Citizenship by investment: market trends and outlook for 2026–2030

Overview

Citizenship by investment has evolved from a status symbol into a practical tool. Investors use a second passport to reduce geopolitical and tax risks, prepare a “second home” for their family, preserve business access to global markets, and maintain access to the international banking system.

Investors are no longer guided solely by the number of

All else being equal, investors prefer a second passport that offers broader opportunities while requiring minimal personal involvement in the country, no

The investment citizenship market continues to grow. Governments earn around $20 billion annually from citizenship programmes. Experts predict further growth, with total revenues potentially reaching up to $100 billion.

Small states such as Vanuatu, St Kitts and Nevis, and Dominica generate between 14% and 40% of their GDP from citizenship by investment programmes.

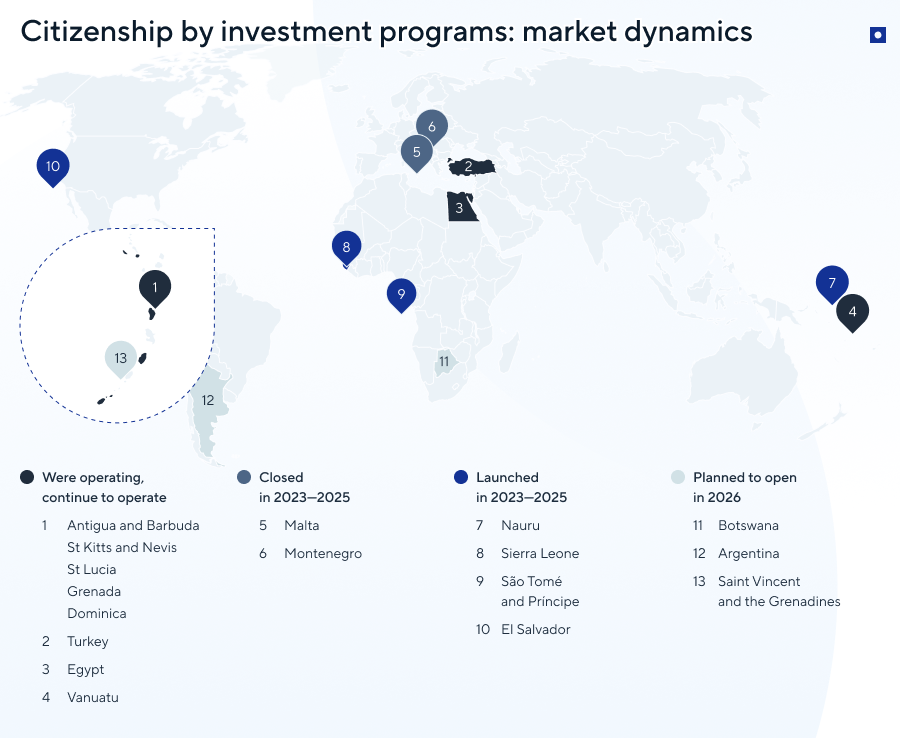

Old programmes are closing while new ones are emerging. The European Court has ruled that granting citizenship by investment violates EU law. as a result, Cyprus and Malta were forced to shut down their programmes, among the most

Against the backdrop of European programme closures and tighter conditions in the Caribbean, investor attention is increasingly shifting to new programmes in Africa and the Pacific region.

Since 2023, citizenship programmes have been launched in Sierra Leone, Nauru, São Tomé and Príncipe, and El Salvador. In 2026, Argentina, Botswana, and St Vincent and the Grenadines are expected to begin issuing passports to investors.

Citizenship requirements are also changing. Due to the geopolitical crisis, states have tightened applicant requirements and restricted participation for nationals of certain countries.

Outlook to 2030. Countries will continue to tighten citizenship by investment requirements by introducing additional due diligence and requiring a demonstrable link to the state. Investors will increasingly build portfolios of two to three residency and citizenship statuses to mitigate risks and optimise taxation.

Why foreigners obtain citizenship by investment

A second citizenship is no longer merely a status symbol or a way to gain

Global mobility

One of an investor’s main objectives is

In 2025, a single passport rarely provides

Access to the banking system

Major international banks refuse to open accounts for clients from countries subject to sanctions, such as Russia and Belarus. A second passport helps avoid automatic blocks in international banks.

When opening an account, banks carry out KYC, Know Your Customer, procedures. These include checks of sanctions exposure, reputational risk, and criminal risk that a bank assumes when working with a client. It is easier for an investor to pass banking compliance checks if they hold citizenship of several countries.

Safe haven

States can close their borders quickly in emergency situations, such as during a pandemic or a geopolitical crisis. A second citizenship guarantees that the investor and their family retain the right to enter a country at any time.

Quality of life and children’s future

For many investors, a second passport is an investment in their family’s future. The question of where children will live and study often becomes the key argument for obtaining a second citizenship.

Investors’ children can attend public schools and, in some cases, universities free of charge. They may also benefit from preferential admission and tuition conditions at foreign universities in other countries. For example, holders of Caribbean passports can send their children to study in the United Kingdom on preferential terms, as Caribbean countries are members of the Commonwealth.

In many countries, medical services are also free for citizens or provided on preferential terms through insurance policies. By contrast, temporary residents and tourists are required to arrange health insurance or obtain a medical treatment visa.

Economic opportunities

Foreign nationals view a second citizenship as a way to access broader business and investment opportunities, such as earning income through investment funds or companies.

Citizenship makes it easier for an investor to enter the local market: register a business, open a bank account, and participate in transactions with local partners. Holding citizenship also simplifies employment for family members, which may be important if they consider a new jurisdiction as their centre of life interests for the next

Where citizenship by investment is available in 2026

By 2026, the map of investment migration has expanded significantly. Previously, the Caribbean and certain EU countries, such as Cyprus and Bulgaria, held a monopoly.

Today, citizenship by investment programmes have become a global trend. Governments in Africa, Asia, and Oceania are launching their own programmes to compete for foreign capital.

Caribbean

The investment migration industry originated in the Caribbean. St Kitts and Nevis has been granting citizenship to investors since 1984, and Dominica since 1993.

In the Caribbean, five countries offer citizenship by investment: St Kitts and Nevis, Antigua and Barbuda, Grenada, Dominica, and St Lucia.

Caribbean programmes consistently rank at the top of the independent CBI Index. The index provides a comprehensive assessment of citizenship by investment programmes and their advantages across multiple criteria, including minimum investment, processing timeframe, freedom of movement, quality of life, and five additional parameters.

In 2025, the St Kitts and Nevis programme ranked first, followed by Dominica in second place and Grenada in third.

All five countries offer a second passport either through a

In 2024, Caribbean countries signed a memorandum of intent establishing a unified minimum investment threshold for citizenship of €200,000. In 2025, they also agreed to introduce minimum residence requirements for investors.

Comparison of Caribbean citizenship-by-investment programmes

| Country | Investment | Processing time | Residence requirements | Real estate purchase |

|---|---|---|---|---|

| St Kitts and Nevis | $250,000+ | No | Available | |

| Antigua and Barbuda | $230,000+ | 5 days within the first 5 years | Available | |

| St Lucia | $240,000+ | No | Not available in practice | |

| Grenada | $235,000+ | No | Available | |

| Dominica | $200,000+ | No | Available |

Oceania

Oceania hosts the fastest citizenship programmes, with status granted in as little as one month.

Vanuatu offers citizenship by investment of $130,000 and more. This amount is paid as a

Applicants may also invest in private funds:

- $157,000 in the CNO Future Fund, which supports coconut production;

- $159,000 in the Sustainable Development Fund, which finances cocoa production.

Fund investment options предусматривают a refund of $50,000 five years after obtaining citizenship.

The processing time for citizenship by investment is from one month, making it the fastest programme globally. Investors are not required to visit the country, but must submit biometric data at the immigration office in Vanuatu or at one of its representative offices in Dubai, Hong Kong, or Nouméa.

Nauru presented its Citizenship Programme for Economic and Climate Resilience at the UN Climate Change Conference in November 2024.

Investors may contribute from $105,000 to the National Treasury Fund. Total participation costs, including fees, amount to:

- $140,500 for a single applicant;

- $155,000 for a family of four.

The procedure is fully remote: applicants do not need to visit the country either to submit documents or to take the oath. Document review takes

Comparison of citizenship programmes in Oceania

| Country | Investment | Processing time | Residence requirements | Real estate purchase |

|---|---|---|---|---|

| Vanuatu | $130,000+ | No | No | |

| Nauru | $105,000+ | No | No |

Africa

African countries began attracting investors after Caribbean citizenship programmes tightened their conditions and after restrictions were introduced on obtaining EU residence permits for certain foreign nationals.

In 2024, Sierra Leone launched a citizenship by investment program. In 2025, São Tomé and Príncipe followed with a similar program. Botswana plans to launch its citizenship by investment program in 2026.

São Tomé and Príncipe offers citizenship for minimum investments from $90,000. Applicants make a

Citizenship by investment extends to close family members: a spouse, financially dependent unmarried children up to and including 30 years of age, parents, grandparents aged 55 and over. Passports are granted together with the main investor.

Citizenship applications are reviewed within six weeks. The entire process is fully remote and takes around two months.

Sierra Leone offers investors three options: a

A

Under the

If the investor does not wish to purchase gold, they may pay an increased government fee of $70,000. Fee increases by $2,000 to $3,000 per family member..

Sierra Leone’s advantage lies in the ability to include a large number of relatives in the citizenship application: spouses, children, grandchildren, parents, grandparents, as well as siblings with their spouses and children. The investor may also pay for the participation of a business partner.

Comparison of citizenship programmes in Africa

| Country | Investment | Processing time | Residence requirements | Real estate purchase |

|---|---|---|---|---|

| São Tomé and Príncipe | $90,000+ | No | No | |

| Sierra Leone | $140,000+ | No | No |

Middle East

Turkey has offered citizenship by investment since 2017. At that time, the minimum investment was $1,000,000 for the real estate option and $3,000,000 for opening a bank deposit, resulting in low demand.

In September 2018, the government lowered the investment threshold to $250,000 for real estate and $ 400,000 for deposits, leading to a significant increase in applications.

In April 2022, the minimum real estate investment was raised to $400,000, while other programme options increased to $500,000. The reasons were high inflation and the depreciation of the Turkish lira.

In 2026, investors continue to purchase real estate worth $400,000 to obtain a Turkish passport. Both residential and commercial properties are eligible, with no requirements regarding size or location.

The process takes from eight months. Three years after obtaining citizenship, the property may be sold and the investment recovered.

Egypt. Investors choose Egypt’s citizenship programme due to access to the largest economy in North Africa, with a population of 110 million, eligibility to apply for a US

To obtain citizenship, investors choose one of four options:

non-refundable contribution to the programme department’s account at the Central Bank of Egypt — $250,000+;- purchase of real estate from a

government-approved register — $300,000+; - investment in a business project — $350,000+, plus a

non-refundable contribution of $100,000; - opening a

non-interest -bearing deposit at the Central Bank of Egypt — $500,000+.

Along with the investor, unmarried children up to and including 21 years of age receive passports. A spouse becomes eligible for Egyptian citizenship two years after the main applicant.

Comparison of citizenship programmes in the Middle East

| Country | Investment | Processing time | Residence requirements | Real estate purchase |

|---|---|---|---|---|

| Turkey | $400,000+ | No | Available | |

| Egypt | $250,000+ | No | Available |

Americas

El Salvador is a Central American country on the Pacific Ocean. It borders Honduras and Guatemala. The country began issuing citizenship by investment in 2023 and became the first in the world to accept cryptocurrency as an investment. The annual limit is 1,000 investor passports.

Citizenship is obtained through a

Together with the investor, citizenship is granted to a spouse and children up to and including 17 years of age. A registration fee of $999 is payable for each family member. The process takes from one to three months.

After submitting a citizenship application and paying the registration fee, the Migration Service of El Salvador verifies the source of the cryptocurrency and checks whether the investor appears on sanctions lists.

During the process, officials may request additional documents from the investor. Lawyers at Passportivity assist with preparing these documents and submit them to El Salvador.

Anastasia Agafonova

Lawyer in International Law

Anastasia Agafonova

Lawyer in International Law

Why citizenship programmes remain in demand

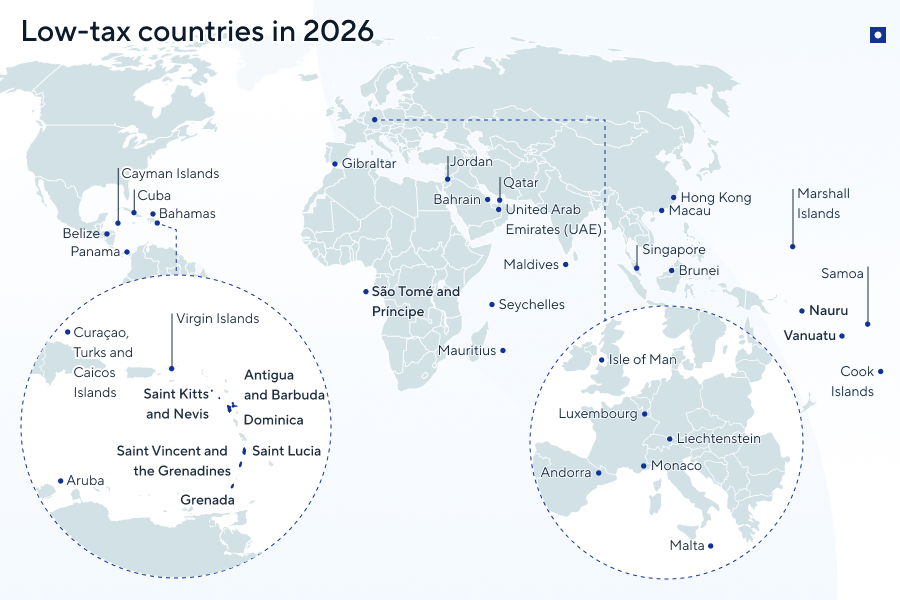

Investment citizenship is now a “Plan B” for many investors. It reduces dependence on a single country. Investors gain flexibility in business decisions. They can choose where to operate and where to pay taxes.

The more restrictions, customs duties, or taxes governments introduce, the stronger the interest of

Geopolitical instability

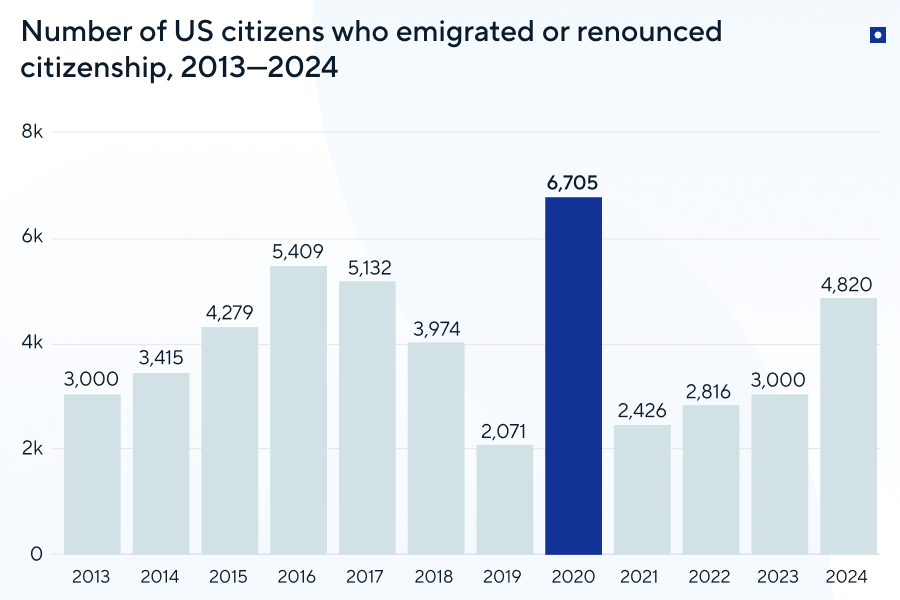

Emigration of Americans. The number of citizenship by investment applications from US clients has increased by three to four times. Investors seek safer

The growing number of military conflicts worldwide in recent years has led wealthy individuals to abandon

Rising taxes and the risk of capital loss

The United Kingdom is experiencing a historic outflow of millionaires following the abolition of the

Countries with no personal income tax are showing sustained growth in demand for citizenship, including Vanuatu, St Kitts and Nevis, and Antigua and Barbuda. For the same reason, investors obtain residence visas in the UAE.

Sanctions and restrictions

Ban on

The United States banned entry for citizens of 36 countries, including Antigua and Barbuda and Dominica. Under pressure from the US, Caribbean states introduced bans on participation in their programmes for Russian, Belarusian, and Iranian nationals. A single Caribbean passport no longer guarantees freedom of movement, investors are forced to obtain two or three statuses in different countries.

The European Council revoked

The United Kingdom stopped issuing electronic travel authorisations to citizens of Nauru, which had been valid until December 9th, 2025. They must now obtain a visa to visit or transit through the country. This is linked to a persistent risk to the UK’s national and border security.

The decision continues a broader trend: in 2023, the United Kingdom revoked

Cancellation of citizenship programmes. The European Court closed the last citizenship programme in the region, the Maltese programme, in the summer of 2025, stating that EU citizenship cannot be sold for money.

How the market is changing: why some countries close citizenship programmes while others launch them

The European Union takes a strict stance against granting passports in exchange for investment. Such schemes are considered high risk because they confer citizenship without a genuine link to the state.

With a second passport, an investor gains the ability to open bank accounts and register companies while reducing compliance risks associated with their primary citizenship.

Caribbean programmes

Five Caribbean countries have established a regional authority to regulate citizenship by investment programmes — ECCIRA. The regulator has been granted powers to introduce unified rules for the programmes of Antigua and Barbuda, Dominica, Grenada, St Kitts and Nevis, and St Lucia.

In 2024, the minimum investment threshold was unified at $200,000 across all countries. Programme conditions and application review rules were also standardised, including Due Diligence procedures and passport issuance quotas.

Despite higher citizenship costs, Caribbean programmes remain popular. For example, the St Kitts and Nevis programme recorded growth of 169% after being transferred from a ministry to a dedicated government authority with a special legal status. This increased transparency and compliance.

Rising application volumes have led to higher revenues for Caribbean states. St Kitts and Nevis and Dominica generate between 14% and 40% of GDP from

Revenues from citizenship by investment are playing an increasingly significant role in Caribbean economies. In 2023, Dominica received around $230 million, equivalent to approximately 37% of the country’s GDP. Grenada, according to 2024 data, attracted around $412 million, marking one of the strongest results in the programme’s history.

If interest from

Elena Garnitsarik

Head of the Legal Department

Elena Garnitsarik

Head of the Legal Department

European programmes

The European Court banned golden passports in 2025. Malta was the last country to abandon citizenship by investment. The country began issuing passports to investors in 2014 and gradually tightened conditions by strengthening compliance.

Under the new rules, obtaining citizenship in Malta requires a genuine link to the country — naturalisation through

By 2025, no EU country continued to offer citizenship by investment. Even Montenegro, which is only a candidate for EU membership, abandoned its programme in order to align with EU rules and requirements.

New citizenship-by-investment programmes in 2025—2026

Argentina is preparing to launch the first citizenship by investment programme in Latin America. According to preliminary information, the process will begin in 2026, with a minimum investment threshold of $500,000.

Botswana plans to issue citizenship by investment to support its economy, which has contracted in recent years due to declining diamond production.

St Vincent and the Grenadines announced that it will launch a citizenship by investment programme in 2026. Specific conditions have not yet been published, but the country will become the sixth in the Caribbean where a second passport can be obtained through investment in the economy.

Belarus has been developing draft legislation to regulate citizenship by investment since March 2025. The minimum investment threshold and other programme conditions have not yet been disclosed. It is expected that all details will be agreed within six months and that the first investor passports will be issued by the end of 2026.

Citizenship by investment programme ranking

Caribbean programmes continue to dominate the citizenship by investment market. However, the geographic focus is gradually shifting towards Africa and the Pacific region.

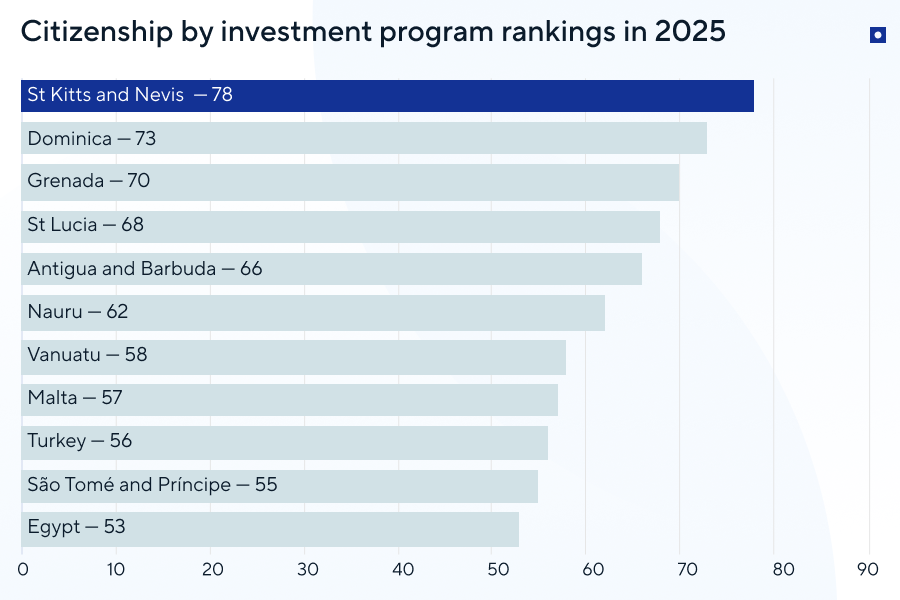

According to the CBI Index, the top seven citizenship programmes include St Kitts and Nevis, Dominica, Grenada, St Lucia, Antigua and Barbuda, Nauru, and Vanuatu.

Nauru debuted in sixth place in the ranking. Experts cited limited transparency and an insufficient track record as the main drawbacks of its

São Tomé and Príncipe ranked tenth, confirming investor interest in African citizenship programmes.

Passport strength

In 2025, the top 10 strongest passports in the world are held by EU countries, the UAE, and several Asian states. They offer

US and UK passports are no longer considered the strongest, but they still rank relatively high: 41st and 39th respectively.

Countries with the strongest passports by level of global mobility

| Rank | Country | |

|---|---|---|

| 1 | UAE | 179 |

| 2 | Singapore, Spain | 175 |

| 3 | Spain, Belgium, France, Sweden, Germany, Netherlands, Finland, Luxembourg, Italy, Denmark, Portugal, Switzerland, Greece, Austria, Malaysia, Norway, Ireland, South Korea, Japan | 174 |

| 4 | Malta, Poland, Slovenia, Croatia, Slovakia, Hungary, Estonia, Latvia | 173 |

| 5 | Romania, Czech Republic, Bulgaria, Lithuania, New Zealand | 172 |

Forecasts for the investment citizenship industry through 2030

The investment citizenship market will maintain steady demand among

1. Growing demand for combining residence permits and second citizenship

Individuals with passive income and digital nomads increasingly choose flexible residence by investment programmes instead of citizenship by investment. These programmes allow applicants to obtain citizenship through naturalisation without “freezing” large sums in investments.

2. Tighter regulation and compliance procedures

The European Union and the OECD will continue to exert pressure and apply strict standards to

The attractiveness of

3. Emergence of new programmes in developing countries

Countries with low GDP will use citizenship programmes to attract investment and stimulate economic growth. African countries and Latin American states have already followed this path.

Developing countries are leading growth in citizenship by investment. Many African states now offer affordable programs. Minimum investment thresholds are lower than before. In São Tomé and Príncipe, investments start from $90,000. In Sierra Leone, the amount starts from $140,000 and above.

Most applicants obtain such citizenship not for relocation, but as a solution for access to European residence permits, tax optimisation, and international business scaling.

Elena Garnitsarik

Head of the Legal Department

Elena Garnitsarik

Head of the Legal Department

4. Growth of “socially significant” investments

Pressure from the European Commission and the intergovernmental

The first example of such changes is Nauru. Under the programme terms, investor funds are directed to the National Climate Resilience and Sea Level Protection Fund.

5. Development of crypto citizenship

Countries that allow payments in cryptocurrency will attract applications from blockchain investors. For example, El Salvador already accepts Bitcoin as payment for citizenship. According to expert forecasts, by 2030 around 20% of second passports issued will be linked to digital assets.

Key takeaways on the investment citizenship market

- The investment citizenship market is undergoing a transformation from competition based on price to competition based on speed and the conditions for obtaining passports for the entire family.

- Foreigners increasingly obtain citizenship by investment due to geopolitical instability and tax reforms. These factors have the greatest impact on migration flows of

high-net -worth individuals. - The investor focus is shifting from choosing a single programme to seeking a combined solution: residence permits, citizenship, and tax residency in different countries.

- Programme preferences are moving away from Europe towards the Pacific region and Africa.

Long-established programmes on the market are complying with US and EU requirements. as a result, they are tightening applicant screening and restricting access for nationals of countries subject to sanctions.

Sources

- CBI Index 2025 by Private Wealth Management experts at Financial Times.

- Memorandum of Understanding on

citizenship-by-investment programmes. - Article by IMGlobal Wealth on American activity in the investment citizenship market.

- Sociological survey of Americans on emigration sentiment and plans to obtain second citizenship.

- Decision of the European Council on the revocation of

visa-free access to the Schengen Area for Vanuatu citizens. - Official website of the Nauru

citizenship-by-investment programme. - Associated Press article on the EU Court ruling banning Malta from issuing citizenship by investment.

- Argentina citizenship by investment: programme announcement and conditions.

- IMF assessment of the economy of St Kitts and Nevis.

- US Federal Register data on the number of American expatriates and citizenship renunciations.

Note

This report has been prepared for educational and informational purposes. It does not constitute advertising or investment advice. The materials may be used for reference purposes, provided that the source and a link to the report are cited. We hope that the collected data will serve as a useful reference point for further study of the investment migration market.

Request Expert Commentary or Custom Research

Are you a journalist or an analyst, or do you work with high-net-worth individuals and need verified data, expert comments on investment migration, or market research for a specific task? We are ready to help.

Elena Dukach

Chief Executive Officer

Frequently asked questions

Geopolitical instability and sanctions increase demand for second citizenship and make programme conditions stricter. Investors look for a “Plan B” for their families and capital preservation, while countries, under pressure from the European Union, the United States, and FATF, raise minimum investment thresholds, tighten Due Diligence, and refuse applications from citizens of sanctioned jurisdictions.

Caribbean programmes have held leading positions in the CBI Index for many years and are considered the “gold standard” of the investment industry. Passports are issued by five countries: Grenada, St Kitts and Nevis, Dominica, Antigua and Barbuda, and St Lucia.

The European Court ruled that using citizenship to attract investment is unlawful. as a result, there are no

There are no legal limits on the number of statuses, provided that the laws of all countries of citizenship are respected.

Investors increasingly combine residence permits and citizenships for different purposes: global mobility, tax reduction, and business development. For example,

Some countries do not recognise dual citizenship. These include Kazakhstan, Uzbekistan, Japan, Singapore, and China. Citizens of these countries must renounce their first citizenship in order to obtain a second passport.

The fastest processes are in Vanuatu and São Tomé and Príncipe. Citizenship by investment can be obtained in Vanuatu in as little as one month, and in São Tomé and Príncipe from two months.

São Tomé and Príncipe offers citizenship by investment from $90,000. In addition, an application fee of $5,000 is payable. Ancillary costs amount to from $750.

In Vanuatu, a second passport can be obtained through a