Golden Visas for Iranians: legal pathways to security, mobility, and a global future

For Iranian investors a Golden Visa offers peace, security, and belonging in a world that once felt closed.

While sanctions and currency restrictions limit global access, residence by investment unlocks legal pathways to Europe, the Gulf, and the US.

Discover how Iranians can turn investments into global mobility.

What is a Golden Visa and why do Iranians need it?

Golden Visa is a

Participation in Golden Visa programmes is possible for Iranian citizens, but it requires careful planning and professional support. Applicants residing in Iran face additional challenges, especially in transferring investment funds abroad and passing international due diligence.

Many successful cases come from Iranians who have already relocated or kept their assets in third countries such as the UAE, Turkey, or Oman.

Residence by investment

A Golden Visa grants residence in return for investment. Some countries issue temporary residence permits, while others offer permanent residence from the first day, each with its own clear rules and compliance checks. Iranian investors use this tool to gain mobility, secure a family base, and protect capital.

Investors can choose from common investment routes:

- government contributions;

- real estate purchase;

- fund units purchase;

- bank deposits;

- creating jobs.

Mobility, safety, and financial diversification

Iranian investors face currency limits and sanctions risk at home. A second base abroad reduces those risks and improves access to global finance. Clear documents and clean funds raise approval chances across all routes.

Key advantages for Iranian investors:

- travel opportunities across major regions;

- safe base for family life, schooling, and healthcare;

- bank accounts and assets in stable jurisdictions.

Pathway to citizenship

Residence by investment often leads to permanent status. Some countries open a direct path to citizenship after a set period of lawful stay. Naturalisation rules differ by country, so timelines and integration tests also differ.

Several countries offer a path to citizenship:

- Portugal usually allows an application after five years of lawful residence;

- Greece typically requires seven years of lawful residence with integration;

- the US allows citizenship five years after receiving a green card through EB‑5.

Residence for family under one application

Golden Visas sets eligibility rules for close relatives. The application can include a spouse, children, parents, and sometimes grandparents, brothers, and sisters.

It helps families plan schooling, healthcare and housing in advance, and family inclusion increases the

What is the current state of travel freedom for Iranian citizens?

Iranian passport holders can visit fewer than 50 countries

Passport ranking at a glance. Iran’s passport sits near the bottom of global league tables. Arton’s

Most advanced economies require a visa before travel. Europe, the United Kingdom and the United States all ask Iranian citizens to secure entry clearance in advance. Independent passport trackers confirm that

Schengen Area. Iranian travellers must obtain a Schengen visa before entering Europe for short visits. The European Commission explains the common rules across the Schengen Area and sets out the documents embassies require [248] Source: EU Visa Policy of obtaining Schengen Visa for Iranians .

An applicant prepares a standard pack for the embassy:

- completed form;

- valid passport and photos;

- travel medical insurance with at least €30,000 cover;

- proof of accommodation and funds;

- evidence of the trip’s purpose;

- biometric fingerprints taken for the Visa Information System.

Gulf travel. The United Arab Emirates does not offer

Regional travel. Access in the neighbourhood varies. Türkiye currently admits Iranian tourists for short stays without a visa, subject to the standard 90 days in any 180 days rule [250] Source: visa requirements, Ministry of Interior in Turkey .

Hungary has relaunched its guest investor route. The law took effect in 2024 with a 10‑year residence permit and set investment types, including a €250,000 real estate fund option and a €500,000 direct property route that became active in 2025.

The UAE has expanded and clarified eligibility across several categories. The official portal lists investors, entrepreneurs, professionals and outstanding graduates among those who can obtain

Which Golden Visas are open to Iranian nationals?

Most

Golden Visas bring concrete positives for families. Spouses and dependent children usually join the main investor, and many routes also accept dependent parents.

Children study in quality schools, families access private healthcare, and business owners open accounts in stable banking systems. Over time, golden visas lead to permanent residence and citizenship.

Comparison of Golden Visas available for Iranian investors

| Country | Minimum investment | Processing time | Eligible family members |

|---|---|---|---|

| Malta | €30,000 | Spouse, children under 25, siblings, parents, grandparents | |

| UAE | AED 2,000,000 | Spouse, children, parents, domestic staff | |

| Greece | €250,000 | Spouse, children under 21, parents | |

| Portugal | €250,000 | Spouse, children under 26, parents | |

| Italy | €250,000 | Spouse, minor children, dependent adult children, parents | |

| Hungary | €250,000 | Spouse, minor children, parents | |

| Cyprus | €300,000 | Spouse and children | |

| Latvia | €50,000 | Spouse, minor children | |

| Andorra | €600,000 | Spouse, children under 25 | |

| US EB-5 | $800,000 | Spouse, children under 21 |

Iranian applicants face unique complexities that go beyond the legal text. Banks apply enhanced screening to Iranian nationals and to any transfer with an Iranian link. Compliance teams ask for a clear audit trail that proves the origin of funds and the lawful path of every transfer.

Investors often route money through

Typical hurdles to plan for include:

- Source of funds scrutiny that requires contracts, tax records and proof of ownership for each income stream.

- Sanctions compliance that requires clean routing, with no transfer from or via restricted banks.

- Banking onboarding in the EU or the UAE may take weeks while the bank completes its customer checks.

- Time gaps caused by embassy appointment wait times and document legalisation.

The routes above remain open, but approval depends on careful paperwork and compliant money movement. A plan that sequences banking, documents and embassy steps increases the chance of a smooth outcome.

Andorra Residence Permit

Andorra runs a passive residence route for investors who base their life in the country while keeping income from abroad [251] Source: Andorra residence permit, Andorra Government . The route appeals to families who want a calm European base, strong banking and low taxes. Residents travel freely to Spain and France and can obtain Schengen visas quickly for wider EU trips.

Investment options. The minimum investment required is €600,000, which includes all qualifying assets and the mandatory security deposit. If the investor purchases real estate, its value must be at least €600,000, not including the deposit.

Applicants may allocate their investment to one or several approved assets:

- Real estate located in Andorra.

- Shares in an Andorran company.

- Debt or financial instruments issued by local organisations.

- Government bonds issued by the Andorran state.

- Life insurance products issued by Andorran companies.

Interest‑free deposits with the Andorran Financial Authority.

The investor must place a refundable security deposit of €50,000 with the Andorran Financial Authority, plus €12,000 for each accompanying family member.

Investors can combine several asset types to reach the total required amount.

Eligible family members. A single application can include a spouse or registered partner, as well as children under 17, including those from previous marriages. Children aged 18 to 24 also qualify if they are unmarried, financially dependent, and enrolled in

Required documents. Applicants prepare a clear file for immigration and banking checks. The pack includes:

- completed application form;

- valid passports;

- police clearance certificates;

- proof of income of at least €52,100 per year plus €17,370 per dependent;

- evidence of property ownership or lease in Andorra;

- health insurance for all family members;

- documentation confirming the investment and deposit.

Translations into Catalan, Spanish or French and notarisation or apostille apply where required. Banks ask for statements and a source of funds file.

Processing time. The process takes about two months once the file and funds are ready. After submitting and passing a short medical in Andorra, authorities usually issue the card within about a month.

Validity and renewal conditions. The residence permit is first issued for 2 years, renewable for 3, and then 10 years. Residents must spend at least 90 days per year in Andorra and maintain the required investments and income.

Additional costs and government fees. The main expenses include the €50,000 refundable deposit plus €12,000 per dependent, administrative and Due Diligence fees, private health insurance, translations, and housing costs. Real estate purchases also involve

Path to permanent residence or citizenship. Andorra focuses on renewable residence rather than a classic permanent card for investors. Naturalisation is possible only after long residence and requires renouncing previous nationality.

Standard eligibility starts at 20 years, with a faster track for those educated in Andorra for at least 10 years, plus language and knowledge tests in Catalan.

USA EB‑5 Visa

The EB‑5 Investor Visa to the US allows a foreign investor and family to become lawful permanent residents, Green Card holders, by making a qualifying investment in the US and creating or preserving at least 10

Investment options. To qualify, an investor must commit capital under one of the approved routes:

- Direct investment in a new commercial enterprise, managed directly by the investor.

- Investment through a

USCIS‑designated Regional Center, indirect investment. - Investment must meet either the standard threshold or a lower threshold if the project is in a Targeted Employment Area.

Eligible family members. The investor’s spouse and unmarried children under age 21 may apply along as derivative beneficiaries.

Required documents. Applicants must submit a complete petition, including:

- Form I‑526 or I‑526E, Immigrant Petition by Investor.

- Passport and identity documents.

- Police clearance certificate.

- Evidence of a lawful source of funds.

- Project or business plan showing job creation.

- Proof of investment or capital transfer.

- For regional center projects, evidence of regional center approval.

Processing time. Once the petition is filed, USCIS reviews I‑526 or I‑526E. If approved, the investor applies for an immigrant visa or adjustment of status. Total processing can take 18 to 30 months or more, depending on the backlog.

Validity and renewal conditions. Successful applicants obtain conditional permanent residence valid for 2 years. Before that period ends, the investor must file Form I‑829 to remove conditions by proving continued investment and maintaining or creating 10

Additional costs and government fees. Applicants pay USCIS filing fees for the forms I‑526 or I‑526E, I‑485 or DS‑260, and I‑829. There are also legal, business structuring and Due Diligence costs. Regional center projects often charge administrative fees.

Path to permanent residence or citizenship. After USCIS approves I‑829, the investor and family become full lawful permanent residents. They may apply for US citizenship after five years of permanent residence, if other naturalisation requirements are met.

In fiscal year 2023, Iranian nationals received at least 54 immigrant EB‑5 visas in the US [253] Source: EB‑5 visas issued to Iranian nationals, US Government . The route remains open to Iranians who document clean funds and move capital in full compliance with US sanctions.

Olga Koltsova

Investment Programs Expert

Olga Koltsova

Investment Programs Expert

UAE Golden Visa

The UAE Golden Visa grants

The residence card is valid for 5 or 10 years and renews automatically while conditions remain in place. The visa offers a safe base in a stable and

Investment options. Investors can choose one of several qualifying routes:

- Purchase real estate with a value of at least AED 2,000,000 or about $545,000.

- Invest through a mortgage with at least AED 2,000,000, or about $545,000, of paid capital.

- Establish or invest in a company with authorised capital of AED 2,000,000, or about $545,000.

- Deposit AED 2,000,000, or about $545,000, in an approved UAE bank for a fixed period.

- Hold a balance of AED 1,000,000, or about $272,000, in a UAE account and maintain an active business license.

Eligible family members. The Golden Visa covers the investor’s spouse, sons under 25 and daughters of any age. It also includes domestic staff such as housekeepers or drivers. Parents can receive renewable residence permits when financially dependent on the main applicant.

Required documents. Applicants prepare a file for the immigration service that includes:

- valid passports for all family members;

- property title deed or investment certificate;

- trade license and company registration documents if applicable;

- bank statements confirming capital placement;

- police clearance certificate from the UAE or country of residence;

- proof of medical insurance and medical fitness certificate;

passport‑size photographs and Emirates ID application forms.

Processing time. Applications take around 2 months once all documents are ready and verified. The process includes medical screening, Emirates ID registration and residence visa stamping.

Validity and renewal conditions. The Golden Visa remains valid for 5 or 10 years depending on the category. Renewal is automatic if the investment or business remains active. There is no minimum stay requirement, and holders may spend time abroad without losing status.

Additional costs and government fees. Applicants pay visa issuance and medical examination fees that range from AED 2,800 to 4,000, or about $760 to 1,090, depending on the emirate.

Other expenses include Emirates ID, insurance, document attestation and registration fee of AED 160,000, or $21,800 for property purchase.

Path to permanent residence or citizenship. The UAE does not currently offer direct citizenship by investment. Golden Visa holders enjoy

Families benefit from stability, education and healthcare access in one of the world’s safest environments.

Hungary Golden Visa

Hungary introduced the Guest Investor Visa in 2024. It grants residence for 10 years to

The visa allows the investor and family to live, study and work in Hungary and travel freely within the Schengen Area. Renewal is straightforward when the investment remains in place.

Investment options. An investor qualifies through one of the following routes:

- Subscription to an approved real estate fund for at least €250,000.

- Donation of at least €1,000,000 to a public interest foundation that supports Hungarian education or culture.

The investment in the fund units must remain active for at least five years to keep residence rights.

Eligible family members. The visa covers the investor’s spouse and minor children. Dependants receive the same length of residence as the main applicant.

Required documents. Applicants prepare a complete file that includes:

- valid passport;

- clean criminal record certificate from the country of residence;

- proof of legal income and source of funds;

- documents confirming the chosen investment or fund subscription;

- proof of accommodation in Hungary;

- medical insurance covering the full stay;

passport‑size photographs.

Processing time. The process takes about five months once the file and investment proof are ready. The investor can submit the application through the Enter Hungary online system or at a Hungarian consulate.

Validity and renewal conditions. The Guest Investor Visa grants residence for 10 years, renewable for another 10 years if the investment continues to meet legal requirements. Holders must maintain the qualifying asset and valid health insurance.

Additional costs and government fees. Applicants pay administrative and residence card fees of about €110, translation and legalisation costs, and property registration fees when applicable.

The fund subscription option also include:

- An administrative fee of €20,000 for the investor and €1,000 per family member.

- Fee for managing a brokerage account for 5 years — €8,700.

Path to permanent residence or citizenship. After three years of lawful residence, an investor may apply for permanent residence in Hungary. Citizenship by naturalisation becomes available after eight years of continuous residence and proven integration, including basic Hungarian language knowledge.

Italy Golden Visa

Italy offers an Investor Residence Permit to

Investment options. Investors qualify through one of the below pathways:

- €250,000 in an innovative

start‑up . - €500,000 in an established Italian company.

- Purchase government or corporate bonds with an investment of at least €2,000,000.

- Donation of at least €1,000,000 to public interest causes, such as culture, research, or the arts.

Eligible family members. The investor may include a spouse, minor children, and adult children who depend on the investor. Parents qualify if they are financially dependent on the investor and have no other children in their country of origin, or if they are over 65 and their other children cannot support them due to documented serious health reasons.

Required documents. Applicants present a file containing:

- valid passport;

- certificate of no criminal record;

- proof of the investment through contracts, bank statements, or securities documentation;

- income statements or business statements proving legal funds;

- proof of health insurance;

- proof of accommodation in Italy;

passport‑style photographs.

Processing time. Once all documentation and investment proof are ready, the process takes about four months. The key steps include visa issuance via the Italian consulate and permit activation once in Italy.

Validity and renewal conditions. The investor visa is valid for two years initially. It can be renewed for three more years if the investment is maintained and other conditions are satisfied.

Additional costs and government fees. Fees include application and permit issuance costs, legalisation and translation charges, notary and agency commissions, and any tax on asset transfers or acquisitions.

Path to permanent residence or citizenship. Investors may apply for permanent residence after 5 continuous years of residence in Italy. Citizenship by naturalisation becomes possible after 10 years of legal residence, subject to language tests, integration, and financial stability.

Malta Residence Permit

The Malta Global Residence Programme, GRB, grants a special residence tax status to

Key features:

- foreign income remitted to Malta is taxed at a flat 15% rate. The minimum annual tax is €15,000 per family;

- foreign income not transferred to Malta is not taxed in Malta;

- capital gains earned outside Malta are exempt from Maltese tax, even if brought into Malta;

- income that arises in Malta and capital gains realised in Malta are taxed at standard rates up to 35%;

- no inheritance tax is charged on assets.

Applicants must become Maltese tax residents and must not reside in any other country for more than 183 days to maintain a residence permit.

Investment options. Applicants comply with one of these options: purchase or rent property in Malta with a minimum annual value of €275,000 for purchase or €9,600 per year for rent.

Eligible family members. The applicant may include a spouse or civil partner, dependent children under 18, dependent children aged 18 to 25 if students, siblings, and dependent parents and grandparents.

Required documents. Applicants provide:

- valid passport;

- criminal record from country of residence;

- proof of legal income and assets;

- property deed or rental agreement plus proof of payment;

- proof of health insurance covering residency in Malta;

- birth, marriage or civil partnership certificates;

- bank statements and audited accounts as evidence of finances;

- translations and apostilles as needed.

Processing time. Applications take four months after submission of a complete file.

Validity and renewal conditions. Malta residence is valid indefinitely as long as conditions remain satisfied. The property or lease must be maintained, and annual fees paid. Renewal is automatic if all requirements continue to be met.

Additional costs and government fees. Applicants pay a government registration fee of €6,000,

Path to permanent residence or citizenship. GRP does not lead directly to permanent residence or citizenship by investment. Applicants may apply under standard naturalisation rules over time through

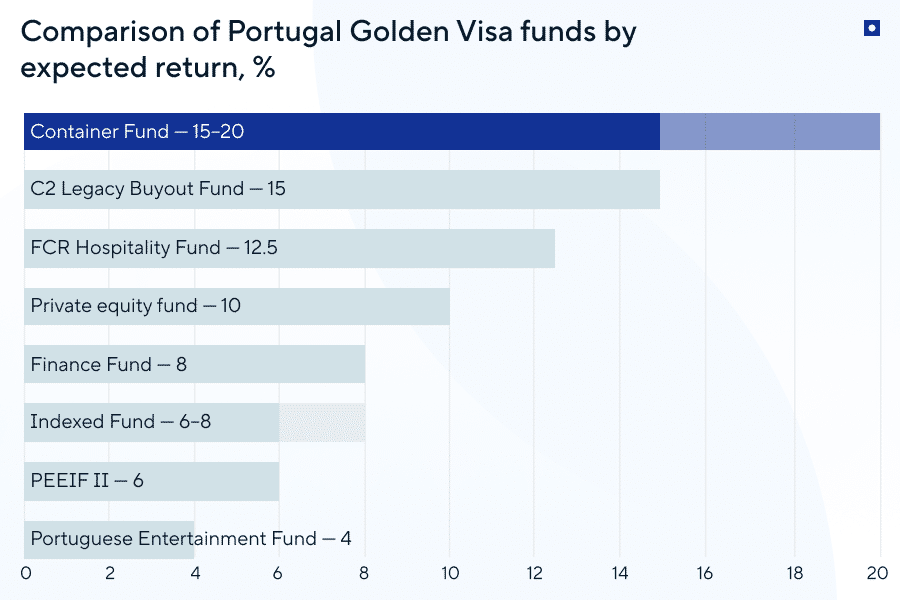

Portugal Golden Visa

Portugal Golden Visa allows

The Golden Visa retains several investment routes, even after 2023 reforms, and continues to attract international applicants [258] Source: Portugal Golden Visa, AIMA .

Investment options. Applicants may choose from several routes:

- Invest at least €500,000 in Portuguese companies or funds.

- Invest €500,000 in cultural, artistic or heritage projects.

- Fund scientific research with a minimum capital commitment.

- Create at least 10 new jobs in Portugal.

- Invest in business.

With the real estate route closed, regulated investment funds and cultural investment have become the leading choices for applicants.

Investment funds, supervised by the Portuguese Securities Market Commission, invest in technology, green energy, tourism, and infrastructure.

Eligible family members. The principal investor may include a spouse or civil partner, dependent children under 18, dependent adult children studying or unmarried up to age 26, and dependent parents.

Required documents. Applicants submit documents including:

- valid passport;

- criminal record certificate from country of residence;

- proof of source of funds and assets;

- property deed, fund subscription or project contract plus proof of payment;

- documentation proving job creation where applicable;

- health insurance covering Portugal;

- proof of accommodation;

- identity, marriage and birth certificates;

- translations and legalisation as necessary.

Processing time. Approval normally takes 12 months for the initial application. The file must be complete and conform to requirements for documents and compliance.

Validity and renewal conditions. The residence permit renews every two years, provided the investment is maintained and conditions are met. Applicants must remain in Portugal for a minimum of seven days every two years.

Additional costs and government fees. Applicants pay state and administrative fees, notary and translation costs, registration and stamp duties, and legal assistance fees. The subscription fee under the fund units purchase is up to 7.5%.

Path to permanent residence or citizenship. After 5 years of legal residence, investors and their families may apply for permanent residence. Citizenship becomes possible after a minimum of 10 years of residence, on meeting language and integration criteria.

Cyprus Permanent Residence

Cyprus runs a permanent residence route by investment in 2020 [259] Source: Cyprus Investment Programme, Cyprus Government . The status remains valid for life if the investor keeps the required assets. The route gives families a stable base in an EU country with mild taxes, a Mediterranean lifestyle, and access to quality healthcare and education.

Investment options. An investor chooses one of the following routes:

- Purchase one or two new residential properties worth €300,000 plus VAT.

- Purchase commercial property with a total value of €300,000.

- Invest €300,000 in shares of a Cypriot company that employs at least five people.

- Subscribe €300,000 to units in a licensed investment fund, AIF, AIFLNP, or RAIF.

If the investment is not residential, the investor also owns or rents a home in Cyprus.

Eligible family members. The application includes a spouse or civil partner, children under 18, unmarried children up to 25 who study and depend on the investor, and children of any age with physical or mental disabilities.

Required documents. Applicants prepare a file with:

- valid passport;

- police clearance certificate from the country of residence;

- proof of legal source of funds and assets;

- contract of sale or investment agreement and proof of payment;

- confirmation of residence or rental in Cyprus;

- medical insurance for all family members;

- birth and marriage certificates;

- translations and apostilles where needed.

Processing time. The government completes most applications within nine months after submission. The process moves faster when the banking and legal checks are clear.

Validity and renewal conditions. The status has lifelong validity if the investor keeps the qualifying assets. The residence card renews every five years. The investor visits Cyprus at least once every two years to maintain the permit.

Additional costs and government fees under the residential property purchase option include:

- registration fee of €500 and €70 per dependent;

- legal, notary and translation costs;

- VAT of €15,000;

- property transfer and stamp duty fees.

Path to permanent residence or citizenship. The residence remains permanent with no need to reapply. After eight years of residence, an investor may apply for Cypriot citizenship through naturalisation. The process requires proof of integration and a record of residence in the country.

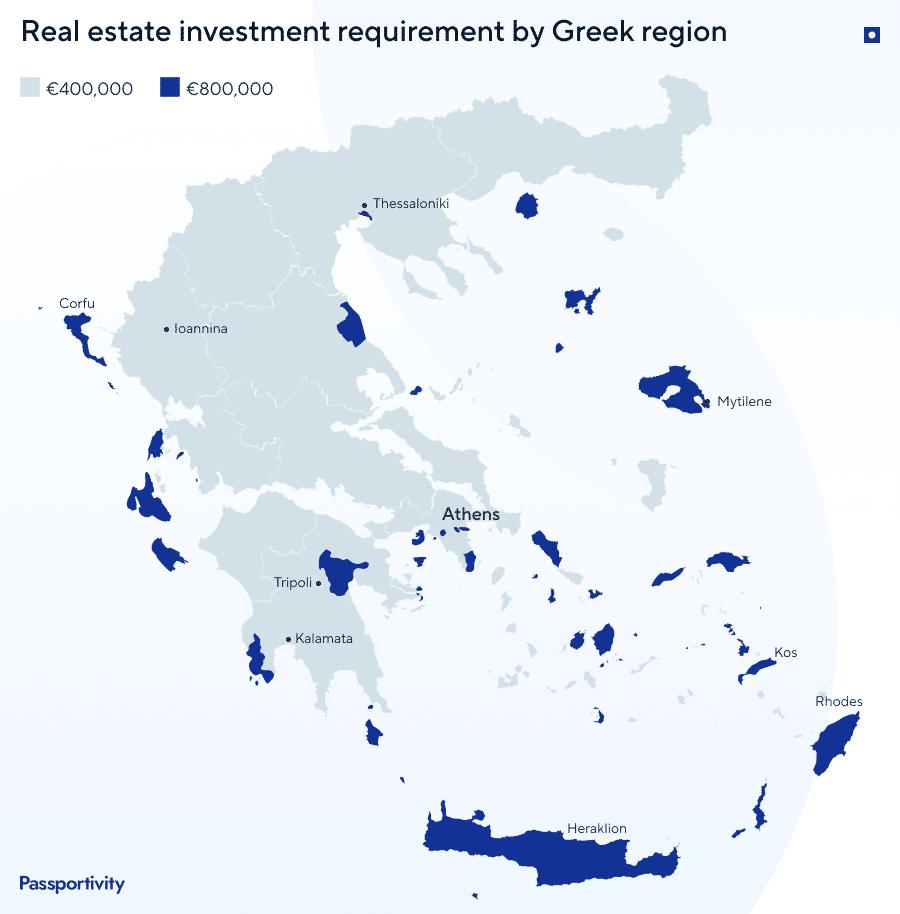

Greece Golden Visa

Greece grants residence to

Investment options. Applicants choose one of these approved paths:

- Acquire real estate worth at least €250,000;

- Invest in Greek strategic or development projects under government lists;

- Make a capital contribution to a business or fund that supports

job‑creating or growth sectors; - Deposit an amount in Greek banks under certain conditions.

The Greece Golden Visa real estate route requires a minimum investment of €800,000 in

The €250,000 threshold applies only to listed heritage buildings under full restoration or to commercial and industrial properties unused for over five years that have been fully converted into residential use with formal approval before the application.

Eligible family members. The main investor may include a spouse or legal partner, children under 21, and parents of the investor or spouse.

Required documents. Applicants submit:

- valid passport;

- clean criminal record certificate;

- proof of legal source of funds;

- property deed or investment contract with proof of payment;

- accommodation proof;

- health insurance;

- civil status certificates;

- translations and legalisation where necessary.

Processing time. Authorities typically issue the residence permit within four months after receiving a complete application.

Validity and renewal conditions. The residence permit renews every five years while the investor keeps the property or investment. There is no requirement to live in Greece or stay a minimum number of days.

Additional costs and government fees. Applicants budget for:

- government processing fees;

- notary, registration and legal fees;

- property transfer taxes;

- translation and legalisation costs;

- real estate maintenance and tax costs.

Path to permanent residence or citizenship. After seven years of legal residence, the investor and family may apply for Greek citizenship under naturalisation conditions. The applicant must pass a Greek language, history or culture test and show proof of continuous residence or connection to Greece.

Latvia Golden Visa

Latvia provides an investor residence permit to

Investment options. Investors may choose one of the approved investment paths:

- Acquisition of shares or capital in a Latvian company with at least 10 employees.

- Transfer of capital into a government bonds portfolio or registered local financial instruments.

- Purchase of real estate in restricted zones or of

state‑approved properties. - Investment through regulated funds that channel capital into Latvian economic projects.

Eligible family members. The investor may include a spouse, minor children, and children up to age 18. Some routes permit inclusion of dependent parents.

Required documents. Applicants present:

- valid passport;

- police clearance from country of residence;

- proof of legal source of funds;

- investment contract or share purchase agreement plus proof of payment;

- proof of residence or accommodation in Latvia;

- health insurance;

- citizenship and civil documents as needed.

Processing time. Approval takes nine months for a complete application after document checks and investment confirmation.

Validity and renewal conditions. Residence permits under investment routes usually renew every five years if investment remains in place. The investor must maintain the qualifying investment throughout.

Additional costs and government fees. Applicants pay government and application fees, notary and registration charges, translation and legalisation, and tax on property acquisition or capital gains if applicable.

Path to permanent residence or citizenship. After a period of continuous residence of 5 years, the investor may apply for permanent residence. After 10 years of legal residence, eligibility for naturalisation becomes possible, subject to integration and language tests.

How to apply for a Golden Visa for residence permit by investment?

Obtaining a Golden Visa usually takes from 2 to 12 months depending on the country, type of investment and document preparation. The process follows a clear sequence of steps that ensure compliance, transparent fund transfers and proper Due Diligence.

-

1 day

Preliminary consultation and eligibility check

An immigration advisor analyses the investor’s profile, source of funds and personal background to confirm eligibility. This stage helps identify the most suitable country, investment route and family structure for the application.

-

30 days

Document preparation and translation

The investor collects civil, financial and criminal record documents. Certified translators prepare versions in the required language, and apostilles or legalisations confirm authenticity. Early preparation prevents delays at the application stage.

-

Up to 30 days

Opening a bank account and transferring investment funds

Before submission, the investor opens a bank account in the destination country or an approved intermediary jurisdiction. Funds are transferred only through transparent, verifiable channels that meet international compliance standards.

-

1—3 daysMaking the investment and securing proof

The investor completes the investment — purchasing property, subscribing to a fund, or depositing capital in a business or bank — and receives official proof such as a contract, payment receipt or title deed.

-

1 day

Submitting the application

The investor submits the full application with supporting documents to the immigration authority or through a licensed representative. In most cases, this includes biometric data, photographs and health insurance confirmation.

-

1—4 monthsDue Diligence and background verification

Authorities conduct enhanced checks to verify the source of funds, identity and background of the applicant and family members. Iranian investors often undergo additional screening to comply with international sanctions regulations.

-

Up to 30 days

Approval and residence card issuance

After successful verification, the authority issues an approval letter and then a residence card. The investor and family travel to the country to collect the cards, register residence and finalise any local formalities such as tax or municipal registration.

-

In

2—10 yearsRenewal and

long‑term planningResidence permits last 2 to 10 years and renew when the investment remains in place. After a qualifying period, 5 to 10 years, the investor may apply for permanent residence or citizenship depending on national laws.

What are the most common reasons for Golden Visa refusal or delay?

Golden Visa applications follow strict compliance and Due Diligence standards. When documentation or transfers do not meet these standards, authorities can delay or reject the application. Understanding the most frequent issues helps investors avoid costly mistakes and plan effectively.

Unclear source of funds. Authorities require full proof of how the investment capital was earned. Missing tax records, company documents or unclear transfers often lead to requests for clarification.

Incomplete documentation. Inaccurate forms, missing translations, or expired certificates can delay approval. Each document must be

Inconsistent personal data. Differences in names, birth dates or document details between certificates and passports create red flags for migration and financial authorities.

Negative Due Diligence results. Any legal disputes, criminal records or association with restricted persons or companies can stop the process entirely.

Unpaid taxes or outstanding liabilities. In some countries, applicants must present tax clearance from their country of residence.

Late or incorrect renewals. Missing renewal deadlines or selling the qualifying investment before renewal leads to automatic cancellation.

Main takeaways about Golden Visas for Iranians

- Golden Visas give Iranian investors a practical and lawful route to international mobility, financial protection, and

long‑term security. They help overcome restrictions on travel and currency transfers while building a second base for families in stable jurisdictions. - The UAE Golden Visa combines flexible residence terms and simple banking compliance, while Greece offers Schengen access and affordable entry at €250,000.

- Portugal and Hungary offer

long‑term opportunities inside the EU. Portugal focuses on regulated funds, culture and research, leading to citizenship after 5 years. - Italy welcomes business investors who plan active presence and

long‑term settlement. Hungary’s Guest Investor Visa gives 10 years of residence with a €250,000 fund option. - Cyprus, Andorra, and Latvia provide lasting residence and easy family participation. Cyprus grants lifelong status from a €300,000 investment, Andorra offers a

low‑tax base between France and Spain, and Latvia remains amodest‑cost Schengen route for families seeking stability without relocation. - Malta’s Global Residence Programme focuses on remittance taxation with a 15% flat rate on income brought to the country.

- The US EB‑5 route offers a direct path to a Green Card by investment starting at $800,000.

About the authors

Frequently asked questions

International sanctions require banks and immigration authorities to verify every transaction from Iran or by Iranian nationals. Applications undergo enhanced Due Diligence to confirm that funds come from lawful,

Most Iranian investors use intermediary accounts in neutral or third countries such as the UAE, Turkey, or Oman. Licensed financial institutions handle international compliance checks and issue the documents required for the Golden Visa application.

Yes. The UAE, Greece, Portugal, Italy, Hungary, Cyprus, Latvia, and Andorra all accept Iranian investors who pass Due Diligence and banking checks. Malta’s MPRP remains closed to Iranian nationals.

Currently, Malta’s Permanent Residence does not accept Iranian citizens. Other EU and UAE routes remain open under strict compliance rules.

Yes. All active Golden Visas allow the inclusion of a spouse and dependent children. Many countries, such as Cyprus, Greece and Hungary, also accept dependent parents of the main applicant or spouse.

Processing takes from 2 to 12 months depending on the country, investment type and speed of document preparation. Golden Visas, such as those of the UAE or Greece, usually issue residence cards within

Yes, if the applicant can prove that the funds have a legal origin and were transferred through a compliant banking route. Certified business records, tax statements and

No. Most Golden Visas, such as those in Greece, Portugal, Hungary and Cyprus, have minimal or no stay requirements. Investors can keep residence rights while living abroad as long as the investment remains active.

Yes. After a qualifying period, usually 5 to 10 years, Golden Visa holders may apply for citizenship by naturalisation. They must meet residence, language and integration requirements that differ by country.

Authorities conduct enhanced Due Diligence on Iranian nationals, focusing on fund origin, business partners and banking routes. Complete documentation and early compliance checks significantly increase approval chances.

The UAE Golden Visa and Greece Golden Visa are currently the most accessible for Iranian nationals. Both have straightforward procedures, clear banking policies and predictable processing times.

Contact us today

Passportivity assists international clients in obtaining residence and citizenship under the respective programs. Contact us to arrange an initial private consultation.