São Tomé and Príncipe Citizenship by Investment: fastest and most affordable way to a second passport

São Tomé and Príncipe’s citizenship by investment program has landed as a genuine sensation in the investment migration market. A fresh framework has pushed Vanuatu off its

What is the São Tomé and Príncipe Citizenship by Investment program?

The São Tomé and Príncipe Citizenship by Investment, CBI program provides a

The core features appear as follows:

- Pathway: a

non-refundable contribution starting at $90,000 to the National Transformation Fund [86] Source: STP CBI Program — Financial Layout . - Naturalisation and passport issuance: 60 days for straightforward cases.

- Family inclusion: option to add a spouse, children, parents and grandparents.

- Process: fully remote, without residency and language requirements. The Citizenship Investment Unit, CIU, may request additional information or a call when clarification is necessary.

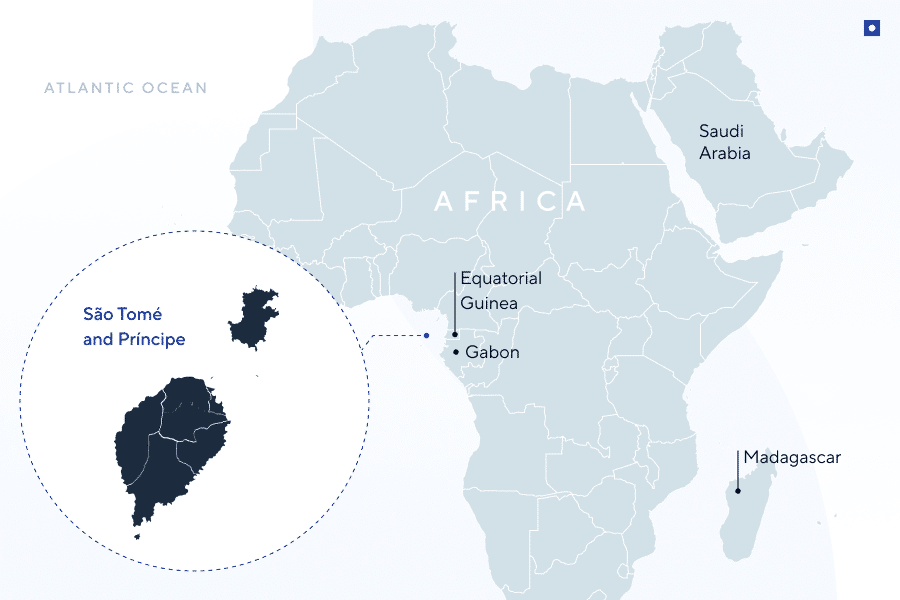

São Tomé and Príncipe is a small island country in the Gulf of Guinea, off Central Africa. The official language is Portuguese. About 240,000 people live in the country. The capital city is São Tomé.

The economy is modest, around $0.55 billion in output. Key activities include ecotourism, agriculture, notably cacao, and light services. The currency is the dobra, STN. It has a fixed exchange rate to the euro: €1 = STN 24.5 [87] Source: IMF, 2025 Selected Issues .

Citizenship by investment is framed as a way to fund public projects and diversify the economy.

11 benefits of São Tomé and Príncipe Citizenship by Investment

São Tomé and Príncipe’s citizenship by investment framework combines a low financial threshold with a streamlined, largely remote process. The benefits go beyond holding an extra travel document: the program can support mobility planning,

1. Cost-efficient entry of $90,000

The headline contribution starts at $90,000 for a single applicant and $95,000 for a family of up to 4 people. This level is the lowest entry threshold among

Families that plan carefully can secure citizenship for several members at a cost that is often below

The investment payment to the CIU must in all cases be remitted from the agent’s account in US dollars.

Stepan Makarov

Lawyer in International Law

Stepan Makarov

Lawyer in International Law

2. Approval in 2 months

The program is presented as a

Caribbean programs often take 6 months or more, which makes the São Tomé and Príncipe route comparatively swift for time sensitive applicants.

3. 100% remote process

All stages — submission, review, and decision — run at a distance, which removes travel costs and scheduling friction and allows busy founders and families to progress the file from their current base.

4. Up to 4 generations in application

Eligibility spans spouses or partners, children under 18, children

The program allows a partner to be included even where there is no formally registered marriage. De facto relationships can be recognised if properly documented, for example, through joint utility bills, shared bank accounts, or tickets and bookings that confirm travel together.

Stepan Makarov

Lawyer in International Law

Stepan Makarov

Lawyer in International Law

5. Payment after approval

The Citizenship Investment Unit charges only the application fee before approval. The donation and document fees are paid post approval, which reduces exposure if a file does not pass government checks.

6. Access to a secure jurisdiction

Citizenship creates a permanent right to reside in São Tomé and Príncipe. This right can serve as a contingency plan if the political or economic situation in the country of origin changes.

A stable island jurisdiction, even if not used for

7. Portuguese citizenship in 7 years instead of 10

São Tomé and Príncipe is part of the Community of Portuguese Language Countries, CPLP [89] Source: Brazil Ministry of Foreign Affairs — CPLP . Citizens may apply for Portuguese naturalisation after 7 years of residence; the usual residence period is 10 years, which creates a measurable time saving for applicants who plan a Lusophone pathway.

8. Stronger financial flexibility

Citizenship enables the holder to open accounts, hold savings and conduct transactions under São Tomé and Príncipe’s legal and banking framework. A second nationality can be useful when structuring

Financial planning that involves more than one citizenship should always be supported by independent tax and legal advice.

9. Possibility to change one’s name under national law

São Tomé and Príncipe’s

This option can help align documents and records across jurisdictions in a lawful, transparent manner.

A

The procedure broadly mirrors the original citizenship application process used to issue citizenship documents.

Stepan Makarov

Lawyer in International Law

Stepan Makarov

Lawyer in International Law

10. Ongoing support and multi-stage options

Once citizenship is obtained, holders may need additional services: passport renewals, replacement of lost or damaged documents, apostilles, banking introductions or later inclusion of new family members.

The program’s structure allows for subsequent applications and administrative actions to be handled within the same legal and procedural framework.

11. Licensed agent gateway

Only licensed agents can submit applications, and filings from unlicensed intermediaries are rejected [90] Source: STP CBI Program — Process & Eligibility . Once the CIU receives the complete package by email, it issues the official application invoice, which adds procedural clarity and traceability for applicants.

How to choose a provider for São Tomé and Príncipe Citizenship by Investment?

São Tomé and Príncipe’s Citizenship by Investment program may only be promoted and processed through agents and representatives that hold a licence issued under

Only licensed agents can submit applications, and filings from unlicensed intermediaries are rejected by the authorities.

Passportivity holds a licence issued in accordance with

Is the São Tomé and Príncipe Citizenship by Investment program aligned with your priorities?

The program is designed for investors who want a clear, codified route to a second citizenship with a defined cost, limited obligations and a relatively short processing timeline. It suits profiles that value planning and predictability more than maximum passport “power” or Schengen access.

Need for a structured Plan B. A second citizenship is viewed as a contingency tool in case of political, economic or security shocks in the country of origin, rather than as a ticket to immediate relocation.

Preference for a lower entry threshold. A budget in the region of $100,

Importance of

No requirement for Schengen mobility. The expected use case is regional and occasional international travel [91] Source: Passport Index — Visa requirements for passport holders , plus the strategic value of a second nationality, rather than daily business between major financial centres.

São Tomé and Príncipe’s program is better viewed as a strategic diversification and contingency instrument than as a direct access point to those areas.

In contrast, investors whose primary objective is settlement rights or free movement across the EU, UK or North America should look at residence by investment immigration routes, such as Greece Golden Visa.

How much does São Tomé and Príncipe citizenship by investment cost end-to -end?

Total cost combines several elements: the core contribution to the program, a set of fixed government fees, and

The table below gives an indicative view of costs for a single applicant and for a family of up to four; Passportivity’s professional fees are calculated and quoted separately after reviewing the client’s profile.

São Tomé and Príncipe citizenship cost breakdown

| Cost item | Single applicant | Family up to 4 people |

|---|---|---|

| Contribution after approval | $90,000 | $95,000 |

| Application processing fee | $5,000 | $5,000 |

| Certificates of registration | $250 | $1,000 |

| National ID cards | $150 | $600 |

| Passports | $350 | $1,400 |

| Translations, notarisation, legalisation | $2,000+ | $2,500+ |

| Estimated total | $97,750+ | $105,500+ |

Documents required for São Tomé and Príncipe citizenship by investment

All documents for a São Tomé and Príncipe citizenship application are expected to be issued no more than six months before submission, except police clearance certificates, which should normally be issued within three months of filing the application. The investor prepares the following documents in one complete set:

- Completed citizenship application form.

- Birth certificate.

- Most recent tax return.

- Medical certificate confirming current state of health

- Copies of all national and foreign passports for every applicant.

- Proof of residential address, for example, a lease agreement or property title plus a recent utility bill.

- Proof of source of income, for example, personal income tax statements or

employer-issued income certificates. - Police clearance certificates from the country of citizenship and from all countries of residence over the last five years.

- Recent

passport-style photographs.

Applicants use an accredited translator or a licensed professional translation company to translate documents into English.

São Tomé and Príncipe citizenship by investment — step-by -step process

Еhe full journey from initial screening to passport delivery usually takes about 2 months. It depends on how quickly documents are collected and how long government Due Diligence takes.

-

1 day

Preliminary Due Diligence

Passportivity runs a confidential preliminary Due Diligence check to identify any circumstances that could prevent participation in the program. If no critical issues are found, a service agreement is prepared, setting out the scope of work and fee structure.

-

2+ week sCollecting documents and filing the application

An assigned Passportivity lawyer guides the applicant through collecting the required documents and preparing the application forms.

Once the file is complete, the full application package is sent to the CIU by email. The CIU reviews it for completeness and issues an application invoice, which must be paid before formal processing starts

-

Up to 2 months

Government Due Diligence and decision

The CIU coordinates a comprehensive Due Diligence process to verify the background, security and eligibility of the main applicant and each family member.

Based on the results, a recommendation is prepared and submitted to the Ministry and Cabinet, which take the final decision. The CIU then issues either an approval letter or a rejection letter, which is communicated to the applicant via Passportivity.

-

Up to 90 days

Contribution and issuance arrangements

After approval, the applicant has up to 90 days to make the required contribution and pay fees for the passport and other citizenship documents.

Once payments are completed, proof of payment, signed Oath of Allegiance forms and passport application forms are provided to the CIU. The CIU initiates issuance of the Certificate of Registration, and applies for the national ID card and passport.

-

1+ week sDelivery of citizenship documents

When all formalities are completed, the Certificate of Registration, national ID card and passport are issued and sent to Passportivity as the authorised representative. The documents are then delivered to the applicant using the agreed method, usually without the need to travel to São Tomé and Príncipe in person.

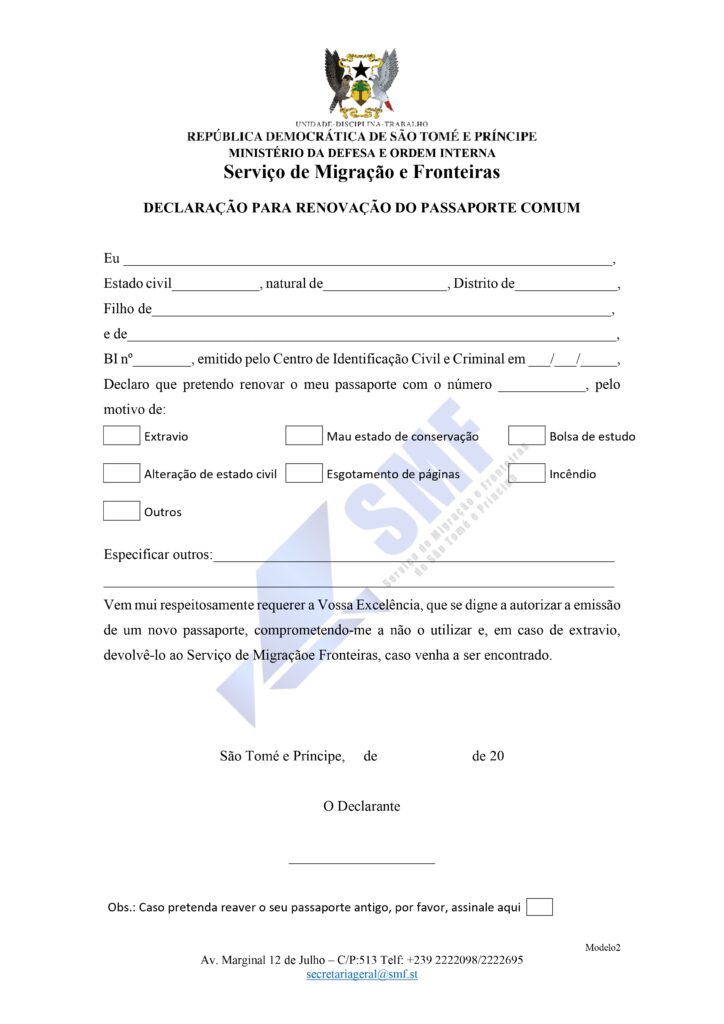

How long is a São Tomé and Príncipe passport valid, and how do you renew it?

An ordinary São Tomé and Príncipe passport is issued for up to 7 years for adults. For children under 6 years old, the standard validity is 3 years. Many countries also expect at least 12 months’ validity remaining on the passport on the date of entry, so it makes sense to plan renewal before you reach that point.

To renew the passport, a citizen completes the official “Passaporte Comum application” form from the Serviço de Migração e Fronteiras, SMF, submits it together with the current or expired passport and supporting ID documents, and pays the applicable state fee.

Residents usually apply directly through SMF offices in São Tomé and Príncipe, while citizens living abroad renew through a São Tomé and Príncipe embassy or consulate, which forwards the request to SMF and issues the new 7-year or 3-year for young children passport once it is ready.

Why can the authorities refuse São Tomé and Príncipe citizenship by investment?

The CIU can refuse an application if they find serious issues during Due Diligence. Typical reasons include:

- criminal record or pending investigations;

- appearance on sanctions or watchlists;

- doubts about the lawful origin of funds;

- inconsistent or false information in the file.

They may also refuse a case if the applicant ignores

Where does São Tomé and Príncipe citizenship by investment stand versus alternatives?

São Tomé and Príncipe sits below the unified Caribbean price floor and slightly below or similar to Vanuatu in terms of cost, while offering processing times that are competitive but not the very fastest. Caribbean programs still lead on passport strength but now require at least $200,000 for a donation route [93] Source: Government of Dominica — CBI Regulations 2024 , which roughly doubles the entry cost compared with São Tomé and Príncipe.

Caribbean citizenship programs and Vanuatu require applicants to submit biometrics and take an oath either in the country itself or at designated consulates, embassies or partner states. In practice this means at least one

São Tomé and Príncipe, by contrast, has been designed as a primarily remote process, with document handling and communication routed through licensed agents and the CIU; any

Caribbean passports provide broad

Vanuatu once offered Schengen access but had its

São Tomé and Príncipe vs Caribbean CBI programs and Vanuatu

| Country | Minimum contribution | Processing time | Access to Schengen Area |

|---|---|---|---|

| São Tomé and Príncipe | $90,000 | No | |

| Antigua and Barbuda | $230,000 | Yes | |

| Dominica | $200,000+ | Yes | |

| Grenada | $235,000 | Yes | |

| St Kitts and Nevis | $250,000 | Yes | |

| St Lucia | $240,000 | Yes | |

| Vanuatu | $130,000 | No |

Life in São Tomé and Príncipe

Daily life in São Tomé and Príncipe feels

Politics and economy

The country is a

The economy ranks as

- Cocoa and other agriculture.

- Fishing and

small-scale services. Eco-tourism and hospitality.

GDP stays modest [95] Source: IMF — São Tomé and Príncipe data , so the domestic market is narrow. For most investors and expatriates, São Tomé and Príncipe work better as a quiet base or “second home” than as a standalone business hub.

Cost of living

Rent. A

Everyday prices and groceries. Basic groceries are affordable in local terms but can feel

- 1 litre of milk — $1.20;

- fresh white bread, 500 g — $1.30;

- white rice, 1 kg — $1.60;

- 12 eggs — $2.80;

- bananas, 1 kg — $1.00.

Average local salaries are low, so many residents combine formal work, small trade and family support. For someone arriving with

Transport

Public transport in São Tomé and Príncipe is pretty limited: most locals use shared minibuses called “Hiace” that run along common routes between towns and villages. You can usually flag one down and pay cash, and they often leave when full rather than on a strict schedule.

There’s no metro or rail system, and a large, reliable “city bus network” isn’t really the norm, so for comfort and timing, travellers often switch to private taxis or a hired driver.

How do taxes, residency, and compliance work under São Tomé and Príncipe citizenship by investment?

An investor's tax position is still determined mainly by where you are a tax resident and where your income arises, rather than by the passport you hold.

Tax residency

Tax residency in São Tomé and Príncipe [97] Source: STP Government — Tax laws is generally determined by physical presence and centre of vital interests, not by citizenship alone.

If you do not actually live in São Tomé and Príncipe and do not derive significant

Main taxes for individuals

For private clients, the key taxes to be aware of are:

- Personal income tax is levied on income according to national rules and progressive rates. Residents are generally taxed on a wider base of income than

non-residents . - Value added tax is 15% VAT applies to most goods and services, with reduced rates for certain basic items. This affects

day-to -day spending and service costs rather than investment income directly. - Other local taxes and fees, such as stamp duties or transaction taxes, may apply to specific dealings — property, company shares.

The exact impact depends on whether you actually relocate, hold assets or earn income in São Tomé and Príncipe.

Main taxes for businesses

Corporate income tax is charged at a standard rate of 25% on profits, with possible reductions available for approved investment projects under the investment and tax incentive laws.

VAT is charged on taxable supplies of goods and services, with registration thresholds and reporting requirements similar to other VAT systems.

Withholding taxes may apply to certain outbound payments such as dividends, interest or royalties, depending on the nature of the payment and any applicable reliefs.

Anyone planning to use São Tomé and Príncipe as a base for holding or operating companies should take separate local tax advice before implementation.

Double taxation and international planning

São Tomé and Príncipe currently has one double tax treaty in force, with Portugal, signed in 2015 and effective since 2017. For income involving any other country, relief from double taxation usually depends on domestic rules in your main country of residence and on any foreign tax credits or exemptions available there.

What are the key takeaways about São Tomé and Príncipe citizenship by investment?

- The São Tomé and Príncipe citizenship by investment program is anchored in Nationality Law No. 07/2022 and

Decree-Law No. 07/2025. - The entry threshold is lower than most alternatives: the contribution starts at $90,000 for a single applicant and $95,000 for a family of up to four.

- The process is structured into five steps — preliminary screening, document collection, government Due Diligence, contribution and issuance, and document delivery — and a straightforward case can be completed in about two months, assuming good document readiness.

- The workflow is primarily remote: applications are prepared and submitted via a licensed agent and the CIU using electronic channels, without a mandatory trip to São Tomé and Príncipe.

- Up to four generations can be planned within one strategy, with options to include a partner, adult children and older dependents if they meet the criteria.

About the authors

Frequently asked questions

The headline figures, $90,000 for a single applicant and $95,000 for a family of up to 4, refer to the core

The following categories are treated as dependants:

- Spouse or recognised partner, including certain de facto relationships if properly documented.

- Children under 18, biological or legally adopted.

- Adult children up to 30, unmarried and financially dependent on the main applicant under the rules in force.

- Parents and grandparents over 55 and financially dependent.

No

The

Government application and Due Diligence fees are typically

Yes. The framework allows later addition of eligible family members, for example, a new spouse, a newborn child or, in some cases, parents or adult children added at a later stage.

Contact us today

Passportivity assists international clients in obtaining residence and citizenship under the respective programs. Contact us to arrange an initial private consultation.