Portugal Golden Visa for Iranian Investors: complete 2026 guide to EU residency

In Portugal, Iranian nationals may obtain a residence permit by investment under the Golden Visa program, one of the few EU residency routes that remains fully accessible to citizens of Iran.

Eligible applicants can contribute €250,000 to cultural projects or invest €500,000 in regulated Portuguese funds, business activities or accredited scientific research, provided that the funds come from lawful, fully documented and

The Portugal Golden Visa offers Iranian investors and their families a secure legal base in the European Union,

Portugal Golden Visa for Iranian investors

The Portugal Golden Visa is a residence permit that foreigners obtain by investment in the country’s economy. Citizens of

Holders of a residence permit have the right to live in Portugal, travel freely within the Schengen Area and, after 10 years, apply for Portuguese citizenship.

The end of

For applicants from jurisdictions classified as higher compliance risk, including Iran, this shift changes the preparation process in several important ways.

Stronger banking Due Diligence

Fund investments and

For Iranian nationals, this usually means:

- preparing enhanced documentation in advance;

- demonstrating that money comes from

non‑sanctioned jurisdictions and institutions; - using clearly documented, compliant payment corridors.

Importance of early compliance planning

To avoid delays, Iranian investors should complete a

Donations and cultural contributions as a practical alternative

Cultural and scientific contributions do not always require funds to originate from a Portuguese bank account. In many cases, payments may be made from accounts in third countries such as Türkiye, the UAE, or Oman.

This can significantly reduce banking friction for Iranian applicants and speed up the early stages of the process.

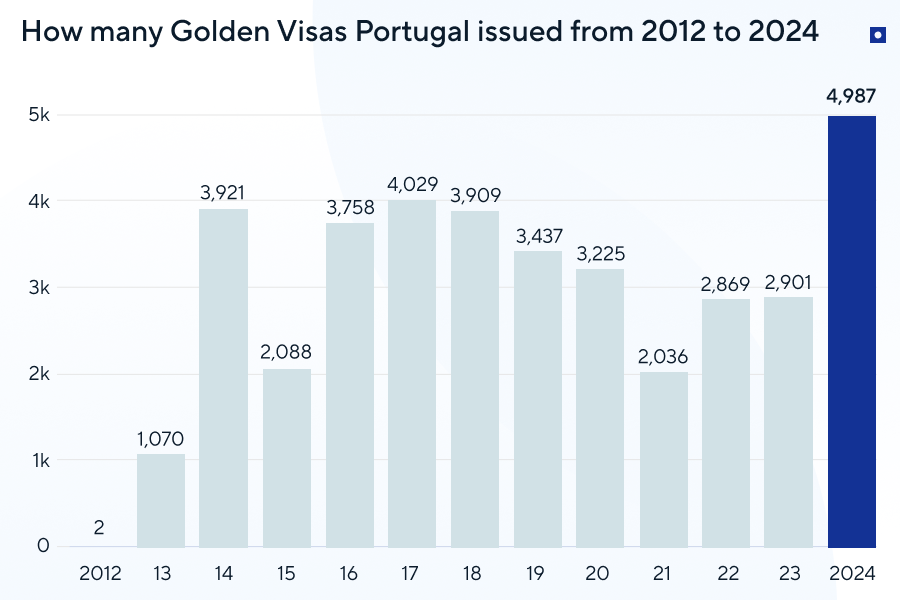

Portugal issued 38,232 Golden Visas between 2012 and 2024. A further 45,000 applicants are still waiting for their applications to be processed [152] Source: Portugal Golden Visa statistics, Idealista .

What are the main advantages of Portugal Golden Visa for investors from Iran?

Portugal’ Golden Visa offers flexible residence conditions, Schengen mobility, family inclusion, access to European education, healthcare and banking, and a clear path to EU citizenship.

For Iranian investors, these benefits are especially valuable because they reduce visa barriers, provide a secure

1. Freedom of travel within the Schengen Area

Holders of a Portuguese residence permit may enter Schengen countries without a visa and stay there for up to 90 days within any 180‑day period

[153]

Source:

Many Iranian investors frequently travel for business meetings, exhibitions and banking matters. The Golden Visa eliminates visa friction, removes uncertainties tied to consular decisions and provides dependable mobility across Europe.

2. Minimal residence requirement

To maintain the status, an investor needs to spend only seven days a year in Portugal. This allows investors to preserve their base of life and business in the Gulf, Türkiye, or elsewhere.

This flexibility is especially valuable for applicants whose businesses operate across several countries or who cannot relocate immediately due to corporate, family or compliance constraints.

3. Family inclusion under one application

The investor may include:

- one spouse;

- children under 18;

- unmarried children up to 26 who are enrolled in

full‑time higher education; - financially dependent parents.

A European residence permit for the whole family creates a stable legal base outside the region, offering educational opportunities for children and a

4. Right to work and run a business in Portugal

Golden Visa holders may work as employees or establish and manage a company. This enables structuring part of one’s business operations in an

5. Access to the European healthcare system

Residents can use public medical services in Portugal and, in many cases, receive treatment in other EU member states [154] Source: Serviço Nacional de Saúde, Portugal Government .

This is an important benefit for families seeking

6. Education opportunities for children

Children of residents may attend Portuguese public schools and apply to universities on the same terms as citizens.

Portugal’s education system is part of the wider European academic space, which gives students access to

7. A pathway to permanent residence and citizenship

Investors may apply for permanent residence after 5 years [155] Source: Permanent residence in Portugal, AIMA and for citizenship after 10 years in resident status, provided they pass the required Portuguese language exam at A2 level [156] Source: Certificado Inicial de Português Língua Estrangeira, CAPLE .

A Portuguese passport provides access to the EU labour market,

8. Access to European banking and financial services

Residents can open accounts, obtain cards, invest via brokers and access mortgages. This can be a key advantage: holding assets in euros and accessing

However, Iranian investors should expect enhanced Due Diligence and prepare a clear money trail for every transfer.

9. Business opportunities in a fast‑growing tech hub

Portugal is a popular destination for building technology companies. Lisbon ranks among the top six European cities for startup development, according to the Startup Heatmap Europe report [157] Source: Lisbon, Portugal: The startup city guide, Websummit .

Financial Times also includes the city among the top IT hubs in Europe: it hosts accelerators, startup incubators and a strong expert network.

Through residency, investors may build an

3 drawbacks of the Portugal Golden Visa

1. No investment in real estate. Since 2023, buying a house or apartment in Portugal has no longer been an eligible route to a Golden Visa [158] Source: Real estate option ended, Lei n.º 56/2023 . In countries where residence permits are granted for investment in real estate, this option is usually the most popular.

Iranians may become EU residents by purchasing real estate in Greece for at least €250,000.

2. A relatively long process. Obtaining a residence permit in Portugal by investment takes from 12 months. This is due to high demand, queues for biometric appointments and delays at the migration authority. By comparison, Greece issues a Golden Visa in as little as four months.

3. No tax incentives. Portugal has abolished the

How to obtain a residence permit in Portugal by investment?

Foreign nationals may qualify for the Portugal Golden Visa if they make an eligible investment and meet the basic requirements: they must be over 18, have a clean criminal record, and prove that their income originates outside Portugal.

The investment must be completed before the application is submitted to the Agency for Integration, Migration and Asylum, AIMA.

Investment options

Applicants can choose one of the following routes:

- €250,000 — contribution to culture and the arts;

- €500,000 — investment in fund units, research activities, creating a company and 10 jobs, or investing in a Portuguese business and creating at least 5 jobs.

For each applicant, a €618.60 fee is charged for the application review and €6,179.40 for issuing a residence card. Additional expenses include health insurance, bank fees and document handling, translation, notarisation and apostille.

Family inclusion

Family members may obtain residence permits together with the investor:

spouses and partners, children under 18, unmarried children aged

Additional considerations for Iranian applicants

Although nationality itself is not a barrier, applicants from Iran fall under stricter compliance categories due to international sanctions and banking regulations [160] Source: Restrictive measures against Iran, COUNCIL REGULATION (EU) No 267/2012 . This does not prevent obtaining the Golden Visa, but it requires more thorough preparation.

1. Enhanced

multi‑year bank statements;- company ownership records;

- tax returns or audited financials;

- documents showing transfer routes from

non‑sanctioned jurisdictions.

2. Sanctions exposure review. Investors must demonstrate that neither they nor their companies appear on international sanctions lists and that no part of the funding chain involves designated entities or individuals.

3. Banking and payment preparation. In some investment routes like culture or science, payments may be accepted from foreign bank accounts in jurisdictions such as Türkiye, the UAE or Oman, which can simplify compliance.

Fund and business routes, however, require a Portuguese bank account, which involves deeper scrutiny.

4. Clear legal income outside Portugal. Applicants must prove stable, legal, international income through employment, business ownership, dividends, or assets located outside Portugal. Consistency in names, dates and amounts across documents is essential.

Portugal residence permit by investment in culture and the arts

A Portugal Golden Visa may be obtained for a contribution of at least €250,000:

- in support of artistic projects such as theatre productions, exhibitions, concerts and literary events;

- for the restoration or conservation of national cultural heritage: monuments, archives and archaeological sites.

An investor may, for example, fund the restoration of a monument, a natural park with petroglyphs or azulejos, traditional Portuguese glazed tiles. The investment project must be approved by the

In municipalities with low population density, the minimum investment may be reduced to €200,000.

To pay for the investment, it is not necessary to open an account with a Portuguese bank. The transfer may, for instance, be made from a bank in Türkiye, Montenegro or Cyprus, which helps reduce risks when obtaining the status.

Portugal residence permit by investment fund units

Investing in fund units is the most popular way to obtain a residence permit in Portugal after the real estate option was closed. The investment may be redeemed after five years, once the units mature.

To become a resident, foreigners transfer €500,000 to an account at a Portuguese bank and then purchase units in an investment or venture capital fund. The fund must be registered in Portugal and invest more than half of its assets in Portuguese instruments, such as company shares or real estate.

When applying for a residence permit, the investor submits a certificate of ownership of the units, which is issued free of charge.

Portugal residence permit by starting a company and creating 10 jobs

To obtain a residence permit, an investor registers a business and creates at least ten jobs for Portuguese citizens. It is permitted to employ eight locals if the company is opened in a municipality with low population density.

Lisbon, Porto, Cascais, Maia and Gondomar are considered

The applicant needs to open an account with a Portuguese bank, rent an office or commercial premises and sign a contract with an accountant who will help formally employ the staff.

When applying for a residence permit, the investor additionally submits employment contracts and a certificate of business registration.

The investment must be maintained for at least three years.

Portugal residence permit by investment in business

An applicant should invest €500,000+ in a business, for example by establishing a new company or buying an existing one, and create five jobs. The company’s head office must be located in Portugal.

If the applicant opens a new business, they submit a company registration certificate when applying for a residence permit. If the investor purchases an existing company, they provide a certificate of ownership and the purchase agreement. Employment contracts must also be submitted.

The investment must be maintained for at least three years.

Portugal residence permit by investment in science

Applicants may obtain resident status by contributing €500,000 to scientific projects. For example, investments may support the Institute for Molecular and Cell Biology at the University of Porto or the Facial Expression Laboratory at Fernando Pessoa University.

The minimum investment may be reduced to €400,000 if the investor contributes in a municipality with low population density. However, most accredited universities are located in major cities such as Porto and Lisbon.

Investor expenses for the Portugal Golden Visa

| Expense | Investment in culture | Investment in funds | Other options |

|---|---|---|---|

| Investment | €250,000+ | €500,000+ Up to 7.5% investment fee 0. | €500,000+ Up to 7.5% investment fee |

| Residence card issuance fee | €6,179.40 per person | €6,179.40 per person | €6,179.40 per person |

| Total cost | €257,000+ | €507,000+ Plus annual fund fees | €507,000+ |

Which investment route works best under Portugal Golden Visa?

The processing time for residence permit applications is roughly the same for all options: 12 or more months. The conditions themselves differ: the minimum investments, the holding period and the possibility of recovering the capital vary.

Investments in culture and science are

Comparison of Golden Visa investment options

| Option | Investment | Minimum holding period |

|---|---|---|

| Investment in funds | €500,000+ | 5 years |

| Creating a company and ten jobs | No minimum amount | 3 years |

| Investment in business | €500,000+ | 3 years |

| Investment in science | €500,000+ | |

| Investment in culture and the arts | €250,000+ |

How to apply for the Portugal Golden Visa for Iranians?

Residence permits in Portugal are issued by the Agency for Integration, Migration and Asylum, or AIMA. The entire process from filing the documents to obtaining a residence permit takes from 12 months.

The timeframe depends on the type of investment, the speed of banking procedures, the availability of biometric slots and the region where the investor intends to submit the application.

Documents for a residence permit are uploaded to the AIMA platform after the funds have been transferred and the investment completed [161] Source: Portugal Golden Visa documents, The Portugal news . Before that, the applicant must open a bank account, obtain a tax identification number, NIF, prepare a document package and sign a contract with a legal firm if they do not intend to manage the procedure on their own.

-

1 day

Preliminary Due Diligence

A legal team conducts an initial compliance review to identify potential risks related to sanctions exposure, the money trail, company ownership or inconsistencies in personal documents.

This step is especially important for applicants from jurisdictions with enhanced banking scrutiny, as early risk detection helps avoid account refusals and ensures the chosen payment corridor will be acceptable to banks and depositaries.

-

Up to 2 weeks

Obtaining a Portuguese tax identification number, NIF

The NIF is required to open a bank account, invest in funds, sign contracts or register a company.

Banks may request a fiscal representative or proof of residence outside a high‑risk country, so it is advisable to arrange these elements in advance.

-

1—2 monthsOpening a Portuguese bank account

Most investment routes require a Portuguese bank account. Banks typically request:

- multi‑year bank statements;

- company documents and ownership records;

- tax declarations or audited financial statements;

- clear evidence of lawful income;

- a detailed money‑flow explanation.

Because EU institutions must follow strict AML and sanctions regulations, applicants from certain jurisdictions undergo more extensive verification. Some banks accept clients only if they hold residency in a third country such as Türkiye, the UAE or Oman.

For cultural or scientific donations, transfers may sometimes be made without a Portuguese account, easing the early stages of the process.

-

2—3 weeksCompleting the investment

Once the account is activated, the investor transfers the funds and fulfils the chosen investment requirement.

Cultural and scientific contributions require confirmation from the relevant authority; fund investments require a depositary certificate confirming unit ownership. It is important to verify that both the receiving institution and the bank approve the payment route and documentation supporting the origin of funds.

-

2 weeks

Preparing the documents

The application requires:

- passports;

- birth and marriage certificates;

- dependant documents where applicable;

- a police clearance certificate issued within the previous 90 days;

- proof of investment;

- source‑of‑funds documentation;

- Portuguese bank statements;

- the NIF;

- health insurance policies.

Documents must be translated into Portuguese, notarised and legalised. Where apostilles are not available, consular legalisation is required. Special care should be taken to ensure consistent spelling of names, dates and amounts across all documents, as even minor inconsistencies may lead to additional requests from AIMA or banks.

-

Up to 6 months

Submitting the documents to AIMA and waiting for review

All documents are uploaded to the AIMA online platform. Although the legal review period is up to six months, real timelines are often longer due to demand. AIMA may request clarifications on the money trail or corporate structure if additional compliance checks are needed.

-

1—2 weeksBiometrics and interview in Portugal

The investor and family members travel to Portugal on a national visa D to submit fingerprints and photographs.

Biometric slots in Lisbon and Porto fill quickly, so early planning is essential. Applicants must bring the original versions of all documents submitted online.

-

2 weeks

Receiving the residence card

Residence cards are typically issued within about two weeks and may be collected by the investor or an authorised representative. All payment confirmations and original receipts should be kept for future renewals.

What are the alternative ways to get Portuguese residency?

Foreigners can obtain Portuguese residence not only by investment but also via

The D7 visa is issued to financially independent foreigners in Portugal. This option suits freelancers, entrepreneurs and pensioners with passive income of at least €920 per month.

The applicant must rent or buy property in Portugal and show a bank balance of at least €11,040. The minimum income and deposit requirements increase by 50% for a spouse and each parent and by 30% for each child included in the application. A separate article explains the advantages of the D7 visa and how to obtain it.

The Digital Nomad Visa. Remote workers may first obtain a

The applicant must show a monthly income of at least €3,680 received from a company outside Portugal. They must also provide a bank statement confirming a balance of at least €11,040.

Startup Visa [162] Source: Startup Visa, LAMPEI . Foreign entrepreneurs may obtain a residence permit in Portugal. To obtain the visa, it is sufficient to present a business plan related to innovation and technology.

No business investment is required at this stage. Applicants simply prove that they have enough money to live in Portugal by providing a bank statement with a balance of at least €11,040.

HQA or D3 visa

[163]

Source:

The applicant must provide an employment contract with a Portuguese employer for at least one year.

The HQA visa is valid for four months and allows two entries into Portugal. During this time, the foreigner must submit their residence permit application.

Why a Portugal golden visa may be refused or cancelled?

Key grounds for refusal with additional considerations relevant to applicants from

Portugal may refuse or cancel a Golden Visa if the applicant fails to meet legal, financial or immigration requirements. While the rules are the same for all nationalities, applicants from jurisdictions subject to enhanced Due Diligence checks must pay special attention to documentation, sanctions screening and the transparency of their financial history.

1. Criminal record or security concerns

A residence permit may be refused if the applicant has a criminal conviction punishable by more than one year under Portuguese law or if they are subject to an entry ban within the EU.

AIMA may also request additional documentation if the applicant has lived in multiple countries or has complex travel histories.

2. Previous breaches of immigration rules

Status may be cancelled if the holder:

- has previously been deported from Portugal or another EU state;

- violated visa conditions;

- stayed outside Portugal so long that renewal criteria are no longer met.

Golden Visa holders must spend at least seven days per year in Portugal to keep the permit.

3. Insufficient proof of lawful income and source of funds

The Golden Visa requires evidence that all invested funds come from clear, legal and traceable sources.

Applications may be delayed or refused if:

- the financial documentation does not match declared income;

- ownership structures are unclear;

- transfers originate from institutions or jurisdictions with limited transparency,

- the money trail contains gaps or unexplained intermediaries.

Applicants from

4. Issues related to sanctions screening

Portugal follows EU sanctions rules. AIMA and Portuguese banks screen applicants and their companies across all major sanctions lists. A refusal may occur if:

- the applicant or any related entity appears on a sanctions list;

- part of the payment route involves designated persons or banks;

- the receiving institution cannot verify that funds come from

non‑sanctioned channels.

A clean sanctions profile must be demonstrated at every stage: account opening, investment transfer and visa application review.

5. Failure to maintain the investment

A residence permit may be cancelled if the investor withdraws or liquidates the investment earlier than required:

- fund units must be held for five years;

- business investments and job creation must be maintained for at least three years.

For renewals, applicants must prove the investment is still fully in place.

6. Missing or inconsistent documentation

AIMA may refuse or delay an application if documents are incomplete, outdated, improperly translated or inconsistently spelled, especially names and dates across passports, certificates and bank documents.

Applicants from countries without apostille coverage must ensure consular legalisation is completed correctly.

7. Inability to attend biometrics

Residence permits cannot be issued without an

How to renew a Portugal Golden Visa?

To renew their residence permit, a Portuguese resident must:

- confirm that the investments are fully maintained;

- prove that they have spent at least seven days a year in Portugal;

- provide certificates confirming no criminal record and no breaches of immigration rules.

The residence permit is renewed every two years. The procedure is similar to the initial application: the applicant gathers the same documents, uploads them to the AIMA website, provides biometrics and original documents, and then receives new residence cards [164] Source: Residence renewal, AIMA .

How to obtain permanent residence and Portuguese citizenship?

Foreigners may obtain a permanent residence permit in Portugal after legally living in the country for at least five years.

Investors may obtain Portuguese citizenship after 10 years in resident status. The applicant must again confirm their knowledge of Portuguese at A2 level.

Children under 12 do not have to take the language test. The process of obtaining a Portuguese passport typically takes about one year.

Rights and obligations of a Portuguese resident

Holders of a Golden Visa have the right to:

- live in Portugal throughout the validity of their residence permit;

- reunite with their family, the status is available to the spouse, children and parents [165] Source: family reunification, AIMA ;

- obtain health insurance and use the public healthcare system;

- enrol children in public schools and apply to universities;

- open accounts with Portuguese banks and use financial services.

An investor with a Golden Visa also has obligations. They must maintain the investment that served as the basis for obtaining their residence permit, spend at least seven days a year in Portugal and monitor the expiry dates of their residence cards. They must also notify AIMA of any change of address or family composition.

If the investor becomes a tax resident of Portugal, that is, spends more than 183 days a year in the country, they must file a tax return and pay taxes on general terms.

Personal income tax is charged at progressive rates from 13.25 to 48%. An additional solidarity tax of up to 5% applies to income above €80,000.

Rental income is taxed at 28%; capital gains are taxed either at the same 28% rate or under the progressive scale. Social contributions, municipal property tax and VAT are also payable.

Key points about the Portugal Golden Visa for Iranians

- The Portugal Golden Visa is one of the few EU residence programs that remains fully open to Iranian citizens, as long as applicants can demonstrate a lawful, transparent and

well‑documented financial background. - A Portuguese residence permit obtained by investment allows Iranian investors to travel freely across the Schengen Area, work or establish a business in Portugal and include their spouse, children and parents in the same application.

- Iranian nationals can obtain the Golden Visa by investing in culture and the arts, in scientific or research institutions, in regulated Portuguese investment funds, or by setting up or financing a Portuguese company that creates local jobs.

- The minimum qualifying amount begins at €250,000 for cultural contributions and rises to €500,000 for fund, scientific or

business‑based investments. - Applications are submitted to AIMA, the Agency for Integration, Migration and Asylum.

- Because Iran is a

high‑compliance jurisdiction under EU banking rules, Portuguese banks and AIMA conduct enhanceddue‑diligence checks for Iranian applicants. - A Golden Visa cannot be issued if the investor is subject to an entry ban, has a criminal conviction that qualifies for refusal under Portuguese law or appears on any international sanctions list.

- For Iranian nationals, ensuring a compliant payment corridor and presenting a complete financial history are essential to avoid delays or additional requests.

About the authors

Frequently asked questions

Yes. Iranian investors almost always fund the investment from

The strongest evidence includes

PEP status does not automatically disqualify Iranian applicants, but it triggers full enhanced due diligence, longer timelines and more detailed questions about income, assets and

Yes. For fund investments, a Portuguese bank account is required before purchasing fund units. The account must be fully

In many cases, yes. Cultural and scientific contributions can often be paid directly from a

Three to six months is realistic. Iranian UBOs undergo deeper background checks, external database screening, additional income verification and, in some cases, interviews with compliance officers.

Only one visit is required: the biometrics appointment in Portugal. Dependents must attend in person and may complete biometrics on the same day if slots are reserved together.

Yes. Although the Golden Visa itself requires minimal stay, citizenship requires demonstrating that Portugal was your effective legal residence. Very limited physical presence over many years may delay or complicate naturalization.

Yes, especially in fund investments or

Iran is not part of the Apostille Convention, so documents must be legalised via the Portuguese Embassy. Preparation should begin early, especially for birth certificates, marriage certificates and police reports, as embassy processing may take several weeks.

The most frequent red flags include partial matches to sanctions lists, unexplained large transactions, transfers linked to

Portugal’s investment programs do not grant citizenship directly in exchange for investment, but they simplify the path to it. An investor may obtain a residence permit in Portugal by investment from €250,000 and, after 10 years in resident status, apply for citizenship.

To qualify for Portuguese citizenship, a foreigner needs to live in the country for at least eight months a year before submitting the application.

Previously, buying real estate in Portugal allowed foreigners to become residents. However, since 2 October 2023, it has no longer been possible to obtain a residence permit in Portugal by purchasing property — this option has been abolished.

Now, a residence permit in Portugal may be obtained by investments in business, science, culture and the arts, as well as by purchasing fund units. The minimum investment amount is €250,000.

To obtain a Portugal Golden Visa, an investor needs to contribute €250,000. This may be more affordable than obtaining a residence permit by investment in some other countries. For example, to become a resident of Cyprus, foreigners invest from €300,000.

A Portuguese residence permit allows its holder to travel within the Schengen Area without a visa and stay there for up to 90 days in any 180‑day period.

A Portuguese passport offers even more opportunities: citizens may travel

Portugal is one of the most affordable countries to live in within the European Union. Living there is cheaper than in Austria, France or Germany.

The average salary in Portugal is €1,777 per month. Rent is around €800 per month in Porto, €1,000 in Lagos and €1,100 in Lisbon. The subsistence minimum is €870 per month.

Most of the Golden Visa procedure can be completed remotely. The investor opens a bank account, obtains a tax number and submits the application via AIMA’s online platform through a representative, such as Passportivity. Personal presence is required only at the biometrics stage.

Obtaining a residence permit by investment takes from 12 months. The timeframe depends on the chosen investment option, AIMA’s workload and the availability of biometric appointments.

A Golden Visa does not require permanent residence in Portugal. It is sufficient to spend seven days a year in the country to maintain the status. Residence permits issued on other grounds, such as work, study or family reunification, usually require living in Portugal for at least 183 days a year.

A residence permit by investment also allows the investor to include the entire family in a single application and obtain status for two years at once.

To renew a residence permit by investment, an investor must spend at least 14 days in Portugal over two years. These days do not need to be consecutive — all trips are counted, including short visits.

A Golden Visa is a temporary residence permit in Portugal. It is issued for two years with the possibility of renewal. Five years after submitting the initial residence permit application, the holder may request a permanent residence permit, and after ten years, apply for citizenship.

The D2 visa is intended for entrepreneurs, and the D7 visa is for applicants with passive income, such as pensions or rental income. Both visas require relocation to Portugal and living there for at least 183 days a year.

The Portugal Golden Visa is designed for investors. It does not require permanent residence in the country: spending seven days a year in Portugal is enough to maintain the status.

Contact us today

Passportivity assists international clients in obtaining residence and citizenship under the respective programs. Contact us to arrange an initial private consultation.