Due Diligence, or a background check: why it is required and how to pass it

Due Diligence is a mandatory stage of any investment programme. If a foreigner plans to obtain a passport by investment, they undergo a background check conducted by the citizenship programme authorities. When applying for residence, the check is carried out by the migration service.

Immigration agents, such as Passportivity, help applicants prepare for the check. The company’s lawyers prepare documents and conduct a preliminary screening of the investor. This increases the chances of application approval.

What is Due Diligence?

Due Diligence is a background check conducted to verify an individual’s identity, reputation, and source of funds. Investors undergo it when applying for temporary or permanent residence permits, as well as for citizenship by investment.

The investor’s documents and biography are reviewed after the application is submitted. Successfully passing the procedure is one of the requirements for obtaining the status.

Background checks are carried out by government authorities, such as security agencies, migration services, and financial regulators. In some countries, programme authorities cooperate with independent compliance companies.

There are different types of Due Diligence, depending on which aspects of an investor’s life are reviewed:

- Tax Due Diligence verifies whether the investor pays taxes on time and in what amounts.

- Financial Due Diligence reviews sources of income and assets, outstanding liabilities, and assesses the risk of bankruptcy.

- Legal Due Diligence analyses the legal history, including the authenticity of documents, involvement in court proceedings, and presence on sanctions lists.

- Banking Due Diligence conducted before opening a bank account and assesses the legality of the source of funds, financial reputation, and cooperation risks.

Due Diligence is also conducted in real estate transactions. On the seller’s side, authorities review encumbrances on the property, outstanding utility debts, and construction restrictions. On the buyer’s side, they verify the origin of funds, check sanctions and criminal lists, and may ask about the purpose of the purchase.

Why are background checks conducted

Due Diligence is a stage that determines whether an investor will obtain a residence permit or citizenship. During the check, government authorities assess who they are granting the status to.

Combating money laundering

Insufficient scrutiny of income sources allows money earned illegally to be laundered, for example through bribery or embezzlement.

In 2018, the United Kingdom suspended its investor visa programme as part of efforts to combat money laundering. Critics argued that, due to inadequate checks, residence permits were granted to foreigners who had earned their money illegally. The programme was particularly popular among citizens of China, Hong Kong, Türkiye, and the United States.

Compliance with international standards

Citizenship and residence by investment programmes affect not only a country’s economy but also its relations with other states. as a result, such programmes are closely monitored by other countries and international unions, such as the European Union.

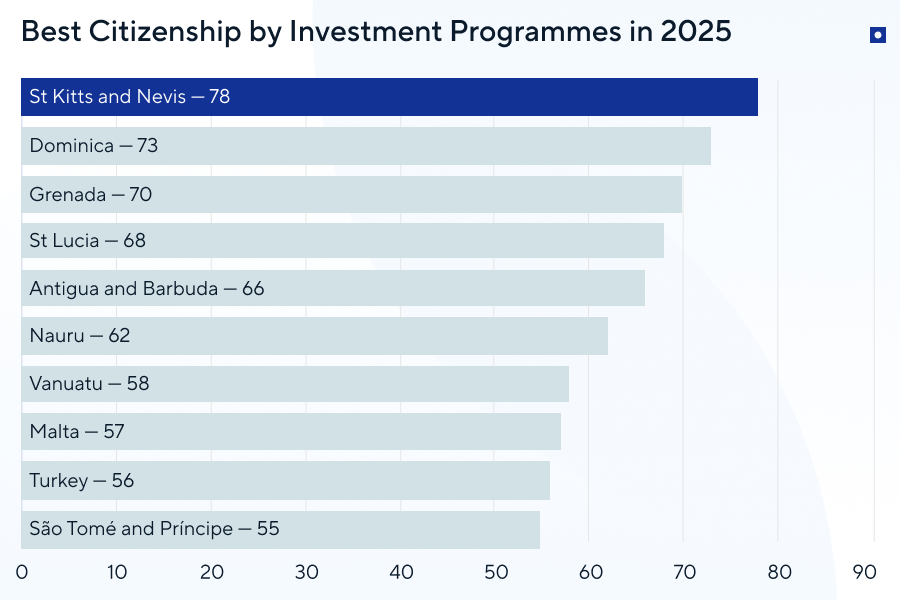

Independent platforms also assess investment programmes. Each year, they compile a global Citizenship by Investment ranking, analysing investment options and amounts, processing times and ease of obtaining a passport, as well as the thoroughness of applicant Due Diligence [17] Source: CBI — 9th report in September 2025 .

Among the 14 countries included in the ranking, St Kitts and Nevis received the highest score for the Due Diligence criterion and ranked first overall. Other Caribbean countries also made it into the top five, followed by Nauru and Vanuatu.

National security protection

Applicants for citizenship or residence permits are checked against international databases, such as Interpol and Europol, to prevent citizenship from being granted to criminals.

Background checks help prevent cases in which foreigners submit applications using forged documents while concealing their true personal information.

Protection of a country’s reputation and the prestige of the programme

Countries seek to ensure that citizenship by investment remains a privilege for foreigners with a strong business and financial reputation. If criminals, drug traffickers, or sanctioned individuals obtain passports, other states may impose restrictions on all citizens of that country.

One such case involved Vanuatu. The country lost

Some investors passed checks despite being under investigation. In Vanuatu, passports were granted to foreigners facing criminal prosecution.

One

Vanuatu has not revoked his citizenship. At the time of his application, he was cleared by both Interpol and UK authorities. The government stated that its laws do not allow retroactive revocation based on later findings. The citizenship remains valid unless he is formally convicted.

In recent years, Vanuatu has implemented significant reforms to its citizenship by investment programme. Investors now undergo more thorough Due Diligence and are required to submit additional documents. The government also introduced mandatory biometric data collection.

These measures make the process more complex while enhancing the prestige of Vanuatu citizenship.

Anton Molchanov

Deputy Head of the Legal Department

Anton Molchanov

Deputy Head of the Legal Department

What is checked during Due Diligence

Each country sets its own requirements. Some focus only on income sources. Others also check the applicant’s health status.

Residence permit applications involve a full assessment. Migration authorities analyse the purpose of stay, financial situation, and overall reliability. The chances of approval are high if each criterion is clearly and positively confirmed.

Citizenship applications involve a deeper review. The state checks all aspects of the investor’s life.

Sources of income

A compliance specialist verifies that the investor has earned their funds legally and that the sources of income are not linked to corruption, drug trafficking, or money laundering.

If the investor owns a business, certain industries may be considered red flags during Due Diligence, such as casinos, brokerage services, or weapons manufacturing.

Concerns may also arise if the investor has received large sums without a clear explanation, frequently used cash instead of bank transfers, or failed to provide transparent reporting for offshore businesses.

Reputation

The compliance specialist assesses how the investor is perceived in professional and media environments. This stage involves reviewing media publications, online mentions, and business connections.

If the investor has been involved in scandals or mentioned in investigations, the review may be expanded.

Criminal records and lawsuits

Investors are checked for criminal and administrative offences, as well as for involvement in court proceedings. as a rule, applicants with convictions for serious crimes, such as drug trafficking or murder, do not pass the check.

Authorities may raise questions even if the investor was only a suspect or was acquitted in court. In such cases, lawyers prepare affidavits, formal explanations that describe the situation in detail.

Sanctions lists

Investor data is checked against international and national databases, such as OFAC and the European Union sanctions lists. This is done to exclude foreigners associated with terrorist activities, money laundering, or political violations.

Sanctions lists are checked for matches with the investor’s details. A person with the same name or birthdate may appear on such a list. Specialists then determine whether it is the same individual or not.

Being on a sanctions list almost always leads to rejection. It nearly eliminates the chance of obtaining residence or citizenship [20] Source: Schengen.news — Cyprus revoked the passports of nine investors .

The investor’s business, or the company from which they derive income, must also not be subject to sanctions.

Political connections

Politically Exposed Person, PEP status, complicates the process of obtaining residence permits and second citizenship. This status applies to heads of state, political party leaders, members of parliament, senior military officials, and holders of other politically significant positions.

Close family or business ties to individuals with PEP status may also raise concerns for compliance specialists.

Citizenships, residence permits, and visas

Authorities review the investor’s visa history and existing residence permits and citizenships. Foreigners who have repeatedly been denied visas or have been deported face a higher risk of failing the check.

Compliance specialists may also be concerned if the investor holds citizenship of countries that are prohibited from participating in a specific investment programme. For example, Iranian citizens cannot apply for citizenship in St Kitts and Nevis or St Lucia. Even if an investor applies using a second passport, Iranian citizenship will be identified during Due Diligence, resulting in a refusal.

Some countries do not accept applications from citizens of Russia, Belarus, China, Afghanistan, and other states. An investor may also fail the check if they own a business in one of these countries.

Financial history

The purpose of this review is to confirm the investor’s financial stability. Specialists analyse bank statements, credit history, outstanding liabilities, and any involvement in bankruptcy proceedings.

Large debts and discrepancies between lifestyle and declared income, for example, expensive purchases combined with officially low earnings, may raise suspicions.

Due Diligence specifics in different countries

The list of documents required for a background check may vary, but most often applicants are asked to provide:

- Passport.

- Police clearance certificate.

- CV.

- Proof of source of funds, such as bank statements and tax returns.

- Education documents.

- Proof of address.

In Vanuatu, investors undergo a

Due Diligence in Vanuatu is one of the fastest in the world. The initial screening takes about a week on average, and the Citizenship Commission meets twice a month, that is, roughly every two weeks.

In São Tomé and Príncipe, the CIU conducts Due Diligence by reviewing the investor’s background, analysing sources of income, and checking for criminal records.

In El Salvador, special attention is paid to sources of income. The key requirement of the

Mining is considered a legitimate source of cryptocurrency. Illegal sources include the distribution of prohibited goods and services.

In Caribbean countries, the check takes on average from three to six months. After Due Diligence, the investor and family members over 16 undergo an online interview. Interview questions may concern biographical facts and the motivation for obtaining a passport.

In Sierra Leone, investors undergo not only Due Diligence but also a Background Check. During Due Diligence, authorities verify the authenticity of documents; during the Background Check, they review the investor’s past, including criminal history, presence on sanctions lists, and professional references.

In Egypt, investor documents are reviewed in two stages:

- Before the investment is made — by Egypt’s security authorities;

- After the investment — by the programme authority.

Each review can take up to six months.

EU countries follow a common standard for citizenship checks. Background checks for citizenship by naturalisation are carried out under EU Directive No. 2018/1673 [21] Source: The Directive defines what constitutes a criminal offence .

Residence permit applications do not have a separate Due Diligence stage. Still, migration authorities review the applicant’s reputation, the origin of funds, and visa history during processing.

Italy is an exception. There, the Secretariat conducts an initial screening. It checks if all documents are provided and verifies their authenticity. After approval, the application goes to the Investor Visa Committee.

Timeframes and cost of Due Diligence in different countries

| Country | Due Diligence fee | Processing time |

|---|---|---|

| Vanuatu | $5,500+ | |

| São Tomé and Príncipe | Included in investment | 2 months |

| Egypt | $10,000 | |

| Türkiye | Included in government fees | |

| El Salvador | $999+ | |

| Sierra Leone | $5,000+ | 40 business days |

| Antigua and Barbuda | $8,500+ | |

| Dominica | $7,500+ | |

| Grenada | $5,000+ | |

| St Kitts and Nevis | $7,500+ | |

| St Lucia | $8,000+ |

Three main mistakes that can prevent passing Due Diligence

Incomplete or inconsistent information. One of the key objectives of Due Diligence is to verify the completeness and accuracy of documents. Expired certificates, errors in dates of birth, misspellings of names, and other inaccuracies may result in a negative outcome.

Omitted or concealed biographical facts. Investors with fully transparent backgrounds are more likely to pass the check successfully. If an investor unintentionally or deliberately withholds information, this will raise suspicions among reviewers.

St Kitts and Nevis and St Lucia do not accept applications from Iranian investors, even if they renounce Iranian citizenship. Any connection to Iran, including place of birth or employment, will lead to a refusal of citizenship, and this will be identified during Due Diligence.

Issues related to family members and associates. Reviewers assess not only the investor but also their family and business connections. The process becomes more complicated if the investor is a close relative or associate of a politically exposed person.

How immigration agents help pass Due Diligence

Lawyers conduct an internal review of the investor and assess the chances of obtaining a residence permit or citizenship. This review helps identify potential obstacles and prepare for them in advance, for example by collecting additional documents or selecting an alternative status in another country.

Passportivity has its own compliance department, whose specialists are familiar with the specifics of each investment programme. Internal Due Diligence takes one day and is conducted on a fully confidential basis.

The investor provides a minimal set of documents:

- copies of passports of all applicants;

- phone number and email address;

- residential address;

- tax identification number.

Document preparation is supervised by lawyers. Investment programme experts have completed the residence and citizenship process dozens of times and therefore understand the practical nuances and potential difficulties.

Migration authorities and consulates often publish standard document lists, but the final requirements depend on the investor’s specific circumstances. Passportivity lawyers compile individual lists for each applicant. After receiving the originals, they prepare the documents for submission in accordance with the rules of the country of future residence or citizenship.

Passportivity lawyers prepare affidavits and explanatory statements. These address biographical facts that may raise concerns during Due Diligence.

Affidavits may be needed in complex cases. For example, if the investor was a defendant in a criminal case or involved in a public scandal. Lawyers explain the circumstances and provide evidence confirming no legal violations.

Key points about Due Diligence and how to pass it

- Due Diligence is one of the stages of obtaining temporary or permanent residence permits and citizenship by investment.

- The citizenship programme authority reviews information about the investor and their background, from sources of income to business reputation. The investor’s family members undergo Due Diligence together with the investor.

- The review takes on average three to six months, but in some countries it is faster. For example, in Vanuatu it takes about three weeks.

- An investor may fail the background check if they provide an incomplete set of documents or conceal biographical facts.

- Passportivity lawyers conduct an internal Due Diligence review that helps assess the investor’s chances of obtaining the status in advance.

About the authors

Frequently asked questions

The country’s authorities will refuse to grant a residence permit or citizenship if it is discovered that the investor concealed biographical facts. A transparent personal history and clear sources of income are the main criteria that influence the outcome of Due Diligence.

Yes, all citizenship applicants are subject to background checks. In Caribbean countries, the investor and family members over the age of 16 also undergo an online interview.

Countries screen citizenship applicants to protect national security, preserve the reputation and prestige of the passport, and combat money laundering and corruption.

It depends on the investor’s circumstances and the nature of the offence. Foreigners convicted of serious crimes, including drug trafficking, have no chance of passing the check.

A visa refusal by the United States or a Schengen country does not automatically lead to a negative Due Diligence outcome. However, the reason for the refusal may affect the decision, for example if it is related to criminal convictions or sanctions against the investor.

To pass the background check, the investor needs to prepare documents properly: collect a complete set, translate the documents, have them notarised, and, if required, apostilled.

For certain biographical facts, lawyers prepare affidavits, explanatory statements that demonstrate the transparency of the investor’s background and show that there is nothing to conceal.

The Due Diligence fee is

Contact us today

Passportivity assists international clients in obtaining residence and citizenship under the respective programs. Contact us to arrange an initial private consultation.