Portugal Golden Visa masterguide for investors: costs, compliance, lifestyle

Portugal Golden Visa is a residency by investment programme centred on funds, culture, science and job creation, with a minimum investment threshold starting at €250,000.

At the same time, the programme is entering a period of uncertainty: legislative discussions and policy signals suggest that further changes may be ahead.

For investors this creates a delicate balance between opportunity and timing, as the Golden Visa still offers family inclusion, low physical presence requirements and a defined route to

Portugal Golden Visa: who qualifies and how it works

The Portugal Golden Visa is a residency by investment program created to attract foreign capital and stimulate economic activity in Portugal. Successful applicants receive a Portuguese residence permit that allows them and qualifying family members to live in Portugal and travel freely within the Schengen Area.

After holding the visa for the required period and meeting the legal conditions, applicants can pursue permanent residency and citizenship.

Who qualifies

Portugal Golden Visa is open to

To qualify for the Portugal Golden Visa, an applicant must meet basic eligibility criteria:

- be at least 18 years old;

- have a clean criminal record;

- be able to make one of the investments defined by the program.

These investments are designed to benefit the Portuguese economy and currently include contributions such as investing in Portuguese venture capital or private equity funds, supporting cultural heritage or scientific research, or creating jobs through business activity.

The program no longer includes residential real estate purchases as an eligible route following recent legislative updates.

According to AIMA, Portugal issued 2,901 Golden Visa residence permits in 2023, of which 1,554 were granted to family members

[2]

Source: The Portugal News, June 18, 2025

. In 2024, the number rose to 4,990, representing a sharp

How it works

Once the investment is made and the application is submitted to the Portuguese immigration authorities, the processing period takes

Upon approval, a temporary residency permit is issued, valid for two years and renewable as long as the investment is maintained and the minimal physical presence requirements are met. These include spending a minimum of 7 days in Portugal during the first year and at least 14 days during each subsequent 2-year period, allowing investors considerable flexibility in terms of their time spent in Portugal.

Holding the Golden Visa and maintaining the investment for the prescribed period allows the investor and qualifying family members to apply for permanent residence and ultimately Portuguese citizenship, subject to meeting the language and legal requirements that apply at that stage.

10 benefits of Portugal residence permit by investment

The Portugal Golden Visa offers a wide range of advantages for investors and their families. Below are the key benefits of obtaining a residence permit through investment.

1. Visa-free travel across the 29-country Schengen Area

Holding a Portuguese residence permit allows the holder to travel

2. Pathway to permanent residency in 5 years

After five years of maintaining the qualifying investment and meeting the minimum residency requirements, the holder may apply for permanent residence and, subsequently, for Portuguese citizenship. A Portuguese passport provides access to EU citizenship and enables

3. High-quality healthcare access for residents

Golden Visa holders and dependent family members are entitled to participate in Portugal’s public healthcare system on the same basis as Portuguese residents, which is widely regarded for accessibility and quality.

4. Right to live, work and study in Portugal

The permit grants legal residency rights to live, work, or study in Portugal. This includes access to Portuguese universities and vocational programmes, offering international education opportunities.

5. Inclusion of eligible family members in one application

The main applicant can include a spouse, children under 18 years old, students aged 18 to 26, and financially dependent parents under a single Golden Visa application. This makes the programme a

6. Only 7 days physical presence required

The residency permit has low physical presence requirements: a minimum of 7 days in the first year and 14 days every subsequent 2-year period. Such flexibility allows investors to maintain their lifestyle and business obligations globally.

7. Life in one of the world’s safest countries

Portugal is ranked in the top 10 of the world’s safest countries globally due to low violent crime rates and strong social stability. It also regularly appears high on expat safety and

8. IFICI tax regime for qualifying residents

Portugal’s IFICI, Tax Incentive for Scientific Research and Innovation, the updated tax regime often referred to as NHR 2.0, offers

Benefits may include a flat 20% tax rate on qualifying

9. Access to Portugal’s high quality of life and global connectivity

Portugal is regularly highlighted for its mild climate, vibrant culture, stable political environment, and relatively affordable cost of living compared with many Western European countries. Its strategic location also offers convenient connections to Europe, Africa, and the Americas.

10. Flexible investment routes aligned with economic growth

Following recent legislative reforms, the Golden Visa now focuses on productive investment routes that support the Portuguese economy, such as:

- Contribution to the reconstruction of national heritage sites or cultural activities — €250,000.

- Purchase of shares in investment funds — €500,000.

- Investment in a business in Portugal creating five jobs — €500,000.

- Contribution to Portuguese scientific projects — €500,000.

- Company creation with a minimum of 10 jobs.

This shift aims to attract

According to data published by AIMA, in recent years, the number of foreign residents with legal status has exceeded one million, showing

Elena Garnitsarik

Head of the Legal Department

Elena Garnitsarik

Head of the Legal Department

Which investment routes are open for obtaining a Portugal Golden Visa?

Investing in regulated Portuguese investment funds is one of the most popular and flexible routes for obtaining a Portugal Golden Visa [4] Source: The Portugal News, February 21, 2025 . These funds offer a diversified way for investors to participate in Portugal’s economic growth, with a focus on sectors such as green energy, technology, private equity, and venture capital.

In addition to investment funds, the Portugal Golden Visa offers other investment options. One of the most

Other routes include investment in business, contribution to scientific research projects, and creation of a company with at least 10 new jobs.

Portuguese fund units purchase — €500,000

To qualify for the Golden Visa through an investment fund, the investor must commit a minimum of €500,000 in a regulated Portuguese investment fund. These funds are specifically designed to support projects that drive growth and innovation in Portugal, including venture capital, technology

The fund must be registered with the Portuguese Securities Market Commission and must comply with Portuguese financial regulations to ensure that the investment is managed transparently and professionally. Moreover, at least 60% of the fund's capital must be directed to investments in Portuguese companies or initiatives that contribute to the development of the Portuguese economy.

Types of funds. There are various types of regulated investment funds that qualify for the Golden Visa, including:

- Private equity funds, which invest in Portuguese businesses that have potential for high growth.

- Venture capital funds, which support

start-ups and innovative technologies, helping to develop Portugal's entrepreneurial ecosystem. - Renewable energy funds, aimed at driving the transition to sustainable energy and reducing the country’s carbon footprint.

- Real estate funds, though no longer directly tied to the Golden Visa programme for residential property purchases, some funds still focus on

large-scale commercial real estate projects.

These funds allow investors to diversify their portfolios and potentially benefit from higher returns, while also contributing to the Portuguese economy in areas such as job creation, technological innovation, and environmental sustainability.

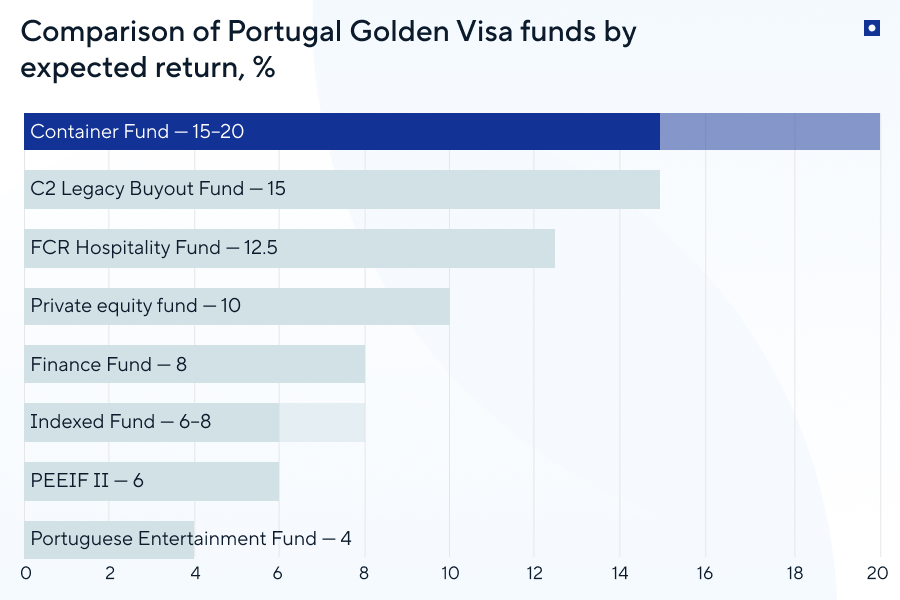

Portugal Golden Visa investment funds list

| Fund name | Economic sector | Subscription fee | Annual management fee | Maturity |

|---|---|---|---|---|

| ActiveCap Opportunities | Mixed | 2% | 2% | 10 years |

| Container Fund | Technology | 2% | 2% | 10 years |

| Finance Fund | Renewable energy | 1.5% | 1.5% | 10 years |

| FCR Hospitality Fund | Hospitality | 1% | 1.5% | 10 years |

| Growth Blue Fund | Blue Economy | 3% | 2% | 10 years |

| Iberian Net Zero | Renewable energy | 1% | 1.6% | 8 years |

| Indexed Fund | Securities | 2% | 2% | 10 years |

| Mercan Private Equity Fund | Hospitality | 0% | 0.25% | 12 years |

| Mercurio Fund | Mixed | 0% | 2% | 7 years |

| Pela Terra | Agricultural | 1% | 1.5% | 7 years |

| Portugal Gateway | Technology | 0% | 2% | 10 years |

| Portugal Golden Opportunities | Equities, bonds | 1% | 1.8% | Continuous ( |

| Private Equity Fund | Venture capital | 0% | 1.5% | 10 years |

Investment strategy and duration. Investors are required to maintain their investment for a minimum of five years, which is the standard period for holding a Golden Visa investment before being eligible for permanent residency or citizenship.

However, some funds offer the opportunity to exit or reduce the investment after a shorter period, depending on the fund's strategy and the investor’s specific terms.

Dividends in Portugal Golden Visa investment funds. When investing in regulated Portuguese investment funds for the Golden Visa, investors may receive dividends as part of the returns generated by the fund. These funds typically distribute dividends annually, with rates varying depending on the fund’s focus and strategy.

For example, funds focused on green energy or agriculture may provide annual dividend payouts of around

While dividends are paid regularly, the final capital return is typically realised when the fund exits or matures, usually after five to ten years. Returns are not guaranteed and depend on the fund's performance, but this route allows investors to benefit from both regular income and potential capital appreciation.

Contribution to cultural heritage — €250,000

One of the most accessible routes for obtaining a Portugal Golden Visa is through cultural heritage and artistic projects. This option requires a

Eligible projects are typically certified by the Bureau for Cultural Strategy, Planning and Assessment under the Ministry of Culture before investment. These projects reflect national cultural priorities and may include the preservation of historical sites, support of artistic productions, and cultural development programmes.

Examples of the types of cultural initiatives that qualify include:

- Restoration of national heritage sites, such as historic buildings, museums or monuments that require refurbishment and conservation.

- Funding artistic productions, such as Portuguese feature films, theatre, dance or music events, where the investment directly supports creative output.

- Support for cultural foundations and public cultural institutions, including arts festivals, exhibitions, or programmes that promote Portugal’s cultural heritage.

- Museum and heritage infrastructure projects that expand public access to cultural artefacts and exhibitions.

In designated

Investment in business — €500,000

One of the key routes for obtaining a Portugal Golden Visa is through investment in a Portuguese business that creates at least 5 new

This investment can be directed towards an existing company or by creating a new one. The business must be based in Portugal, and the jobs created must be

Example projects:

- technology

start-ups developing new innovations or services; - renewable energy projects that promote sustainability;

- retail or hospitality businesses that create jobs in local communities.

This option encourages job creation and supports Portugal’s economic development by fostering entrepreneurship and supporting small and

Contribution to scientific research projects — €500,000

This investment must be made into scientific research projects approved by the Portuguese authorities, typically with a minimum contribution of €500,000. This option is ideal for investors who wish to support scientific and technological advancements in Portugal.

The projects may involve research in fields such as biotechnology, renewable energy, engineering, and information technology. This route is perfect for those who want to contribute to global innovation and help advance Portugal’s position as a hub for research and development.

Creation of a company with at least 10 jobs — €500,000

Investors who are interested in establishing a new company in Portugal and creating at least 10

This route is designed for entrepreneurs who want to actively contribute to Portugal’s labour market by creating job opportunities and supporting the country's economic growth. The company can be in any sector, including technology, services, manufacturing, and retail, as long as the requirement to create jobs is met.

Comparison of Portugal Golden Visa costs

| Investment route | Minimum investment | Additional expenses | AIMA fees per person | Investment return |

|---|---|---|---|---|

| Investment in fund units | €500,000 | Fund subscription — 7.5% | Application fee — €618.60 Card issuance fee — €6,179.40 | Yes |

| Investment in the cultural sector | €250,000 | Usually none beyond legal and transfer costs | Application fee — €618.60 Card issuance fee — €6,179.40 | No |

| Investment in science | €500,000 | Usually none beyond legal and transfer costs | Application fee — €618.60 Card issuance fee — €6,179.40 | No |

| Business investment | €500,000 | Company setup and employment costs for 5 jobs | Application fee — €618.60 Card issuance fee — €6,179.40 | Yes |

| Opening a company | Not specified | Company setup and employment costs for 10 jobs | Application and processing fee €618.60; initial issuance fee €6,179.40 | Yes |

Documents required for a Portugal Golden Visa application

AIMA reviews each application based on a standard set of documents for the main applicant and every family member included

[5]

Source: AIMA, document requirements

. Applicants submit scans through the ARI portal and bring the originals to the

To apply for a Portugal Golden Visa, the main applicant and each family member included in the file must prepare a standard set of identity, compliance, and investment documents, which are typically submitted online first and later presented in original form at the appointment:

- Valid passport for each applicant.

- Birth certificate.

- Marriage certificate if a spouse is included.

- Proof of family relationship for each dependent, such as marriage and birth certificates.

- Supporting evidence for dependents where relevant, such as proof of

full-time study for adult children and proof of financial dependence for parents. - Criminal record certificate from the country of origin or the country of permanent residence, issued less than 3 months before submission, translated into Portuguese and certified by a Portuguese consular authority or with an Apostille.

- Certificates confirming no outstanding debts with the Portuguese Tax Authority and Social Security, or proof of

non-registration where applicable. - Health insurance.

- Portuguese tax identification number, NIF.

- Personal tax identification number from the country of origin, residence, or tax residence, or proof that none exists.

- Proof of address in Portugal.

- Statement from a Portuguese bank account.

- Bank declaration confirming the effective transfer of the required amount through a credit institution authorised or registered in Portugal.

- Declaration of source of funds.

- Proof of investment and updated evidence that the investment was made and is still maintained.

- Declaration confirming compliance with the investment requirements, including the minimum amount and the required holding period.

- If investing through a Portuguese company, an updated commercial registry certificate confirming the applicant’s shareholder status.

What is the timeline and process for obtaining a Portugal Golden Visa?

The process of obtaining the Portugal Golden Visa involves a series of steps, each of which takes a certain amount of time. Realistic planning and careful document preparation help reduce delays, but investors should expect the overall timeline to span about 12 to 24 months from start to receiving the first residence card. This reflects both statutory requirements and current administrative realities in Portugal.

-

2 days

Preliminary Due Diligence

It helps to reduce the risks of failure to 1%. Passportivity only signs an agreement with the investor once the check is passed and both lawyers and the investor are aware of the chances and risks.

-

2+ week sPreparation of documents

Passportivity lawyers prepare a personalised list of required documents for the Portugal residence permit application. They also complete government forms and assist with translation and notarisation.

-

1—2 weeksObtainment of a tax number

Applicants receive their unique Portuguese tax number, the Número de Identificação Fiscal, NIF, which is essential for opening a bank account, signing contracts, or making investments in Portugal.

-

4—6 weeksOpening of an account in a Portuguese bank

All investments for the Golden Visa must be made through a Portuguese bank account. We assist with opening and activating the account. Once it's ready, the applicant transfers the necessary investment funds.

-

4—6 weeksInvestment

Depending on the chosen route, the applicant may invest in fund units, set up a company with job creation, or support cultural or scientific projects. Lawyers collect supporting documents to confirm the investment.

-

5—6 monthsApplication

Electronic copies of the full application are submitted to the Agency for Integration, Migration and Asylum, AIMA, for review.

-

1—2 weeksSubmission of biometrics

The investor and their family travel to Portugal to submit original documents and provide fingerprints. Appointments must be scheduled in advance through the online system.

-

6—8 monthsApproval and acquisition of the residence permit cards

AIMA processes the application within six months of the biometric appointment. Once approved, the investor pays the government fee, and residence cards are issued and either collected in person or by a lawyer with power of attorney.

-

Every 2 years

Renewal of the residence permit

To maintain residency, the investor and their family must spend at least 7 days per year in Portugal. The permit is renewed every 2 years, following a process similar to the initial application, including document submission, biometrics, and collection of new cards.

Why a Portugal Golden Visa may be refused or cancelled?

A Portugal Golden Visa application can be refused, or an approved permit can later be cancelled, if the investor or the family members included fail to meet legal, compliance, or programme requirements. The most common reasons include:

- criminal record issues, including serious convictions or

security-related concerns in Portugal or abroad; - providing false information, inconsistencies in documents, or using forged documents;

- inability to prove the lawful source of funds, or concerns related to

anti-money laundering checks; - failure to complete the qualifying investment correctly, including investing in a

non-eligible route or not meeting the minimum amount; - not maintaining the investment for the required period, such as redeeming fund units too early or reducing the investment below the threshold;

- missing deadlines or failing to renew the permit on time;

- not meeting the minimum physical presence requirements during the validity and renewal periods;

- outstanding debts or unresolved issues with Portuguese authorities where relevant, including

tax-related compliance in Portugal; - changes in family status that affect eligibility, such as dependents no longer meeting dependency requirements at renewal stage;

- administrative

non-compliance , such as failure to attend biometrics, submit originals when requested, or respond to official requests for additional documents within the set timeframe.

In practice, most avoidable refusals come from weak document preparation, unclear

How should investors plan taxes without overcomplication?

When planning taxes in connection with the Portugal Golden Visa, the key point to understand is that holding the visa itself does not automatically make an investor a tax resident in Portugal. Tax obligations depend on where Golden Visa holders legally live and spend their time and on whether they choose to become Portuguese tax residents under local rules.

Understanding tax residence vs. Golden Visa residency

Under Portuguese law, individuals are considered a tax resident if they either:

- Spend more than 183 days in Portugal in any 12‑month period, or

- Maintain a habitual home in Portugal, indicating an intention to live there.

If they do not meet these criteria, they remain a

This distinction allows investors to hold the Golden Visa without changing their tax residence, which can significantly simplify tax planning.

Non‑resident tax position

As a

When capital is invested in regulated Portuguese investment funds, many of these vehicles are structured to defer distributions until exit or maturity. This can help postpone or reduce Portuguese tax exposure while the investor remains

Maintaining tax residency outside Portugal while holding a Golden Visa is a common strategy among investors who wish to benefit from EU mobility without becoming subject to Portuguese taxation on worldwide income.

Becoming a Portuguese tax resident and available incentives

Many investors eventually choose to become Portuguese tax residents to take advantage of Portuguese tax regimes and bilateral treaties. One of the most relevant incentives is the Incentivised Tax Status Programme, IFICI 2.0 [6] Source: Financial government portal, IFICI tax regime .

Under this regime:

- qualified income from Portuguese sources may be taxed at a flat 20% rate over a

ten‑year period; foreign‑sourced income, including dividends, interest and rent, can be exempt from Portuguese tax, provided it is being taxed in the source jurisdiction or falling under double taxation agreements.

These incentives aim to make Portugal attractive to professionals, innovators and investors who bring economic value to the country.

Double taxation treaties and international planning

Portugal has signed and implemented a broad network of double taxation treaties with other countries to prevent the same income from being taxed twice for individuals and companies.

According to the official Portuguese tax authority, Portugal currently has 79 double taxation agreements in force, with one additional agreement signed and awaiting entry into force. These treaties cover jurisdictions across Europe, the Americas, Africa, the Middle East and Asia, including major economies such as the United States, the United Kingdom, Canada, Brazil, China and others.

This can be especially important for investors who receive income from multiple jurisdictions.

Path to Portuguese permanent residence and citizenship

The Portugal Golden Visa offers a pathway to both permanent residency and Portuguese citizenship. By meeting certain residency and investment requirements, Golden Visa holders can eventually apply for citizenship, provided they meet Portugal's legal and language criteria.

However, the rules surrounding this process are subject to change, as new amendments to Portugal’s nationality law were approved in 2025.

Current pathway

Holders of a Portugal Golden Visa can convert their temporary residency into permanent residency and eventually Portuguese citizenship by meeting several requirements.

To be eligible for permanent residence, a Golden Visa holder must:

- Maintain the qualifying investment for the required period.

- Comply with the minimal physical presence requirements: 7 days in the first year and 14 days in each subsequent

two‑year period. - Demonstrate that they have legal residence and valid documentation in Portugal.

Golden Visa holders become eligible to apply for permanent residence after holding the visa for five years if those conditions are met. Permanent residence grants broad rights to live, work and access services in Portugal without the need for an investment condition. It remains valid when the investment is maintained and can be renewed periodically.

Once permanent residence has been obtained, many holders choose to pursue Portuguese citizenship [7] Source: Portugal’s Ministry of Justice, official site .

Under the current nationality law, citizenship by naturalisation usually requires:

- Five years of legal residence in Portugal.

- Demonstration of basic proficiency in the Portuguese language at an A2 level.

- A clean criminal record and evidence of integration into Portuguese society.

After meeting these criteria, a successful applicant may be eligible for Portuguese citizenship, which provides full rights, including holding a Portuguese passport and the ability to vote and stand in elections.

Portugal Nationality Law changes in 2025

In 2025, Portugal’s Parliament approved a significant reform of the Nationality Law, reshaping the timeline and requirements for citizenship

[8]

Source: EuroWeekly News, April 21, 2025

. These changes reflect broader efforts to align naturalisation with integration and

Under the new framework:

- The minimum period of legal residence required for naturalisation is extended to 10 years for most applicants, compared with the previous

five‑year requirement. - Nationals of

Portuguese‑speaking countries (for example, citizens of Brazil, Angola or Mozambique) may qualify after seven years of legal residence. - Enhanced integration requirements will emphasise Portuguese language proficiency and knowledge of Portuguese culture and civic duties as part of the naturalisation process.

The nationality law reform still faces legislative and constitutional processes, including debate, revision and presidential approval, making the timing of any future changes uncertain. Until then, Golden Visa holders continue to follow the current citizenship pathway based on five years of legal residence and language integration requirements.

Where do investors actually live, and why those areas?

Investors who participate in the Portugal Golden Visa often choose where to live based on quality of life, accessibility, community presence, climate and infrastructure. Although holding the Golden Visa does not require

Lisbon metropolitan area — the main hub

The Lisbon metropolitan area is the most popular destination for foreign residents in Portugal. Official migration data show that almost 40% of all foreign residents live across Lisbon and surrounding municipalities such as Sintra, Cascais, Oeiras and Amadora. This reflects Lisbon’s role as Portugal’s economic, cultural and transport hub.

Investors are drawn to this area for several reasons:

- international community and services — a large expatriate population makes integration easier for newcomers;

- career and business opportunities, especially in finance, tech and creative industries;

- transport connectivity — an international airport and

high‑speed rail links make travel across Europe and within Portugal straightforward; - lifestyle and amenities — international schools, hospitals and cultural attractions are abundant, making it appealing for families, professionals and retirees alike.

Porto and the north — growth and affordability

Porto, Portugal’s

Porto’s popularity has been growing among expats and Golden Visa holders looking for quality of life with lower housing costs and a vibrant city atmosphere.

Faro and the Algarve — climate, leisure and expat communities

The Algarve region, including cities and resorts around Faro, is another favourite among foreign residents, particularly those seeking a Mediterranean climate, beaches and an outdoor lifestyle. The coastal zone attracts retirees and

The district of Faro ranks among the top Portuguese regions where foreign residents settle, representing more than 30 % of the local population in some areas.

Within the Algarve, the

Cascais — quieter ocean lifestyle close to the capital

Cascais offers easy access to Lisbon’s international airport, business districts, schools and services, while providing a quieter, more relaxed environment than the busy capital. The coastal Cascais Line connects the town directly with Lisbon’s Cais do Sodré station, making daily commuting practical.

The area is known for its beautiful beaches, marinas, parks and golf courses. Cascais appeals to families and retirees who want a seaside lifestyle without sacrificing quality infrastructure or access to urban amenities.

Cascais consistently ranks among the safest municipalities in Portugal, with low crime rates and a strong sense of community cohesion. This makes it especially attractive for families and retirees.

The local property market features a mix of luxury villas, modern apartments and historic homes. Many investors view Cascais as a stable and appreciating asset because of the limited supply in premium locations facing the Atlantic and the proximity to Lisbon.

The town combines boutique shopping,

Education for children in Portugal: from kindergarten to universities

Portugal offers a comprehensive and

Preschools and kindergartens

There are three main types of preschool institutions:

- State kindergartens, which are free of tuition but may charge for meals and extended care.

- Private kindergartens, often offering bilingual or specialised pedagogies, such as Montessori or Waldorf, with monthly fees that vary by location and services.

- International kindergartens and bilingual programs with instruction in English or other languages, helping children transition to international or local schooling.

Children can attend crèche, or nursery, from birth up to three years old, and then kindergarten groups from ages 3 to 6, with the final year preparing them for primary education.

Primary and secondary education

Formal education in Portugal becomes compulsory at age 6 and continues through age 18. The national system includes:

- Primary education, starting at age 6;

- Lower secondary, middle years;

- Upper secondary school, where students choose academic or vocational tracks.

Public schools are

Higher education and universities

Portugal operates a robust higher education sector with universities, polytechnic institutes and specialised colleges. The system follows the Bologna framework, with degrees structured into bachelor’s, master’s and doctoral programmes.

Portuguese universities are well regarded internationally:

- the University of Lisbon and the University of Porto are among the country’s largest and most prestigious institutions, offering hundreds of academic programmes;

- the University of Coimbra, one of the oldest universities in Europe, has a strong reputation in law, medicine and humanities.

Many universities provide programmes in English, and a number of institutions regularly feature in global rankings, reflecting recognised academic standards.

Healthcare in Portugal

Portugal’s healthcare system is widely regarded as one of the stronger systems in Europe due to its universal coverage, quality standards and mix of public and private care options. Legal residents, including Golden Visa holders and their families, can access both public services and private care tailored to their needs, offering strong medical support throughout life.

Public healthcare — Serviço Nacional de Saúde

Portugal’s public healthcare system is known as the Serviço Nacional de Saúde, SNS. It is universal and available to all legal residents, including expatriates who have registered and obtained a health user number at a local health centre.

Once registered, residents can use a wide range of services, including primary care, specialist consultations, hospital care and emergency treatment.

Private healthcare

Many residents, including Golden Visa holders, choose private healthcare in addition to SNS. Private care generally offers:

- shorter waiting times for appointments and procedures;

- access to specialists without long referral delays;

- modern facilities and a higher likelihood of

English‑speaking doctors and staff.

Private health insurance is widely available in Portugal and helps residents manage costs predictably. Plans vary in monthly premiums and coverage levels, often ranging from more affordable basic packages to comprehensive plans covering hospitalisation, specialist care and additional services.

How to access healthcare as a resident

To use the public system, residents must:

- Register with a local health centre.

- Provide proof of legal residence and identity documents.

- Obtain a número de utente, a health service user number, which enables access to services across the country.

Golden Visa holders are eligible for SNS once legally residing and registered, but private health insurance is strongly recommended initially, especially before registration is complete or for faster specialist access.

Key takeaways

- The Portugal Golden Visa remains one of the most flexible

residence-by -investment programmes in Europe, allowingnon-EU ,non-EEA andnon-Swiss nationals to obtain legal residence in Portugal without the need to relocate permanently. - The programme allows investors to include close family members in the same application.

- After recent reforms, the Golden Visa is based on 5 investment routes, including investment funds, cultural contributions, business investment, scientific research and job creation.

- Investors are required to spend only 7 days a year in Portugal to maintain their residence status, which makes the programme suitable for internationally mobile individuals.

- The application process is structured but

time-consuming . From preparation to receiving the first residence card, the timeline typically ranges from 12 to 24 months, depending on administrative factors. - Portugal offers a high quality of life, strong safety rankings, a stable legal environment, and broad international connectivity, which explains why investors tend to settle in areas such as Lisbon, Cascais, Porto and the Algarve.

About the authors

Frequently asked questions

No. Direct investment in residential or commercial real estate is no longer an eligible route for the Portugal Golden Visa. The programme now focuses on investments that support culture, innovation, business activity, research and job creation.

The minimum investment depends on the route chosen. The lowest threshold applies to cultural contributions, starting at €250,000, and this contribution is

In practice, the process from preparation to receiving the first residence card usually takes between 12 and 24 months. The timeline depends on document readiness, the chosen investment route and processing times at the immigration authority.

For Iranians the process of obtaining Portugal Golden Visa may take longer due to Enhanced Due Diligence.

At present, the rules have not changed. Under the current law, Golden Visa holders may apply for Portuguese citizenship after five years of legal residence, provided all requirements are met. Although amendments to the nationality law were discussed in 2025, they have not entered into legal force, so the existing

Yes. It is possible to add eligible family members. This typically includes a spouse, children under 18, student children aged 18 to 26, and financially dependent parents, subject to meeting the legal requirements.

Contact us today

Passportivity assists international clients in obtaining residence and citizenship under the respective programs. Contact us to arrange an initial private consultation.