |

| 113 | Seychelles | Not specified | Not specified |

| 114 | Sierra Leone | Not specified | Not specified |

| 115 | Singapore | 30 days | |

| 116 | Slovakia | 90 days | |

| 117 | Slovenia | 90 days | |

| 118 | Solomon Islands | Visa on arrival | 45 days |

| 119 | South Africa | 30 days | |

| 120 | South Korea | Not specified | Not specified |

| 121 | South Sudan | Not specified | Not specified |

| 122 | Spain | 90 days | |

| 123 | Sri Lanka | Not specified | Not specified |

| 124 | St. Vincent and the Grenadines | Not specified | |

| 125 | Suriname | 180 days | |

| 126 | Sweden | 90 days | |

| 127 | Switzerland | 90 days | |

| 128 | Tanzania | 90 days | |

| 129 | Visa on arrival | 30 days | |

| 130 | Togo | Not specified | Not specified |

| 131 | Trinidad and Tobago | Not specified | |

| 132 | Tunisia | 90 days | |

| 133 | Türkiye | Not specified | Not specified |

| 134 | Tuvalu | Visa on arrival | 30 days |

| 135 | Uganda | 90 days | |

| 136 | Ukraine | 90 days | |

| 137 | United Kingdom | Not specified | Not specified |

| 138 | Uzbekistan | 30 days | |

| 139 | Vanuatu | 120 days | |

| 140 | Vatican City | 90 days | |

| 141 | Venezuela | 90 days | |

| 142 | Viet Nam | Not specified | Not specified |

| 143 | Zambia | 90 days | |

| 144 | Zimbabwe | Not specified | Not specified |

4. Access to international banking

Citizenship creates access to several

For Iranian nationals, banking compliance is critical:

- institutions require fully documented and transparent sources of funds;

- no payment in the chain may involve Iran, Iranian banks, or Iranian counterparties;

- transfers must originate exclusively from clean, compliant jurisdictions.

Applicants may be asked for detailed tax records, corporate documents, and letters from financial institutions confirming the legitimacy of funds.

5. Dual citizenship recognised

Antigua and Barbuda allows dual citizenship, enabling Iranian applicants to retain their original nationality [194] Source: Citizenship legislation, CIU .

However, Iran does not recognise dual citizenship. This means that rights, obligations, tax exposure, reporting requirements, and residency rules under Iranian law continue to apply. Iranian applicants should obtain local legal advice to understand the implications of holding an additional nationality.

6. A predictable path to a second passport

The procedure is fully remote and usually takes from six months. Applicants complete enhanced Due Diligence, an online interview in English, and document the lawful origin and movement of funds.

For

- departure from Iran before age 18;

- more than 10 years of continuous residence abroad;

- full termination of economic ties with Iran;

- clean international payment routes;

- transparent financial and corporate documentation.

Incomplete or inconsistent documentation may lead to delays or refusal.

Nuances of the Antigua and Barbuda citizenship program

The Antigua and Barbuda citizenship program is one of the newest in the Caribbean. Its conditions are regulated by Act No. 2 of 2013, the Citizenship by Investment Act.

The Antigua and Barbuda Citizenship by Investment Unit received 3,779 applications from 2014 to 2022. In total, 7,205 passports were issued to investors and their family members.

Investors obtain citizenship by contributing to the country’s economy. They may choose one of four options:

non‑refundable contribution to the National Development Fund, starting at $230,000;- contribution to the University of the West Indies Fund or another institution approved by the minister, starting at $260,000;

- the purchase of real estate starting at $300,000;

- business investment starting at $400,000.

Since the program was launched, 76% of applicants have chosen the

Who can obtain Antigua and Barbuda citizenship by investment?

The authorities update the rules for

General eligibility requirements

Antigua and Barbuda sets several requirements for applicants under its citizenship program. The following investors are eligible to apply:

- over 18 years old;

- with lawful income;

- with no criminal record;

- without serious health conditions;

- not subject to sanctions.

Family members you can include

Citizenship through investment is also available to an investor’s family members. An application may include:

- spouse, provided the marriage is officially registered;

- children up to 30 years old;

- parents, grandparents aged over 55 who are financially supported by the investor;

- unmarried siblings with no children.

Children with disabilities under 11 years old are approved automatically. Siblings, parents, and grandparents may join the Antigua and Barbuda citizenship program at any time. The processing of an application takes up to 90 days.

Additional requirements for Iranian families

For

- departure from Iran before turning 18;

- more than 10 years of residence outside Iran;

- complete absence of economic or financial ties to Iran.

Enhanced Due Diligence applies to all dependents aged 18 and older. Authorities may also request additional documents confirming financial dependency or independence within the family group.

Key documents required for a citizenship application from Iranians

Participation in the Antigua and Barbuda citizenship program is possible only through a licensed agent, such as Passportivity. The agent’s lawyers assist applicants in preparing the required documents and ensuring that all compliance standards, including the strengthened rules applicable to

The standard document package includes:

- valid passports of all applicants;

- birth certificates for all participants;

- marriage or divorce certificate, if applicable;

- military service record, if applicable;

- educational documents;

- eight photographs sized 35 × 45 mm;

- police clearance certificate for each adult [195] Source: Police certificate, CIU ;

- bank reference letter;

- documents confirming the lawful origin of funds;

- two

proof‑of ‑address documents, for example, a utility bill and a tenancy agreement; - bank statements for the past 12 months showing account activity and the funds required for the program.

Iranian applicants must prepare an expanded document package demonstrating compliance with the three mandatory exemption criteria and the enhanced Due Diligence rules.

Proof of at least 10 years of continuous residence outside Iran

To meet the requirement of at least ten years of continuous residence outside Iran, applicants must provide clear evidence of

Employment contracts, payroll statements, rental agreements, and utility bills can help confirm

Proof of no economic or financial ties with Iran

Applicants must show that they:

- do not own property or companies in Iran;

- do not maintain Iranian bank accounts;

- do not receive income from Iranian sources;

- have fully separated from any Iranian business interests.

Supporting documents may include: property sale agreements, deregistration certificates, business closure documents, corporate registry extracts and tax confirmations.

Evidence of clean international banking routes

To demonstrate clean international banking routes, applicants must provide evidence that all funds originate from compliant foreign jurisdictions and move through fully transparent channels. This typically includes recent bank statements covering 12 to 24 months, accompanied by confirmation letters from the institutions maintaining the accounts.

The documentation must clearly show that the investment payment will be executed without the involvement of any

Additional compliance documents

Depending on the applicant’s background, the Citizenship by Investment Unit may request:

- detailed corporate ownership charts;

- tax certificates from all countries of residence;

- letters from employers or business partners;

- enhanced KYC documentation;

- statements explaining historic mobility or

country‑of ‑residence changes.

In summary, Iranian applicants must prove

How to obtain Antigua and Barbuda citizenship through investment

Make a

In addition, the applicant pays a government fee of $10,000 when applying alone. For a family of up to four people, the fee is $20,000. From the 5th family member onwards, the fee increases by $10,000 per person.

Make a contribution of $260,000 to the University of the West Indies Fund or another institution approved by the minister of Antigua and Barbuda [197] Source: University of the West Indies Fund, CIU . This option is available for families of six or more. Its main benefit is the absence of government fees, unlike the National Development Fund option.

Purchase real estate in Antigua and Barbuda [198] Source: Real estate purchase, CIU . The minimum investment is $300,000. Applicants may invest only in properties approved by the government, which limits the choice but protects investors from fraud and unreliable developers.

A real estate property may participate in the citizenship program only twice, with the first and second buyers. It cannot be resold to a third or subsequent investor for program purposes.

An investor may purchase a share in a hotel or spa resort, as well as a villa or an apartment. Rental income typically ranges from 3 to 5% per year. During the high tourist season, rental rates may double. Antigua and Barbuda does not charge income tax, so investors do not pay tax on rental income.

The property must be held for at least five years, after which it may be sold.

Real estate prices have been growing by

Business investment [199] Source: Business investment, CIU . This option allows for joint investments starting at $400,000 in a local business, provided that the total value of the joint investment is at least $5,000,000.

Applicants who prefer to invest independently must commit a minimum of $1,500,000 to a qualifying business.

Cost components of the Antigua and Barbuda citizenship program

| Expense category | National Development Fund Contribution | University of the West Indies Fund Contribution | Real estate purchase | Business investment |

|---|---|---|---|---|

| Investment amount | $230,000+ | $260,000+ For a family of six | $300,000+ | $400,000+ |

| Government fee | $10,000 for the main applicant $20,000 for a family of up to four $10,000 for each additional applicant starting from the fifth | No government fee | $10,000 for the main applicant $20,000 for a family of up to four $10,000 for each additional applicant starting from the fifth | $10,000 for the main applicant $20,000 for a family of up to four $10,000 for each additional applicant starting from the fifth |

| Due Diligence fee | $8,500 for the main applicant $5,000 for a spouse $2,000 per child aged $4,000 per dependant aged 18 or older | $8,500 for the main applicant $5,000 for a spouse $2,000 per child aged $4,000 per dependant aged 18 or older | $8,500 for the main applicant $5,000 for a spouse $2,000 per child aged $4,000 per dependant aged 18 or older | $8,500 for the main applicant $5,000 for a spouse $2,000 per child aged $4,000 per dependant aged 18 or older |

| Interview fee | $1,500 | $1,500 | $1,500 | $1,500 |

| Passport fee | $300 per family member | $300 per family member | $300 per family member | $300 per family member |

Step-by -step process of obtaining Antigua and Barbuda citizenship

The Antigua and Barbuda citizenship process typically takes from six months. For Iranian applicants the timeline depends on the quality of evidence confirming compliance with the three exemption criteria, the transparency of financial documents, and the approval of clean international payment routes.

-

1—7 daysPreliminary pre‑screening and eligibility confirmation

Before any engagement or document collection, Iranian applicants must undergo a confidential pre‑screening to confirm whether they qualify for an exemption. This assessment reviews:

- proof of departure from Iran before age 18;

- evidence of at least 10 years of continuous residence outside Iran;

- absence of economic or financial ties with Iran;

- initial documentation of lawful funds;

- potential sanctions or compliance risks.

Only after passing this stage can the case proceed.

-

1—2 weeksEnhanced background check

Passportivity’s compliance team performs an internal background review to identify risks before the official submission. For Iranian applicants this includes:

- verification of foreign banking history;

- review of corporate structures;

- confirmation of clean payment channels;

- identification of any remaining Iranian links.

This step significantly reduces the risk of refusal.

-

3+ month sDocument preparation

The applicant collects all required documents, including the expanded package for Iranian‑born nationals. Passportivity’s lawyers translate and notarise the documents, and coordinate apostilles or legalisation where required.

-

3+ month sSubmission of the application and enhanced Due Diligence

Passportivity submits the full file to the Antigua and Barbuda Citizenship by Investment Unit. The Unit conducts enhanced Due Diligence for all Iranian applicants and every adult dependant, including:

- international background checks;

- verification of residence history outside Iran;

- review of financial statements and tax records;

- screening for sanctions and

high-risk jurisdictions; - analysis of corporate ownership chains;

open-source intelligence checks.

All applicants aged 16+ must attend an online interview in English.

-

Up to 30 days

Approval and fulfilment of the investment requirement

If the application is approved, the applicant receives an official letter of approval‑in‑principle. The investment must then be transferred via fully compliant banking routes, with no involvement of Iranian banks or intermediaries.

For Iranian applicants, additional confirmation from the receiving bank may be required.

-

3+ week sOath of allegiance

Applicants aged 18+ take the oath of allegiance online before a licensed notary. After the ceremony, naturalisation certificates are issued.

-

Up to 4 weeks

Passport issuance

The applicant and their dependants receive:

- naturalisation certificates;

- biometric passports.

The first passport is valid for five years. Renewal requires proof of at least five days of physical presence in Antigua and Barbuda within the first five years, unless an exemption applies.

How to renew an Antigua and Barbuda passport?

The first Antigua and Barbuda passport is valid for five years. During this period, an investor must spend at least five days in the country [200] Source: Passport renewal, Antigua and Barbuda Government . However, there are situations in which this requirement does not apply.

Since December 15th, 2023, investors are exempt from the

- the applicant was 80 years old at the time citizenship was granted or reached this age within the first five years;

- the applicant has a serious illness or a disability;

- the parents of applicants under 18 spent five days in Antigua and Barbuda, and their passports expire in 6 months or less.

A passport renewal application must be submitted six months before the expiry date. The new passport is issued for 10 years.

The government fee for passport renewal is $1,000 for an adult and $500 for a minor child. The investor also pays a bank charge, delivery costs, and the licensed agent’s service fee.

Other ways to obtain Antigua and Barbuda citizenship

By naturalisation. Foreigners who have lived in Antigua and Barbuda for more than five years may apply for citizenship by naturalisation.

By marriage. Spouses of Antigua and Barbuda citizens may apply for citizenship if they live together and their marriage has been officially registered for at least three years [201] Source: Citizenship FAQs, Department of Immigration .

By birth. Children born on the territory of Antigua and Barbuda automatically acquire citizenship, except for children of diplomatic personnel.

Foreigners born outside Antigua and Barbuda before October 31th, 1981 may obtain citizenship if one of their parents or grandparents was a citizen of the country. Those born outside the country after October 31st, 1981 acquire citizenship if at least one parent is a citizen of Antigua and Barbuda.

Why can Antigua and Barbuda citizenship be refused?

Antigua and Barbuda may refuse citizenship if an applicant does not meet the program’s statutory requirements or fails to satisfy the enhanced compliance standards applied to

General grounds for refusal

An application may be declined if the applicant:

- provides false or misleading information in the application;

- submits forged or fraudulent documents;

- has unresolved legal issues, a criminal background, or pending investigations;

- poses a security, reputational, or compliance risk to Antigua and Barbuda;

- has serious health conditions that may endanger public safety.

These grounds apply to applicants of all nationalities. Failure to pass Due Diligence or to fully document the source of funds can also result in rejection.

Additional refusal risks for Iranian applicants

Because applications from Iranian nationals are reviewed only under the exemption rules, the Citizenship by Investment Unit may refuse a case if the applicant:

- cannot prove departure from Iran before the age of 18;

- cannot demonstrate at least 10 years of continuous residence outside Iran;

- maintains any economic, financial, or commercial ties with Iran, even indirectly;

- uses banking channels that involve Iranian banks or counterparties at any point in the payment chain;

- provides incomplete or inconsistent

source‑of ‑funds documentation; - cannot show clean and compliant capital flows from foreign jurisdictions;

- fails the enhanced Due Diligence review conducted for all adults in the family;

- does not pass the mandatory online interview in English;

- withholds information about corporate interests, property, or inherited assets connected to Iran.

Even minor indications of

Loss of citizenship after approval

Citizenship already granted may be revoked if the investor:

- fails to visit Antigua and Barbuda for the required five days within the first five years;

- provides false information or conceals relevant facts during or after the application process;

- is convicted in Antigua and Barbuda of treason, extremist activity, or incitement to rebellion.

Citizenship may also be revoked if serious violations of immigration or compliance rules occur.

Entry and immigration consequences

Failure to comply with immigration requirements or misrepresentation when using the passport may result in:

- refusal of entry to a foreign country;

- administrative penalties;

- deportation;

- additional screening or travel restrictions.

For Iranian applicants, it is important to follow all compliance rules strictly, as international authorities may apply enhanced scrutiny to travel history, documentation, and financial behaviour.

Taxes paid by Antigua and Barbuda citizens

Antigua and Barbuda has one of the most favourable tax systems in the world [202] Source: Antigua and Barbuda tax system, Inland Revenue Department . Tax residents do not pay income tax, dividend tax, royalties tax, or tax on interest. Capital gains, inheritance, and wealth are also not taxed.

Individuals become tax residents if they live in Antigua and Barbuda for at least 183 days per year. They pay social contributions, taxes, and stamp duties when owning, purchasing, or selling real estate or land.

The main taxes for legal entities include corporate tax, sales tax, and taxes related to the ownership, purchase, and sale of real estate. Branches and subsidiaries are also subject to taxation.

Drawbacks of Antigua and Barbuda citizenship

Citizenship is not inherited beyond the first generation. Only children and grandchildren of the investor who are born in Antigua and Barbuda may acquire citizenship automatically.

Possible double taxation. Iran and Antigua and Barbuda have not signed a double tax treaty. If a tax resident of Iran earns rental income from real estate in Antigua and Barbuda, this income must be declared in Iran and may be taxed there.

Limited stay in the Schengen Area. An Antigua and Barbuda passport does not grant the right to live or work in the European Union. Holders may enter Schengen Area countries only for tourism and stay for up to 90 days in any 180‑day period.

Key points about Antigua and Barbuda citizenship by investment

- Antigua and Barbuda offers one of the Caribbean’s most accessible citizenship by investment programs, with minimum investment requirements starting at $230,000.

- Citizenship is available to investors aged 18 or older who can demonstrate a lawful source of income, a clean criminal record, and full compliance with the program’s Due Diligence standards.

- Applicants may obtain citizenship by several investment routes, including contributions to the National Development Fund or the University of the West Indies Fund, the purchase of approved real estate, or qualifying business investment.

- The program also allows investors to include close family members, such as a spouse, children up to the age of 30, parents and grandparents over 55, and unmarried siblings.

- For eligible

Iranian‑born applicants, the program is available only by exception and requires proof of departure from Iran before age 18, at least ten years of residence abroad, and the absence of any economic ties with Iran. Enhanced Due Diligence applies to all adult family members. - The citizenship process is conducted remotely and typically takes from six months, depending on the completeness of the documentation, the quality of the financial records, and banking compliance.

- The result is a secure second citizenship that supports

long‑term mobility, contingency planning, and international financial access, subject to global immigration and compliance rules.

About the authors

Frequently asked questions

Only

If even one of these conditions is not met, the application cannot be submitted under the current rules.

Iranian nationals may also be eligible to apply for citizenship in other countries, subject to the specific eligibility criteria, compliance requirements, and programme conditions applicable in each jurisdiction.

Proof usually consists of early passports, historical entry and exit stamps, old residence permits, or school and university records showing

In practice, this means the applicant must not own property, companies, bank accounts, or other assets in Iran, nor receive income of any type from Iranian sources. If any financial or commercial link to Iran remains active, no matter how small, it is viewed as a continuing economic connection and undermines eligibility.

Not usually. Ownership of property is regarded as an ongoing economic tie. To proceed, the applicant would need to sell the property, document the termination of ownership, and demonstrate that no income or financial relationships remain connected to that asset. Until this separation is complete, payment cannot be made through approved channels.

Funds must be transferred exclusively through banks and jurisdictions with no sanctions exposure and strong international compliance records. Transfers typically originate from reputable banks in the EU, the UK, Canada, or the UAE, provided the applicant can demonstrate clean, lawful capital held abroad. Any payment chain containing

The review is detailed and focuses on corporate structures, tax filings, foreign operations, contracts with international partners, and the full movement of capital. Entrepreneurs must show that their income is generated entirely outside Iran and that all financial activity is processed through foreign banks that comply with international standards. Transparency is essential.

While the general timeline is around 6 months, applications from

Additional Due Diligence and interviews may extend the process to

No. Even with

Citizenship alone does not make an individual a tax resident of Antigua and Barbuda. Tax obligations depend on where the person lives, works, or holds assets. Iranian applicants should obtain professional advice about their tax residency status and the implications of controlled foreign corporation rules in their country of residence.

If requirements change while an application is in progress, the updated rules typically apply at the time the passport is issued. Transitional allowances may sometimes be granted, but applicants should be prepared to meet the revised conditions unless an exemption is formally confirmed by the authorities.

Antigua and Barbuda does not sell passports. The government attracts investors who contribute to the country’s economy. Citizenship is granted for investments starting at $230,000 in government funds, real estate, or a business.

No. Under the law, an application for the Antigua and Barbuda citizenship program may be submitted only through a licensed agent.

The Antigua and Barbuda passport is issued remotely. However, the program requires applicants to spend five days in the country within the first five years. Otherwise, an investor may lose their citizenship.

Investment may be returned through the real estate option. An investor may sell the property or share after five years and recover the invested amount. In some cases, additional profit is possible, for example, rental income from a hotel apartment.

Contact us today

Passportivity assists international clients in obtaining residence and citizenship under the respective programs. Contact us to arrange an initial private consultation.