Greek regional real estate market overview: 2025 trends

Summary

Passportivity experts have prepared an overview of the real estate market in Greek regions outside Athens. The study analyses property prices, rental rates, yields, and demand drivers in the Peloponnese, Epirus, Western and Central Greece, Thessaly, and Halkidiki.

The report is intended for investors considering property purchases in Greece as a means of capital preservation, an additional source of passive income, or a basis for applying for a Greece Golden Visa.

The analysis is based on current market data for

Property prices vary by region. Average purchase prices start at €780 per m², while gross rental yields reach

In the coming years, price growth in the Greek real estate market is expected to be driven primarily by infrastructure development, including new road projects, port and airport modernisation, resort developments, and urban regeneration initiatives.

As a result of these changes, regional markets are likely to become more accessible, with longer tourist seasons and an increase in both tenants and buyers. This, in turn, is expected to strengthen the potential for capital appreciation in regional property markets.

5 benefits of purchasing real estate in Greece

Purchasing real estate in Greece remains one of the more transparent and predictable strategies for investors. Residential properties have shown steady price growth, generate stable rental income, and, in certain cases, provide grounds for obtaining residence status in the country.

1. Eligibility for a Greek residence permit

By purchasing residential property with a minimum floor area of 120 m², investors may qualify for a residence permit in Greece under the Greece Golden Visa programme.

The minimum property value is €400,000 in most regions. In Thessaloniki, Mykonos, Attica, and Santorini, as well as on islands with a population of 3,100 residents or more, the minimum threshold is €800,000.

It is also possible to invest a lower amount, starting at €250,000. In this case, investors are permitted to purchase properties classified as historical or former industrial buildings, provided that they are renovated and converted into residential use.

Elena Garnitsarik

Head of the Legal Department

Elena Garnitsarik

Head of the Legal Department

Investors may acquire property jointly, each contributing a share of the purchase price. To qualify for a residence permit, the value of each individual share must meet the applicable investment threshold — €250,000, €400,000, or €800,000, depending on the property category and location.

Applicants for a Greek residence permit are not required to pass exams in the Greek language or national history. There are also no minimum residence requirements in Greece to maintain the status.

The residence permit is granted for five years and may be renewed. After seven years of continuous residence in Greece, holders may become eligible to apply for Greek citizenship, subject to meeting the statutory naturalisation requirements.

2. Relatively affordable prices

Residential real estate in Greece is more affordable than in many European Union countries. For example, the average price per m² for apartments in central urban areas in Greece is €2,807, compared with €3,539 in Italy and €5,200 in France.

3. Liquid asset

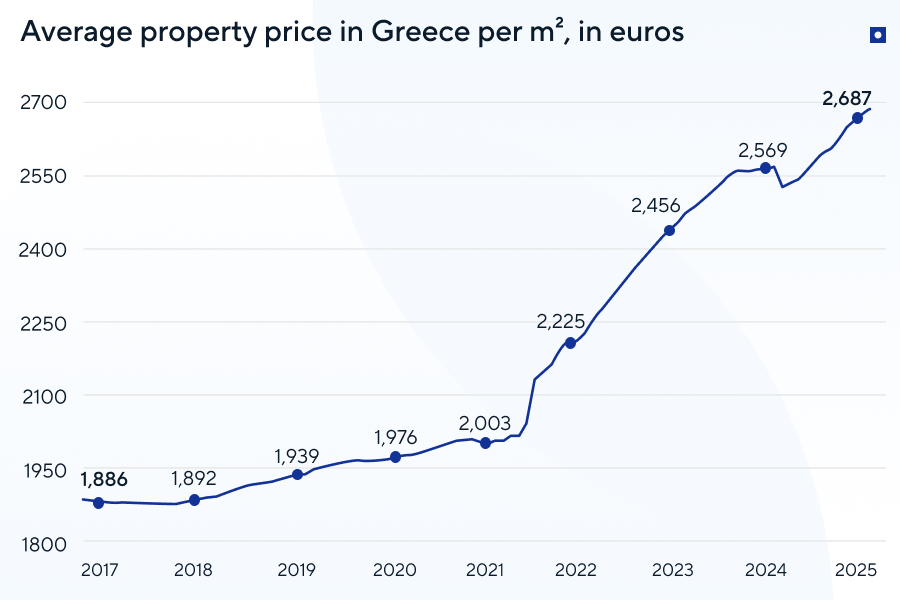

Real estate in Greece continues to be regarded as a reliable means of preserving and growing capital. Property prices have increased by approximately 25% since 2020.

In 2024, prices for newly built apartments rose by 9.2%, while residential properties more than five years old increased in value by 5.5%. In the first quarter of 2025, price growth reached 6.8% and 6%, respectively.

If market conditions remain favourable at the time of sale, investors may benefit from capital appreciation. Under the Greece Golden Visa programme, the property must remain in the investor’s ownership in order to renew the residence permit. However, once permanent residence or Greek citizenship is obtained, the owner may dispose of the property without restrictions.

4. Stable rental income

Greek real estate benefits from sustained demand. as of November 2025, the average gross rental yield stands at 4.4% per annum.

In Patras, a city in the northwest of the Peloponnese Peninsula, the average rental yield for apartments reaches 4.81% per year.

In Volos, rental returns are more moderate, averaging 4.23% per annum.

5. Relatively low additional costs

Property owners in Greece are required to pay utility charges and an annual property tax, which consists of a state levy and a municipal component.

The state levy amounts to up to €13 per m², depending on the property’s floor area, floor level, year of construction, and location.

The municipal tax rate ranges from 0.025 to 0.035% of the cadastral value, with the exact rate set by the local authorities. By comparison, property tax rates reach up to 0.8% in Portugal and 1% in Spain.

When purchasing property, investors pay a property transfer tax of 3.09%. The same rate applies to newly built properties, as they are exempt from 24% VAT until the end of 2026.

Upon the sale of property, a capital gains tax of 15% on the difference between the purchase and sale prices is normally applied. However, the Greek government has suspended this tax until December 31st, 2026, in order to support the real estate market.

Greek real estate market overview: 2025 indicators

Experts at Passportivity have prepared an overview of the Greek real estate market with a focus on regions where the minimum investment threshold for the Greece Golden Visa is €400,000.

Prices for residential property in Greece continue to rise, although at a slower pace than during the

Price growth is slowing

In 2024, residential property prices in Greece increased by 8.7% compared with 2023, when annual growth reached 13.9%. This trend is reflected in the quarterly house price indices published by the Bank of Greece, where growth rates eased from 10.9% at the beginning of the year to 7% by the end. The trend continued in the first quarter of 2025, with property prices rising by 6.8%.

Growth rates are gradually normalising. Instead of the sharp increases observed in the

Changes to the Greece Golden Visa programme have also influenced the market. In 2024, the minimum investment threshold was raised from €250,000 to €400,000 in most regions and to €800,000 in major locations.

As a result, the volume of transactions concluded at the minimum qualifying amount declined. Previously, a portion of buyers focused on the most affordable properties in

The revised Golden Visa requirements have affected not only programme applicants but also the broader investor base. Investors have increasingly turned their attention to regions outside Attica, where the same budget allows the purchase of larger or newly built properties. This shift has redistributed demand across the country and helped to reduce overheating in key markets.

Newly-built properties outperform the secondary market

In 2024, prices for apartments up to five years old increased by 10.2%, while properties older than five years rose by 8.1%. This gap in growth rates has persisted over the past three years and continues to widen gradually.

The divergence reflects limited supply in the

A significant share of Greece’s housing stock was built before 1985. Older properties often require additional investment in insulation, heating systems, and refurbishment.

From a financing perspective, banks tend to view

The Bank of Greece publishes an apartment price index that tracks changes in residential property values by construction period. The index reflects price dynamics over time rather than absolute price levels in euros.

The index uses 2007 as the base year; 2007 = 100. This means that prices in 2007 serve as the reference point. Index values above 100 indicate that average residential prices have exceeded the 2007 level, while values below 100 show that prices remain below their

Apartment price indices in Greece

| Property age | Indicator | 2024 Q3 | 2024 Q4 | 2025 Q1 | 2025 Q2 | 2025 Q3 |

|---|---|---|---|---|---|---|

| Up to 5 years | Price index | 107,2 | 108,7 | 110,8 | 112,7 | 114,3 |

| +10,0% | +9,0% | +8,0% | +7,1% | +6,6% | ||

| Over 5 years | Price index | 98,1 | 98,6 | 102,1 | 104,8 | 106,5 |

| +7,6% | +6,0% | +6,5% | +7,9% | +8,5% |

Property prices are rising unevenly

In Epirus, a northwestern region of Greece, property prices recorded the strongest growth. In the Thesprotia regional unit, residential prices increased by 30% year on year in the third quarter of 2025. The main driver is demand for more affordable alternatives to the Ionian Islands.

Additional momentum has come from new resort developments. In recent years, boutique hotels, apartment complexes, and small rental villas have been launched in Sivota, Preveza, and along the coastline south of Igoumenitsa. as tourism infrastructure expands and the rental market strengthens, residential prices tend to rise faster, particularly in smaller areas with limited development capacity, such as Thesprotia.

In Thessaly, which occupies the central part of mainland Greece, price growth has been more moderate. Between the third quarter of 2024 and the third quarter of 2025, the strongest increases were recorded in Karditsa, where prices rose by 19%, and in Magnesia, with growth of 11.6%.

These areas are recovering from the floods of 2023. Some properties have been renovated, while others have undergone full reconstruction. Given the relatively low initial price levels, even a modest increase in demand has translated quickly into higher prices per m².

In Central Greece, price dynamics vary significantly by area. In Evrytania and on the island of Evia, residential prices increased by

By contrast, prices in Phthiotis and Phocis declined by 0.9% and 1%, respectively. In these regions, supply exceeds demand, tourist inflows are limited, and new development activity remains scarce. as a result, investors approach these markets with greater caution, putting downward pressure on property prices.

Commercial real estate lags behind residential growth

According to the Bank of Greece, prices for prime office properties increased by 4.9% in 2024, while rental rates rose by 1.9%. The most pronounced growth was recorded in the retail segment, where rental rates increased by 6.4% nationwide. This trend reflects the recovery of domestic tourism and the gradual rebound of small businesses following the COVID-19 pandemic.

In regional markets, commercial property prices are rising at a significantly slower pace than in Athens. Office prices in the regions increased by 2% in 2024, compared with 6.9% in the capital. A similar pattern is observed in retail real estate, where prices rose by 6.7% in the regions versus 10.4% in Athens.

For investors, regional commercial markets tend to be more predictable, as prices are less sensitive to external shocks. Commercial properties outside the capital primarily serve local demand, including small businesses, service providers, and retail outlets. as a result, price adjustments in these markets are typically gradual.

The Bank of Greece publishes price and rental indices for commercial real estate, including office and retail properties. These data capture market dynamics by property type and region and allow for comparisons of price and rental trends over time.

The indices use 2010 as the base year (2010 = 100). This means that values for 2010 are taken as the reference point. Index readings above 100 indicate that prices or rental rates have increased relative to the 2010 level, while values below 100 suggest that they remain lower than the base level.

The index does not reflect absolute property prices. Instead, it is designed to analyse trends and differences across regions and segments of the commercial real estate market.

Commercial property price index in Greece: annual dynamics

| Регионы | Offices | Retail | ||

| 2023 | 2024 | 2023 | 2024 | |

| Greece overall | 90.6 (+5.9%) | 95.1 (+4.9%) | 97.1 (+7.2%) | 105.6 (+8.8%) |

| Athens | 100 (+5.7%) | 106.9 (+6.9%) | 101.3 (+9.1%) | 111.8 (+10.4%) |

| Greek regions | 82.6 (+7%) | 84.3 (+2%) | 90.6 (+3.9%) | 96.7 (6.7%) |

Greek regional real estate market: where investment is more attractive

Property specialists at Passportivity have prepared regional rankings based on verified and

Methodology

Prices: average asking prices per m² in each area.

Rental rates: average asking monthly rent per m².

Gross rental yield: calculated as 12 × monthly rent ÷ purchase price.

Composite score (

Key findings

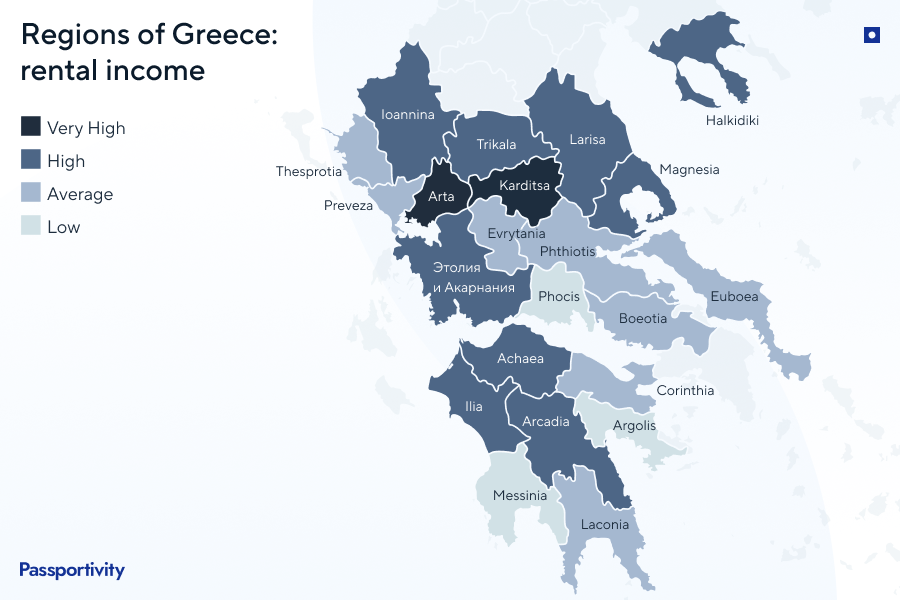

Entry thresholds in the Greek real estate market vary significantly by region. The most affordable locations are Karditsa in Thessaly and Arta in Epirus, where residential prices start at €784 and €900 per m², respectively. These areas are located away from the coast and major resort destinations, and demand is driven primarily by local residents. as a result, property prices remain relatively low.

The most expensive regions are the Peloponnese and Halkidiki, where prices range from €2,000 to 2,667 per m². Coastal land availability is limited, while terrain constraints, protected natural areas, and established settlements restrict new development. as a result, supply growth is slow, supporting higher price levels.

Rental demand is strongest in regions with large cities, universities, and diversified economic activity.

In Larissa, Magnesia, and Ioannina, rental rates range from €8 to €9 per m². These cities attract students, university staff, medical professionals, and specialists commuting from neighbouring areas. Rental demand is

In Halkidiki, by contrast, rental rates rise to as much as €16 per m² during the high season, reflecting its status as one of Northern Greece’s most popular resort destinations. Demand there is driven primarily by tourists rather than permanent residents.

Gross rental yields are higher in regions where property prices are lower and rental demand is supported by the local population.

The highest gross yields are observed in Arta, Karditsa, and Trikala, reaching

When purchasing property for rental purposes, it is essential to assess local demand. Properties acquired under the Greece Golden Visa programme may only be rented on a

Tourist locations are less reliable in this context, as demand there is typically

Elena Garnitsarik

Head of the Legal Department

Elena Garnitsarik

Head of the Legal Department

In coastal and

The table below compares Greek regions by purchase price, rental rates, gross yield, and overall investment score. It provides a clear overview of where market entry is more affordable, where rental income is higher, and which regions demonstrate more устойчивый demand dynamics.

All data are sourced from the Spitogatos Property Index, Q3 2025.

Assessment of regional real estate markets in Greece by key indicators, 2025

| Region | Area | Price per m² | Monthly rent per m² | Gross yield | Score |

|---|---|---|---|---|---|

| Peloponnese | Argolida | €2,083 | €7.89 | 4.55% | 53.0 |

| Peloponnese | Arcadia | €1,214 | €7.14 | 7.05% | 76.8 |

| Peloponnese | Corinthia | €1,667 | €7.43 | 5.35% | 59.4 |

| Peloponnese | Laconia | €1,435 | €6.43 | 5.37% | 64.7 |

| Peloponnese | Messenia | €2,000 | €8.00 | 4.80% | 54.6 |

| Epirus | Thesprotia | €1,680 | €7.00 | 5.00% | 57.1 |

| Epirus | Ioannina | €1,547 | €9.09 | 7.06% | 69.3 |

| Epirus | Arta | €900 | €7.50 | 10.00% | 100.0 |

| Epirus | Preveza | €1,833 | €7.86 | 5.15% | 57.7 |

| Western Greece | Achaea | €1,406 | €8.90 | 7.60% | 70.5 |

| Western Greece | Elis | €948 | €5.65 | 7.15% | 80.2 |

| Western Greece | €977 | €6.09 | 7.48% | 78.8 | |

| Central Greece | Evia | €1,481 | €7.32 | 5.93% | 65.4 |

| Central Greece | Boeotia | €1,300 | €6.43 | 5.94% | 68.3 |

| Central Greece | Phthiotis | €1,062 | €6.00 | 6.79% | 76.0 |

| Central Greece | Evrytania | €1,162 | €6.00 | 6.20% | 72.5 |

| Central Greece | Phocis | €1,485 | €5.77 | 4.66% | 57.2 |

| Thessaly | Larissa | €1,250 | €8.62 | 8.27% | 78.2 |

| Thessaly | Trikala | €1,008 | €6.62 | 7.88% | 81.6 |

| Thessaly | Karditsa | €784 | €7.11 | 10.88% | 98.2 |

| Thessaly | Magnesia | €1,378 | €8.33 | 7.64% | 71.4 |

| Halkidiki | Halkidiki | €2,667 | €16.36 | 7.36% | 42.2 |

Differences between regions are becoming increasingly pronounced. In areas where entry prices are lower and rental demand is driven by local residents, rental yields tend to be consistently higher. The

Coastal and

Investment options for obtaining residence through property purchases in Greek regions

Passportivity lawyers have analysed regional real estate markets in Greece in the context of the investment thresholds applicable under the Greece Golden Visa programme.

€250,000: specialised projects

At this threshold, investments are directed towards the restoration of listed buildings or the conversion of former industrial properties into residential use. as a result, former factories and warehouses are transformed into modern residential complexes, while historic houses are redeveloped into apartments with preserved architectural features.

To qualify for a residence permit, applicants may purchase only one property in any region of Greece. There are no minimum floor area requirements.

In regional markets, such projects are more common than in Athens, although supply remains limited. Properties vary significantly in their stage of completion, ranging from structured redevelopment projects to older buildings requiring substantial refurbishment.

€400,000: regional markets in Greece

At the €400,000 threshold, investors may acquire a single residential or commercial property. In most regions, this budget allows the purchase of

The key requirement is that the property must be a single asset with a minimum floor area of 120 m². Such properties are more widely available in the regions than in Athens, where

In regional markets, investors more often consider detached houses or villas. With a €400,000 budget, it is possible to acquire a standalone property close to the sea. This is generally perceived as a more rational purchase than a large apartment in an urban setting.

Elena Garnitsarik

Head of the Legal Department

Elena Garnitsarik

Head of the Legal Department

€800,000: high-demand locations and large islands

The highest investment threshold of €800,000 applies to properties located in Attica, Thessaloniki, Mykonos, Santorini, and on islands with populations exceeding 3,100 residents. In practice, investors most frequently purchase property in Athens and in the capital’s coastal districts.

This maximum threshold does not apply to other regions and is included in the analysis for comparative purposes only.

Overview of investment options under the Greece Golden Visa programme

| Investment threshold | Eligibility for residence permit | Typical property type | Price range | Gross yield |

|---|---|---|---|---|

| €250,000 | Only through restoration or conversion projects | Former factories, warehouses, offices, historic mansions, | Not determined | Not determined |

| €400,000 | If the property size is at least 120 m² | Apartments, townhouses, houses, or seaside villas | € | 4. |

| €800,000 | If the property size is at least 120 m² | Premium apartments in central and coastal locations | €1, | 3. |

Outlook for 2026: where and why property prices in Greece may rise

New roads, tourism projects, resort upgrades, and infrastructure modernisation directly affect demand and gradually push property prices higher across Greece.

Peloponnese: Argolida, Arcadia, Corinthia, Laconia, and Messenia

The Peloponnese is increasingly viewed as an alternative to

The coastal stretch between Nafplio and Kalamata spans three regional units: Argolida, Arcadia, and Messenia. These areas offer clinics, schools, retail facilities, and equipped beaches, creating infrastructure suitable for

Epirus: Thesprotia, Ioannina, Arta, and Preveza

Investment in tourism is the main driver of property price growth in Epirus. In June 2025, the government approved a €60 million project on a site of around 2 million m² on the Preveza coast. The development includes a

Epirus is also receiving funding under the EU programme European Structural and Investment Funds

In

As infrastructure improves, housing demand typically rises, first from local residents and subsequently from foreign buyers. Over time, this leads to higher property prices.

Western Greece: Achaea, Elis, Aetolia-Acarnania

Construction of the

Enhanced connectivity with Athens and other major cities is changing perceptions of the coastline from a purely holiday destination to an area suitable for

Another growth factor is the modernisation of Araxos Airport, with major works scheduled for completion in 2026. Following the upgrade, the airport will be able to handle more international flights not only during the summer season but also in the shoulder months. Currently, the airport operates on a limited basis in winter and early spring.

Airport modernisation is expected to extend the tourist season, smooth rental demand throughout the year, and reduce dependence on peak summer months.

The strongest impact from these infrastructure changes is likely to be felt in the coastal areas of Achaea and Elis, from Kato Achaia and Vrachneika to Killini and the coastline towards Pyrgos. Property prices there remain noticeably lower than in the Peloponnese core or on Corfu, as demand has historically been driven almost exclusively by the domestic market.

Improved transport accessibility typically brings new buyers, particularly foreign investors seeking seaside property in a more affordable price segment.

Price growth is expected to be gradual rather than sharp, but faster than in regions without major infrastructure projects. Initial price increases are likely within a

Halkidiki

Halkidiki remains one of the most

The region attracts buyers from Germany, Serbia, Romania, and Bulgaria who are looking for seaside homes within easy reach of Thessaloniki Airport. Domestic demand also remains strong, as residents of Thessaloniki view property in Halkidiki as second homes for summer and weekend use. Construction volumes are increasing slowly, which supports steady price growth.

The most pronounced price increases are expected on the first coastline of Kassandra and Sithonia, the peninsula’s two main coastal areas. Land available for development is limited, while demand for beachfront housing remains consistently high.

Property prices in Halkidiki are still lower than in many Aegean and Ionian resort destinations. However, this gap is gradually narrowing, creating potential for capital appreciation over a

Central Greece: Evia, Boeotia, Phthiotis, Evrytania, and Phocis

Residential prices in Central Greece remain significantly lower than in coastal and

In Phthiotis, port modernisation is underway. By the end of 2025, plans include dredging the fairway, expanding the approach zone, and upgrading quay infrastructure.

For the local economy, this translates into increased cargo handling, job creation, and the emergence of supporting services around coastal areas. In such cases, demand for nearby housing typically rises among professionals employed in logistics, shipping, and trade.

Evrytania is implementing a regional development programme supported by approximately €445 million in government funding. The funds are allocated to road upgrades, tourism development, and infrastructure improvements in mountainous areas. This is the first comprehensive development plan for the region in many years, and its launch has already increased interest in locations previously considered hard to access.

Plans include the reconstruction of the

Once completed, travel between Karpenisi, the mountainous areas of Evrytania, and Lamia will become faster and more convenient. This will improve access to major transport routes, simplify daily life for residents, and increase the attractiveness of the region for property buyers.

In Karpenisi, a ski resort modernisation project is underway, with funding of around €10 million. The upgrades include lifts, slopes, and service areas, aimed at increasing capacity and enhancing the resort’s appeal for winter and

In Evia, a new resort is under construction in the Heromilos area, while in Chalkida the Saint Minas Beach hotel is being upgraded to a

Thessaly: Larissa, Trikala, Karditsa, and Magnesia

Thessaly remains one of Greece’s most undervalued regions, which underpins its potential for property price growth. Residential prices start from as little as €780 per m².

Low entry prices make the market highly sensitive to change: even relatively small infrastructure projects can lead to noticeable increases in property values over time.

A regional recovery programme was launched in 2023 following severe flooding. The government plans to complete repairs to railway lines and key roads connecting Thessaly with Athens and Thessaloniki by the end of 2026. Improved transport accessibility is expected to increase interest from buyers considering the region for permanent residence.

Demand for housing is growing most rapidly in Magnesia, particularly around Volos and towards the Pagasetic Gulf. The area offers access to the sea and developed infrastructure, while property prices remain relatively affordable. Once road and rail connections are fully restored, these locations are likely to be among the first to demonstrate

5 key considerations for buyers of regional real estate in Greece

Purchasing property requires attention to details that are not always evident from listings. Legal status,

1. Legal status of the property

A lawyer verifies ownership title, compliance with cadastral records, the presence of valid building permits, and the absence of unauthorised alterations. In regional markets, properties with discrepancies in floor area or unregistered parts of a building are relatively common.

Without proper legal Due Diligence, an investor may acquire a property that does not qualify for obtaining a Greek residence permit.

In some cases, the stated 120 m² includes basements or

Elena Garnitsarik

Head of the Legal Department

Elena Garnitsarik

Head of the Legal Department

2. Location and land-use restrictions

A significant share of Greece’s coastal and mountainous areas falls within the Natura 2000 protected network. This includes 446 designated sites covering around

Before purchasing property, it is essential to confirm whether the plot is located within such a zone, as this determines what can be done with the property in the future.

Protected areas are subject to specific

For example, along the coast of Messenia and in certain parts of Halkidiki, municipalities may refuse approval for swimming pools, guest houses, or terrace extensions, even if the plot size would otherwise allow such additions.

In some regions, restrictions also apply to the external appearance of buildings. Replacing windows, roofs, or fences may require separate permits, while changes to the terrain, such as earthworks or tree removal, may be prohibited altogether.

3. Total transaction costs

The price stated in a listing does not reflect the full cost for the buyer. When purchasing property in Greece, additional mandatory expenses apply, including:

- property transfer tax — 3.09%;

- legal and notarial fees — typically 2% each, plus VAT;

- land registry registration — approximately 0.

2—0 .6%; - annual ENFIA property tax and municipal charges;

- maintenance and communal service costs.

Assessing these expenses in advance allows buyers to compare options accurately and understand the true cost of ownership.

4. Legal access to the property

In rural and coastal areas, some properties are accessed via private or unregistered roads. Such access routes may lack a clear legal owner or may not be recognised as public roads. For buyers, this means that legal access to the property is not always guaranteed.

The status of the access road also affects utility connections. Electricity, water supply, and waste collection services are not obliged to serve properties without officially recognised access. This is particularly relevant for houses outside urban areas, where infrastructure provision depends on municipal regulations.

Before purchasing, it is essential to verify who owns the access road, whether it is registered in the cadastre, and whether there is a legally established right of passage and access. This affects both daily usability and the property’s future liquidity.

5. Energy efficiency of the building

In Greece, each property is assigned an energy efficiency class, which is indicated in the building’s energy certificate. Older regional properties are often classified in lower categories, E, F, G, or H, reflecting higher heat loss, insufficient insulation, and outdated engineering systems.

Properties with low energy efficiency incur higher heating costs in winter and cooling expenses in summer, particularly in mountainous areas and coastal regions with pronounced temperature variations.

A low energy efficiency rating also affects

Property purchase process in Greece

Purchasing real estate in Greece is open to citizens of any country. Transactions can be completed either in person or remotely, through a power of attorney granted to a local representative.

Foreign buyers may own an unlimited number of residential and commercial properties. However, for the purpose of obtaining a residence permit, only one property may be purchased.

-

1 day

Signing a power of attorney in Greece

A power of attorney is required if the investor does not plan to travel to Greece and intends to complete the purchase remotely.

The document is signed in Greek in the presence of a certified interpreter, who confirms the accuracy of the translation. If the property is purchased remotely, the power of attorney must be notarised in the investor’s country of residence and then sent to Greece.

-

1+ week Selecting a property

The property is selected based on the investor’s budget, investment objectives, and the requirements of the relevant residence programme. At this stage, location, technical condition, potential rental yield, and compliance with residence permit criteria are assessed.

-

1—2 weeksProperty Due Diligence

Lawyers conduct a legal review of the property. This includes verifying that the property is free of encumbrances, such as mortgages or ongoing court disputes, and that it complies with cadastral and planning regulations.

-

3—7 working daysObtaining a Greek tax number

An authorised lawyer acts on behalf of the investor under the power of attorney. The lawyer submits an application and supporting documents to register a Greek tax identification number. Without this number, it is not possible to purchase real estate in Greece.

-

1+ month Property purchase and registration

The investor signs a preliminary sale and purchase agreement and pays a deposit, typically 10% of the property price. The lawyer prepares the final sale contract in cooperation with a Greek notary.

Once the final agreement is signed and the full purchase price is paid, the lawyer submits the documents for registration with the land cadastre and obtains the ownership certificate.

The investor receives a complete set of property documents with officially certified translations.

Purchasing real estate in Greece can now be completed entirely online, without visiting the land registry. In 2024, Greece introduced the digital myPROPERTY system, through which most sale and purchase transactions are processed.

The notary opens a digital case and uploads the documents, while the buyer and seller confirm the transaction online. Tax checks are carried out automatically. In most cases, ownership is transferred within one working day, whereas previously the process could take several weeks.

Property in Greece can be acquired remotely by issuing a power of attorney to a lawyer who represents the investor’s interests throughout the transaction.

Elena Garnitsarik

Head of the Legal Department

Elena Garnitsarik

Head of the Legal Department

Final thoughts on real estate outside Athens

According to Passportivity’s research, the regional real estate market in Greece is expected to continue growing. This trend is supported by infrastructure upgrades, rising interest from foreign buyers, and demand from investors seeking Greek residence permits through property purchases at more moderate price levels.

Key takeaways:

- The real estate market has moved beyond the phase of rapid growth. In 2024, residential property prices increased by an average of 8.7% year on year.

New-build properties are appreciating faster than older housing stock. Properties up to five years old rose in value by 10.2% over the year, compared with 8.1% for older properties.- Price growth is increasingly driven by infrastructure development. Roads, ports, airports, and tourism projects are redistributing demand, as investors favour locations with improving quality of life and

year-round rental potential. - Following changes to the Greece Golden Visa, demand for property in the regions has increased. Higher investment thresholds reduced speculative purchases in prime locations and redirected interest towards the Peloponnese, Western Greece, Epirus, Thessaly, Halkidiki, and Central Greece.

- Price growth remains uneven. The strongest increase was recorded in Epirus, where property prices in Thesprotia rose by 30% year on year. The key drivers were relatively affordable seaside housing and the launch of new resort developments.

Sources

- VAT regulations in Greece, official website of the Ministry of Economy and Finance

- Greek property price indices, Spitogatos Property Index

- Cost of living and rental data in Greece, Numbeo

- Quarterly residential property price dynamics, Bank of Greece

- Commercial real estate price and rental indices, Bank of Greece

- Comparative rental yield statistics for Greece and other countries, Global Property Guide

- Legislative changes to

residence-by -investment programmes, PwC Greece analytical briefing - Greek tax legislation texts and guidance, Taxheaven legal portal

Note

This report has been prepared for educational and informational purposes only. It does not constitute advertising or investment advice.

The materials may be used for reference purposes provided that the source and a link to the report are cited. We hope that the data presented will serve as a useful starting point for further analysis of the Greek real estate market.

Request Expert Commentary or Custom Research

Are you a journalist or an analyst, or do you work with high-net-worth individuals and need verified data, expert comments on investment migration, or market research for a specific task? We are ready to help.

Elena Dukach

Chief Executive Officer

Frequently asked questions

Greek regions are suitable for real estate investment, particularly areas and cities where infrastructure is developing actively.

For example, in Western Greece, the construction of a new motorway to Patras and the modernisation of Araxos Airport are bringing previously local markets to the attention of a wider investor base. Entry prices remain lower than in Athens, while growth potential is higher.

For many years, demand in regional markets was driven mainly by local residents. Infrastructure developed more slowly, large resort projects were limited, and international buyers tended to focus on Athens, Thessaloniki, or major islands. as a result, market dynamics were more subdued, and prices per m² remained lower.

The highest residential rental yields are observed in Thessaly and Epirus, particularly in Arta, Karditsa, Trikala, Larissa, and Ioannina. Gross yields reach

In resort regions, rental rates are higher, but yields are lower due to higher acquisition prices.

In 2024, the Greek government revised the property investment option under the residence programme, increasing the minimum threshold to €800,000 in the most popular regions and to €400,000 elsewhere.

Investor interest shifted away from Athens and Attica towards the Peloponnese, Western Greece, Epirus, Thessaly, Halkidiki, and Central Greece.

Regional markets are becoming more attractive not only due to lower prices but also because of active upgrades to roads, ports, airports, and tourist infrastructure. Buyers see improving infrastructure and anticipate further price growth.

New homes are in higher demand due to modern infrastructure and lower operating costs. Older buildings often require insulation, refurbishment, and heating system upgrades, whereas these aspects are already addressed in new developments.

At the same time, the supply of new projects is growing slowly; construction activity declined almost fourfold after the crisis, supporting faster price growth.

The most affordable regions for real estate investment are Thessaly and Epirus. In Karditsa, prices start from €784 per m², while in Arta they begin at €900 per m². These inland cities are located away from the coast, with demand driven mainly by local residents, which keeps prices lower and growth more gradual.